Form 8805 2014

What is the Form 8805

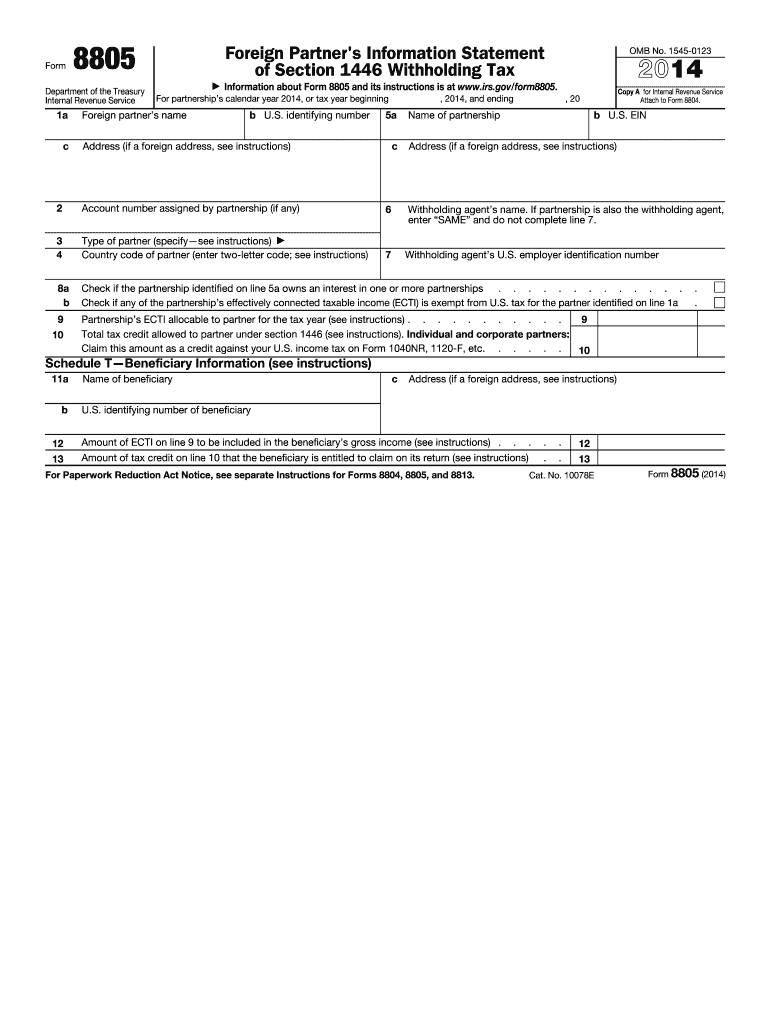

The Form 8805 is a tax document used by partnerships to report income, deductions, and credits allocated to foreign partners. This form is essential for ensuring compliance with U.S. tax laws, particularly for foreign entities that have invested in U.S. partnerships. It provides the Internal Revenue Service (IRS) with information about the income that foreign partners earn from partnerships operating in the United States. The form must be filed annually by partnerships that have foreign partners and is critical for proper tax reporting and withholding obligations.

How to use the Form 8805

Using the Form 8805 involves several steps to ensure accurate reporting of income and tax obligations. Partnerships must first gather all relevant financial information regarding the income earned by foreign partners. This includes details on distributions, allocations, and any applicable deductions. Once the necessary information is compiled, the partnership completes the form, ensuring that all sections are filled out accurately. After completion, the form must be submitted to the IRS, along with any required payments for withholding taxes. It is important to retain copies for record-keeping and to provide copies to the foreign partners for their tax filings.

Steps to complete the Form 8805

Completing the Form 8805 requires careful attention to detail. Here are the steps to follow:

- Gather financial data related to the partnership's income and distributions to foreign partners.

- Fill out the partnership's identifying information, including the name, address, and Employer Identification Number (EIN).

- Report the total income earned by the partnership and the amounts allocated to each foreign partner.

- Calculate any deductions that apply to the foreign partners and report these on the form.

- Ensure that the correct withholding tax rates are applied and calculate the total amount to be withheld.

- Review the completed form for accuracy and completeness before submission.

- File the form with the IRS by the required deadline, ensuring that copies are provided to the foreign partners.

Legal use of the Form 8805

The legal use of the Form 8805 is governed by IRS regulations, which require partnerships to accurately report income and taxes withheld for foreign partners. Failure to comply with these regulations can result in penalties and interest on unpaid taxes. The form serves as a crucial document for both the partnership and the foreign partners, ensuring that all tax obligations are met. It is essential for partnerships to understand their legal responsibilities when using this form and to ensure that they adhere to all applicable laws and guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8805 are critical for compliance. The form must be submitted to the IRS by the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this typically means a deadline of March 15. If the partnership requires additional time, it may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Penalties for Non-Compliance

Non-compliance with the filing requirements for Form 8805 can lead to significant penalties. The IRS imposes fines for late filing, which can accumulate daily until the form is submitted. Additionally, partnerships that fail to withhold the appropriate taxes from foreign partners may face further penalties and interest charges. Understanding these consequences is essential for partnerships to maintain compliance and avoid financial repercussions.

Quick guide on how to complete 2014 form 8805

Prepare Form 8805 easily on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Handle Form 8805 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 8805 effortlessly

- Obtain Form 8805 and click on Get Form to begin.

- Utilize the features we provide to complete your form.

- Mark important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to submit your form, whether by email, SMS, or a link invitation, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 8805 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 8805

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 8805

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is Form 8805 and how is it used?

Form 8805 is a tax document used by partnerships to report income allocable to non-resident partners. It helps ensure compliance with IRS regulations regarding withholding tax on income earned by foreign partners. Businesses can utilize airSlate SignNow to easily send and eSign Form 8805, streamlining the process for all parties involved.

-

How can airSlate SignNow help with filling out Form 8805?

airSlate SignNow offers a user-friendly platform that simplifies the process of filling out Form 8805. With its eSignature capabilities, users can complete and sign the form electronically, reducing paperwork and ensuring timely submissions. This efficient solution helps businesses stay organized and compliant.

-

Is there a cost associated with using airSlate SignNow for Form 8805?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs, including those specifically designed for handling Form 8805. The cost is competitive, especially considering the time and resources saved through its easy-to-use eSigning features. You can choose a plan that best fits your requirements.

-

What features does airSlate SignNow offer for managing Form 8805?

airSlate SignNow includes features like customizable templates, automated workflows, and cloud storage, all of which are beneficial for managing Form 8805. Additionally, the platform supports secure eSignatures and tracking, ensuring that you can monitor the status of your documents and compliance easily.

-

Can I integrate airSlate SignNow with other software for managing Form 8805?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM systems, accounting software, and cloud storage services, enhancing your ability to manage Form 8805 efficiently. These integrations allow for a more streamlined workflow, reducing the need for manual data entry.

-

What are the benefits of using airSlate SignNow for Form 8805?

Using airSlate SignNow for Form 8805 provides numerous benefits, including faster processing times, reduced paperwork, and improved compliance with IRS regulations. The platform's ease of use and secure eSigning features make it an ideal choice for businesses looking to enhance their document management processes.

-

How secure is airSlate SignNow when handling Form 8805?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like Form 8805. The platform utilizes advanced encryption and complies with industry standards to ensure that your documents are safe from unauthorized access. This commitment to security gives users peace of mind when eSigning tax forms.

Get more for Form 8805

- The university of tennessee group travel procurement card form

- Visiting graduate researchersemel institute for form

- Health records and other forms brandeis university

- University of houston downtown student incident report form part uhd

- Declaration of teaching majors amp minors form

- Tuition appeal form longwoodedu

- Fillable online wcupa application fee form west chester

- Victoria street wh 350 form

Find out other Form 8805

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document