Form 8805 Instructions 2012

What is the Form 8805 Instructions

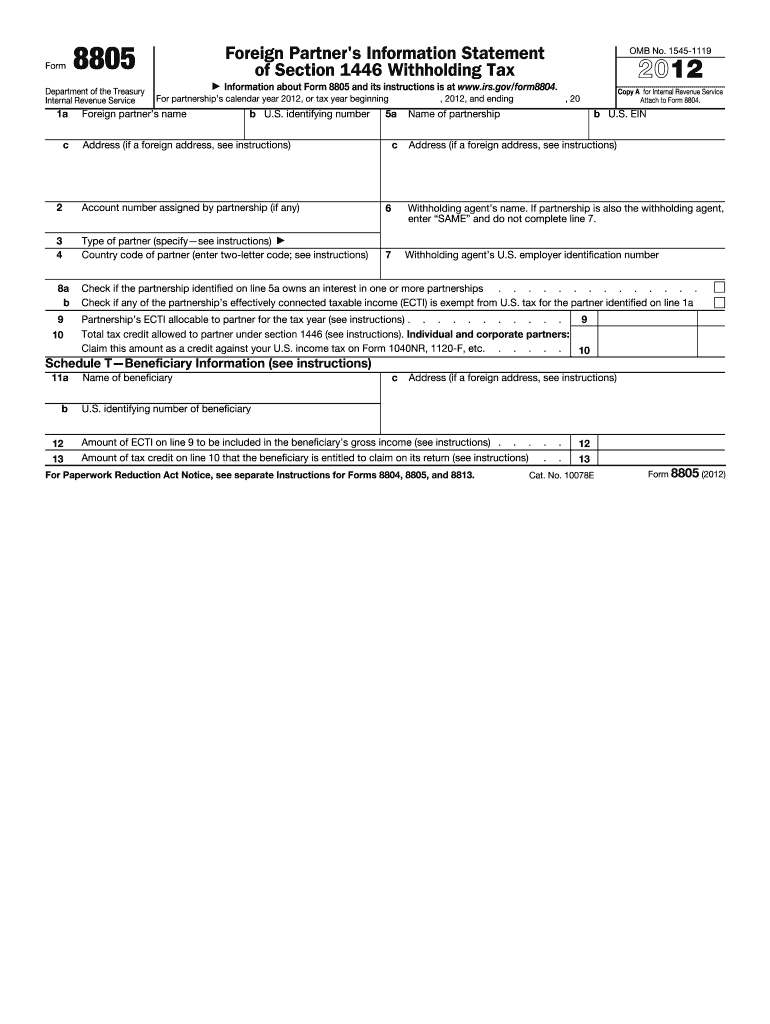

The Form 8805 Instructions provide guidance for partnerships and multiple-member LLCs that are required to report income effectively connected with a U.S. trade or business. This form is essential for reporting the income tax withheld on foreign partners' share of effectively connected income. Understanding these instructions ensures compliance with IRS regulations and helps avoid penalties associated with incorrect filings.

Steps to complete the Form 8805 Instructions

Completing the Form 8805 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the partnership and each partner, including names, addresses, and taxpayer identification numbers.

- Determine the amount of effectively connected income allocated to each foreign partner.

- Calculate the tax withholding amount based on the allocated income.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 8805 Instructions

The legal use of Form 8805 Instructions is crucial for partnerships and LLCs that have foreign partners. By adhering to these instructions, businesses ensure that they fulfill their tax obligations under U.S. law. Compliance with the instructions helps prevent legal issues and ensures that the correct amount of tax is withheld and reported to the IRS.

Filing Deadlines / Important Dates

Timely filing of the Form 8805 is essential to avoid penalties. The form must be filed by the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is typically March 15. It is important to stay informed about any changes to deadlines that may occur in a given tax year.

Form Submission Methods (Online / Mail / In-Person)

Form 8805 can be submitted through various methods, ensuring flexibility for partnerships. The form can be filed electronically using IRS e-file services, which is often the fastest method. Alternatively, it can be mailed to the appropriate IRS address based on the partnership's location. In-person submissions are generally not available for this form, making electronic filing or mail the preferred options.

Key elements of the Form 8805 Instructions

Understanding the key elements of the Form 8805 Instructions is vital for accurate reporting. The form includes sections for reporting the partnership's information, details about each foreign partner, and the amounts of effectively connected income and tax withheld. Each section must be completed with precise information to ensure compliance and avoid issues with the IRS.

Who Issues the Form

The Form 8805 is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the necessary forms and instructions to assist taxpayers in meeting their obligations under U.S. tax law. It is important for partnerships to refer to the official IRS guidelines when completing the form to ensure compliance with current regulations.

Quick guide on how to complete form 8805 instructions 2012

Accomplish Form 8805 Instructions effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Handle Form 8805 Instructions on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to edit and eSign Form 8805 Instructions effortlessly

- Access Form 8805 Instructions and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide on how you want to send your form, via email, SMS, or a shared link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 8805 Instructions to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8805 instructions 2012

Create this form in 5 minutes!

How to create an eSignature for the form 8805 instructions 2012

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What are Form 8805 Instructions?

Form 8805 Instructions provide guidance on how to complete the Form 8805 for reporting the income of partners in a partnership that complies with U.S. tax regulations. Understanding these instructions is essential for accurate tax filing and compliance. Using airSlate SignNow can streamline the process of gathering necessary signatures on the completed form.

-

How can airSlate SignNow assist with Form 8805 Instructions?

AirSlate SignNow offers a user-friendly platform that simplifies document eSigning and management related to Form 8805 Instructions. Our solution allows users to easily send documents for electronic signatures, ensuring that all parties can quickly approve the necessary forms. This can signNowly reduce the time spent on paperwork and enhance compliance.

-

What are the benefits of using airSlate SignNow for Form 8805 Instructions?

Utilizing airSlate SignNow for Form 8805 Instructions means you gain access to a cost-effective solution that enhances efficiency in document management. This platform offers features like templates, reminders, and easy tracking of signed documents. With these benefits, you can ensure a smoother process for tax preparation.

-

Is there a cost associated with using airSlate SignNow for Form 8805 Instructions?

AirSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective choice for managing Form 8805 Instructions. You can select a plan based on your volume of documents and the number of users. Pricing transparency means you'll know exactly what you're paying for.

-

Can I integrate airSlate SignNow with other applications for Form 8805 Instructions?

Yes, airSlate SignNow provides integrations with popular applications that help you streamline workflows related to Form 8805 Instructions. This includes CRM systems, cloud storage solutions, and project management tools. This interoperability ensures that you can manage all your documentation processes from one place.

-

Do I need technical skills to use airSlate SignNow for Form 8805 Instructions?

No, airSlate SignNow is designed to be user-friendly, allowing individuals without technical skills to easily navigate the platform for Form 8805 Instructions. The intuitive interface guides users through the process of creating, sending, and signing documents effortlessly. Our customer support is also available for any assistance you might need.

-

How does airSlate SignNow ensure the security of Form 8805 Instructions?

AirSlate SignNow prioritizes the security of your documents, including those related to Form 8805 Instructions. We employ industry-leading security measures such as encryption, secure access controls, and audit trails to protect your sensitive information. This commitment to security helps users confidently manage their documents.

Get more for Form 8805 Instructions

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property hawaii form

- Hi landlord 497304447 form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497304449 form

- Hawaii violating form

- Hawaii violating 497304451 form

- Hawaii violating 497304452 form

- Business credit application hawaii form

- Individual credit application hawaii form

Find out other Form 8805 Instructions

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF