Form 706 2017

What is the Form 706

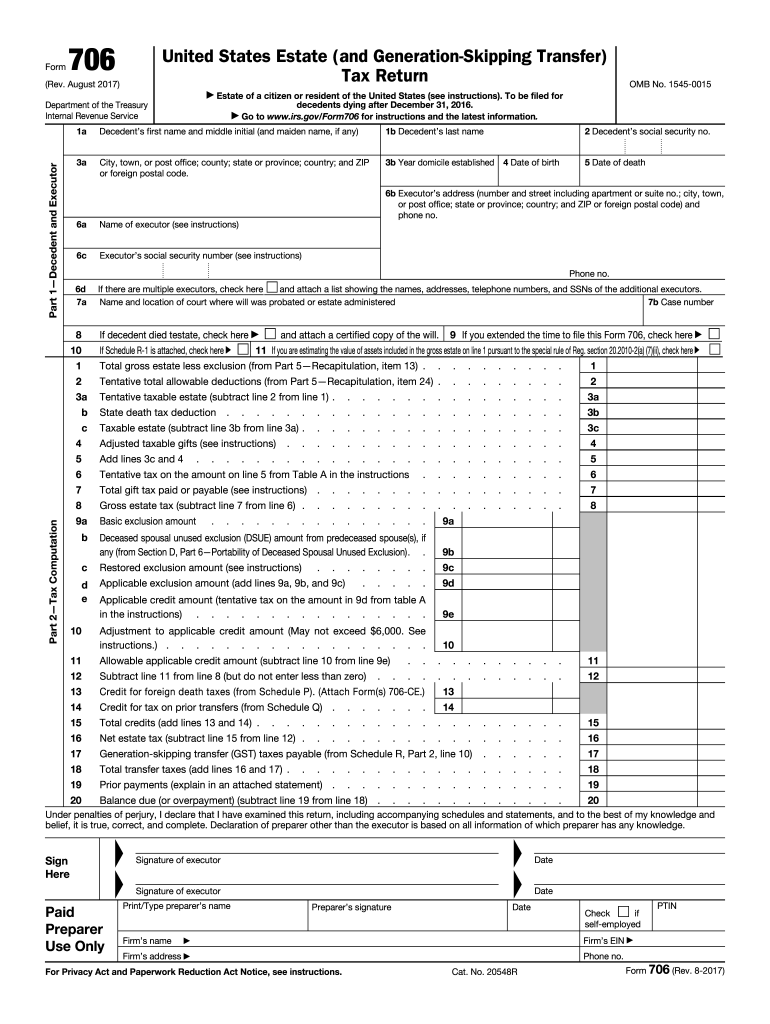

The Form 706, officially known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a crucial document used to report the estate tax liability of a deceased individual. This form is required for estates with a gross value exceeding the federal estate tax exemption threshold, which is set annually by the Internal Revenue Service (IRS). The form helps determine the amount of estate tax owed and ensures compliance with federal tax laws.

How to use the Form 706

Using the Form 706 involves several steps. First, gather all necessary financial information about the deceased's assets and liabilities. This includes real estate, bank accounts, investments, and any debts. Next, complete the form by accurately reporting this information, ensuring that all required fields are filled out correctly. After completing the form, it must be filed with the IRS, along with any required supporting documents. It's important to review the form thoroughly to avoid errors that could lead to penalties or delays.

Steps to complete the Form 706

Completing the Form 706 requires careful attention to detail. Follow these steps for accurate submission:

- Collect all necessary documents, including wills, trust documents, and financial statements.

- Determine the date of death and the value of the estate on that date.

- Fill out the form, starting with the decedent's information and proceeding to list all assets and liabilities.

- Calculate the total gross estate and any deductions, such as debts and funeral expenses.

- Complete the tax computation section to determine the estate tax owed.

- Review the form for accuracy and ensure all signatures are in place before submission.

Filing Deadlines / Important Dates

The Form 706 must be filed within nine months of the decedent's date of death. If additional time is needed, an extension can be requested using Form 4768, which grants an automatic six-month extension. However, it's important to note that any estate taxes owed must still be paid by the original due date to avoid interest and penalties. Keeping track of these deadlines is essential for compliance.

Required Documents

When preparing to file the Form 706, several documents are necessary to support the information reported. These include:

- The decedent's will and any trust documents.

- Death certificate.

- Financial statements for all assets, including bank statements and appraisals for real estate.

- Documentation of debts and liabilities.

- Any prior gift tax returns if applicable.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 706. It's essential to refer to the latest instructions provided by the IRS to ensure compliance with current tax laws. These guidelines detail the necessary information to include, the calculation of the estate tax, and the proper filing procedures. Staying informed about any changes in tax legislation can also impact how the form is completed.

Quick guide on how to complete form 706 2017

Uncover the easiest method to complete and authorize your Form 706

Are you still spending valuable time preparing your official documents on paper rather than online? airSlate SignNow offers an improved approach to complete and authorize your Form 706 and associated forms for public services. Our intelligent eSignature tool equips you with everything necessary to work on documents efficiently and in accordance with official standards - robust PDF editing, management, security, signing, and sharing features all available through a user-friendly interface.

Only a few steps are needed to finish filling out and signing your Form 706:

- Upload the editable template to the editor using the Get Form button.

- Verify what details you need to enter in your Form 706.

- Navigate through the fields using the Next option to avoid missing anything.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Blackout fields that are no longer relevant.

- Select Sign to generate a legally valid eSignature using your preferred method.

- Add the Date next to your signature and finish your task with the Done button.

Store your completed Form 706 in the Documents folder of your account, download it, or send it to your chosen cloud storage. Our service also provides versatile file sharing options. There’s no requirement to print your forms when submitting them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it today!

Create this form in 5 minutes or less

Find and fill out the correct form 706 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the form 706 2017

How to generate an eSignature for your Form 706 2017 online

How to make an electronic signature for your Form 706 2017 in Chrome

How to generate an electronic signature for putting it on the Form 706 2017 in Gmail

How to generate an eSignature for the Form 706 2017 right from your mobile device

How to create an eSignature for the Form 706 2017 on iOS

How to generate an eSignature for the Form 706 2017 on Android OS

People also ask

-

What is Form 706 and why is it important?

Form 706 is a United States estate tax return that must be filed if an estate exceeds a certain value threshold. Understanding Form 706 is crucial for estate planning, as it determines tax liabilities for the deceased's estate. Filing this form accurately can help beneficiaries manage their inheritance effectively.

-

How can airSlate SignNow help with Form 706 e-signing?

airSlate SignNow allows you to easily prepare and e-sign Form 706 online, streamlining the process of handling estate tax documents. With our user-friendly interface, you can collect signatures efficiently and ensure that your Form 706 is filed accurately and on time. This saves you time and reduces the risk of errors in critical documents.

-

What features does airSlate SignNow offer for preparing Form 706?

airSlate SignNow provides a range of features tailored for Form 706 preparation, including customizable templates, secure cloud storage, and real-time tracking of document status. These features ensure that you can create, edit, and send your Form 706 seamlessly while maintaining all necessary compliance and security standards.

-

Is airSlate SignNow cost-effective for handling Form 706?

Yes, airSlate SignNow is a cost-effective solution for managing Form 706 and other document workflows. Our pricing plans are designed to fit various budgets, and the efficiencies gained through our platform can help save both time and money in the long run. You can try our service with a free trial to assess its value for your Form 706 needs.

-

Can I integrate airSlate SignNow with other tools for Form 706 management?

Absolutely! airSlate SignNow offers integrations with various tools such as Google Drive, Dropbox, and CRM systems, making it easier to manage your Form 706 documents within your existing workflow. These integrations enhance collaboration and streamline the process of preparing and signing your estate tax returns.

-

What security measures does airSlate SignNow implement for Form 706 documents?

airSlate SignNow prioritizes the security of your Form 706 documents with top-tier encryption and secure access controls. We ensure that all data is transmitted and stored securely, protecting sensitive information related to estate taxes. You can trust us to keep your documents safe and compliant with industry standards.

-

Is it easy to get started with airSlate SignNow for Form 706?

Yes, getting started with airSlate SignNow for Form 706 is quick and easy. Simply sign up for an account, choose a template for your Form 706, and start customizing it to fit your needs. Our intuitive platform is designed for users of all levels, ensuring a smooth experience right from the start.

Get more for Form 706

- Income payees sworn declaration of gross receipts sales form

- Noaa form 25 700

- Modello 511 enasarco form

- Affidavit of heirship 21452921 form

- Surat akuan pdf form

- Home security checklist como form

- Business license application overview city of hailey haileycityhall form

- Professional services consideration request form the university utexas

Find out other Form 706

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement