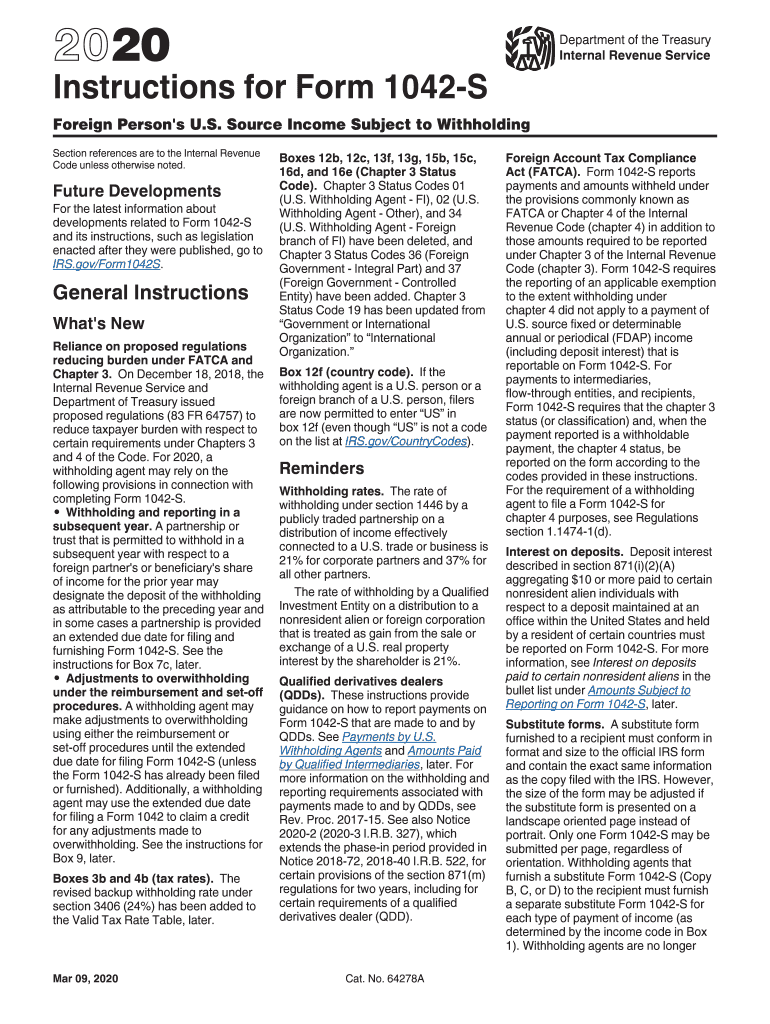

Instructions for Form 1042 S Internal Revenue Service 2020

What is the Instructions for Form 1042-S?

The Instructions for Form 1042-S are provided by the Internal Revenue Service (IRS) to guide taxpayers in reporting income that is subject to withholding for non-resident aliens and foreign entities. This form is primarily used to report amounts paid to foreign persons, including interest, dividends, rents, and royalties. Understanding the instructions is crucial for accurate reporting and compliance with U.S. tax laws.

Steps to Complete the Instructions for Form 1042-S

Completing the Instructions for Form 1042-S involves several key steps:

- Gather all necessary documentation, including payment records and information about the recipient.

- Review the specific instructions provided by the IRS to ensure compliance with reporting requirements.

- Fill out the form accurately, providing details such as the recipient's name, address, and taxpayer identification number.

- Calculate the amount of U.S. tax withheld and ensure it aligns with the applicable tax treaty provisions.

- Submit the completed form to the IRS along with any required supporting documentation.

Legal Use of the Instructions for Form 1042-S

The legal use of the Instructions for Form 1042-S ensures that taxpayers comply with U.S. tax regulations regarding payments to foreign individuals and entities. The form must be filled out in accordance with IRS guidelines to avoid penalties. Proper use of the form helps in maintaining accurate records and fulfilling withholding obligations under U.S. tax law.

Filing Deadlines / Important Dates

Filing deadlines for Form 1042-S are critical to ensure compliance. Generally, the form must be filed by March 15 of the year following the payment year. If the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to keep track of these dates to avoid late filing penalties.

Required Documents

To complete Form 1042-S accurately, several documents are required:

- Payment records detailing amounts paid to foreign recipients.

- Taxpayer identification numbers for both the payer and the recipient.

- Any applicable tax treaties that may affect withholding rates.

IRS Guidelines

The IRS provides comprehensive guidelines for completing Form 1042-S, which include instructions on how to report various types of income and the specific withholding requirements for each. Taxpayers should refer to the latest IRS publications to ensure they are following the most current regulations and procedures.

Quick guide on how to complete 2020 instructions for form 1042 s internal revenue service

Effortlessly prepare Instructions For Form 1042 S Internal Revenue Service on any device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without hassle. Manage Instructions For Form 1042 S Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Instructions For Form 1042 S Internal Revenue Service with ease

- Obtain Instructions For Form 1042 S Internal Revenue Service and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to confirm your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invite link, or save it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Instructions For Form 1042 S Internal Revenue Service while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions for form 1042 s internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions for form 1042 s internal revenue service

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the 1042 s 2018 form and who needs to use it?

The 1042 s 2018 form is used to report income that is subject to withholding for non-resident aliens and foreign entities. Businesses and tax professionals who deal with foreign payments need to use this form to ensure compliance with IRS regulations.

-

How can airSlate SignNow simplify the process of managing the 1042 s 2018 form?

airSlate SignNow simplifies the management of the 1042 s 2018 form by allowing users to electronically sign and send documents securely. This streamlines the workflow and reduces the paperwork hassle associated with tax forms, ensuring timely submissions.

-

What are the pricing options for using airSlate SignNow for 1042 s 2018 form management?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. You can choose from various subscription tiers that provide access to features necessary for efficient handling of the 1042 s 2018 and other documents.

-

What features does airSlate SignNow provide for the 1042 s 2018 process?

Key features include document templates, automated workflows, and advanced security measures. These capabilities enable businesses to manage the 1042 s 2018 form effectively and ensure that all parties can sign the document with ease.

-

Are there any integrations available with airSlate SignNow that support the 1042 s 2018 form?

Yes, airSlate SignNow integrates with various third-party applications such as CRM systems, cloud storage services, and accounting software. These integrations streamline the workflow for managing the 1042 s 2018 form and improve overall productivity.

-

How does airSlate SignNow enhance security for the 1042 s 2018 document?

airSlate SignNow employs advanced encryption and authentication methods to protect sensitive information in your 1042 s 2018 documents. This ensures that all data is secure during the signing process, providing peace of mind for users and clients alike.

-

Can I use airSlate SignNow on mobile devices for handling the 1042 s 2018 form?

Absolutely! airSlate SignNow is optimized for mobile use, allowing you to manage and sign the 1042 s 2018 form while on the go. This flexibility ensures that you can complete necessary tasks wherever you find yourself.

Get more for Instructions For Form 1042 S Internal Revenue Service

Find out other Instructions For Form 1042 S Internal Revenue Service

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now