706 Form 2011

What is the 706 Form

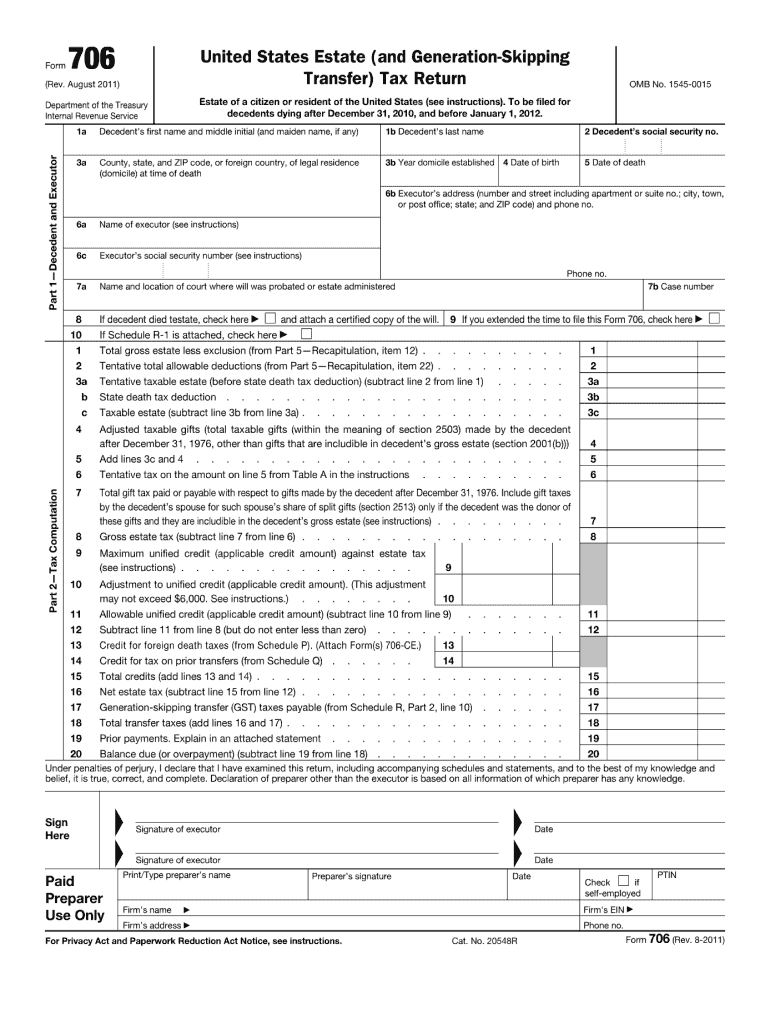

The 706 Form, officially known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a tax document required by the Internal Revenue Service (IRS) for reporting the value of an estate after a person's death. This form is essential for determining whether estate taxes are owed based on the total value of the deceased's assets. It is typically filed by the executor of the estate and must include detailed information about the decedent's property, debts, and any applicable deductions or exemptions.

How to use the 706 Form

Using the 706 Form involves several key steps to ensure accurate reporting and compliance with IRS regulations. First, gather all necessary documentation, including the decedent's will, asset valuations, and any debts owed by the estate. Next, complete the form by providing detailed information about the estate's assets, liabilities, and deductions. It is crucial to ensure that all values are accurate and supported by documentation. Once completed, the form must be signed and submitted to the IRS by the appropriate deadline.

Steps to complete the 706 Form

Completing the 706 Form requires careful attention to detail. Follow these steps:

- Gather necessary documents, including the decedent's will and asset valuations.

- Identify all assets owned by the decedent at the time of death, including real estate, bank accounts, and investments.

- List all debts and liabilities of the estate, which can be deducted from the total value.

- Complete the form sections, ensuring that all values are accurately reported.

- Review the completed form for errors or omissions before signing.

- Submit the form to the IRS by the filing deadline.

Legal use of the 706 Form

The legal use of the 706 Form is critical for ensuring compliance with federal estate tax laws. This form must be filed if the gross estate exceeds the exemption threshold set by the IRS. Filing the form accurately and on time helps avoid penalties and interest on unpaid taxes. It is advisable to consult with a tax professional or attorney specializing in estate planning to navigate complex legal requirements and ensure that all necessary information is included.

Filing Deadlines / Important Dates

The filing deadline for the 706 Form is nine months after the date of the decedent's death. However, an extension may be requested, which can provide an additional six months to file the form. It is important to adhere to these deadlines to avoid penalties. Executors should also be aware of any state-specific deadlines that may apply, as these can vary by jurisdiction.

Required Documents

To complete the 706 Form, several documents are required:

- The decedent's will and any codicils.

- Appraisals of real estate and other significant assets.

- Records of debts and liabilities owed by the estate.

- Documentation of any gifts made by the decedent prior to death that may affect the estate tax calculation.

- Any previous estate tax returns filed for the decedent or related estates.

Quick guide on how to complete 2011 706 form

Prepare 706 Form effortlessly on any device

Online document management has become favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 706 Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to edit and eSign 706 Form with ease

- Locate 706 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Stop worrying about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device of your choice. Edit and eSign 706 Form and ensure excellent communication at any stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 706 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 706 form

How to make an electronic signature for your PDF online

How to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is the 706 Form and how is it used?

The 706 Form, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is used to report the value of an estate subject to federal estate taxes. It helps ensure compliance with tax regulations and is essential for estate planning. Using airSlate SignNow, you can easily eSign and manage your 706 Form securely and efficiently.

-

How can airSlate SignNow simplify the process of completing a 706 Form?

airSlate SignNow simplifies the completion of the 706 Form by allowing users to fill out and electronically sign the document online. This reduces the need for paper forms and in-person signings, streamlining the process. With our user-friendly interface, you can save time and ensure accuracy when preparing your 706 Form.

-

What features does airSlate SignNow offer for signing the 706 Form?

airSlate SignNow provides a range of features for signing the 706 Form, including customizable templates, secure storage, and automated workflows. You can invite others to sign, track the status of the document, and receive notifications when it’s completed. These features enhance efficiency and organization in handling important estate documents.

-

Is there a cost associated with using airSlate SignNow for the 706 Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, which include features for eSigning the 706 Form. The cost is competitive and reflects the extensive functionalities provided, making it a cost-effective solution for managing documents. You can choose a plan that best suits your requirements and budget.

-

Can I integrate airSlate SignNow with other software for handling the 706 Form?

Absolutely! airSlate SignNow integrates seamlessly with numerous software applications, allowing you to manage your 706 Form efficiently. Whether you use CRM systems, cloud storage, or project management tools, our integrations ensure that you can streamline your document workflow without any hassle.

-

What are the benefits of using airSlate SignNow for the 706 Form compared to traditional methods?

Using airSlate SignNow for the 706 Form offers numerous benefits over traditional methods, including increased speed, enhanced security, and improved accuracy. Electronic signing eliminates the need for physical paperwork and in-person meetings, while advanced security features protect your sensitive information. This modern approach saves time and reduces the risk of errors.

-

How secure is my information when using airSlate SignNow for the 706 Form?

Your information is highly secure when using airSlate SignNow for the 706 Form. We utilize advanced encryption protocols and secure servers to protect your data throughout the signing process. Our commitment to security ensures that your estate documents remain confidential and protected from unauthorized access.

Get more for 706 Form

Find out other 706 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors