1042 Form 2012

What is the 1042 Form

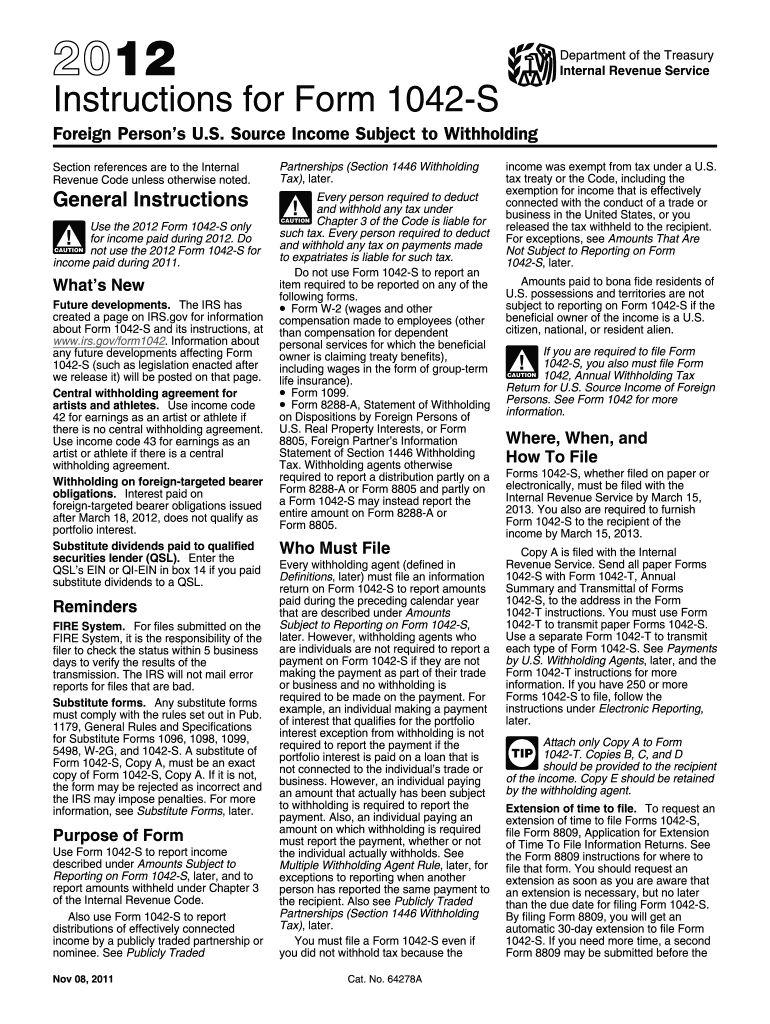

The 1042 Form is a tax document used by the Internal Revenue Service (IRS) in the United States. It is primarily designed for reporting income paid to foreign persons, including non-resident aliens and foreign entities. This form is essential for withholding agents who are responsible for withholding taxes on certain types of income, such as interest, dividends, rents, and royalties, that are sourced from the U.S. The 1042 Form ensures compliance with U.S. tax laws and helps to facilitate the proper reporting of income and tax withholding obligations.

How to use the 1042 Form

Using the 1042 Form involves several key steps. First, a withholding agent must determine if they need to file the form based on the payments made to foreign persons. If so, they must accurately report the total amount of income paid and the corresponding taxes withheld. The form requires specific information about the recipient, such as their name, address, and taxpayer identification number. After completing the form, it must be submitted to the IRS along with any required payments. It is crucial to ensure that all information is accurate to avoid penalties or issues with compliance.

Steps to complete the 1042 Form

Completing the 1042 Form involves a systematic approach:

- Gather necessary information about the foreign recipient, including their name, address, and taxpayer identification number.

- Determine the type of income being reported and the applicable withholding tax rate.

- Fill out the form by entering the total income paid and the amount of tax withheld.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the specified deadline, ensuring that any taxes owed are also paid.

Legal use of the 1042 Form

The legal use of the 1042 Form is governed by IRS regulations regarding tax withholding on payments to foreign individuals and entities. It is essential for withholding agents to understand their obligations under U.S. tax law. Proper use of the form ensures that the correct amount of tax is withheld and reported, thereby preventing legal issues related to non-compliance. Additionally, maintaining accurate records and documentation related to the 1042 Form is crucial for legal protection in case of audits or inquiries from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 1042 Form are critical for compliance. Typically, the form must be submitted to the IRS by March 15 of the year following the reporting year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important for withholding agents to be aware of these dates to avoid penalties. Additionally, any payments of withheld taxes must also be made by the same deadline to ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to comply with the requirements of the 1042 Form can result in significant penalties. The IRS may impose fines for late filing, inaccuracies, or failure to withhold the correct amount of tax. Penalties can vary based on the severity of the non-compliance, including potential criminal charges for willful neglect. To mitigate these risks, it is essential for withholding agents to ensure accurate and timely completion and submission of the form, as well as proper withholding practices.

Quick guide on how to complete 2012 1042 form

Finalize 1042 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Handle 1042 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to edit and eSign 1042 Form with ease

- Obtain 1042 Form and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tiring searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device of your choice. Edit and eSign 1042 Form and ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 1042 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 1042 form

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is a 1042 Form and why is it important?

The 1042 Form is a tax document used by foreign individuals and entities to report income received from U.S. sources. It's essential for non-resident aliens to comply with U.S. tax regulations, ensuring proper withholding and reporting of taxes on income earned in the U.S. Using airSlate SignNow, you can easily eSign and manage your 1042 Form to streamline your tax filing process.

-

How can I use airSlate SignNow to complete my 1042 Form?

With airSlate SignNow, you can upload your 1042 Form, fill it out digitally, and eSign it securely. Our platform simplifies the completion of tax documents by allowing you to collaborate with others in real-time and store your completed forms safely. This way, you ensure that your 1042 Form is accurate and submitted on time.

-

Is airSlate SignNow suitable for businesses that need to manage multiple 1042 Forms?

Absolutely! airSlate SignNow is designed to handle multiple documents efficiently, making it an ideal solution for businesses dealing with several 1042 Forms. Our platform allows you to organize, track, and manage all your tax documents in one place, ensuring seamless workflows and compliance.

-

What are the pricing options for using airSlate SignNow for my 1042 Form needs?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different users, including those who need to manage 1042 Forms. Whether you are an individual or a business, you can choose a plan that fits your budget while enjoying features like unlimited eSigning and document storage.

-

Can I integrate airSlate SignNow with other software for my 1042 Form processing?

Yes, airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and Salesforce, allowing you to streamline your workflow for processing 1042 Forms. These integrations enhance your productivity by enabling you to access and manage your documents seamlessly across platforms.

-

What security measures does airSlate SignNow have for handling sensitive 1042 Form data?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure servers to protect your sensitive information, such as that found in a 1042 Form. You can trust our platform to keep your tax documents safe and confidential.

-

Can I access my 1042 Form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage your 1042 Form on the go. Our mobile app ensures that you can eSign and complete your tax documents anytime, anywhere, making it convenient for busy professionals.

Get more for 1042 Form

- Authorization for release of counseling information

- For the health law certificate program hlcp are form

- Health history form

- Training grants tnih national institute of allergy and form

- Initial shra grievance filing form uncg human

- Intent to organize worksheet southern university subr form

- Attestation form southern new hampshire university snhu

- Igetc 05 06 antelope valley college form

Find out other 1042 Form

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure