2848 Form 2012

What is the 2848 Form

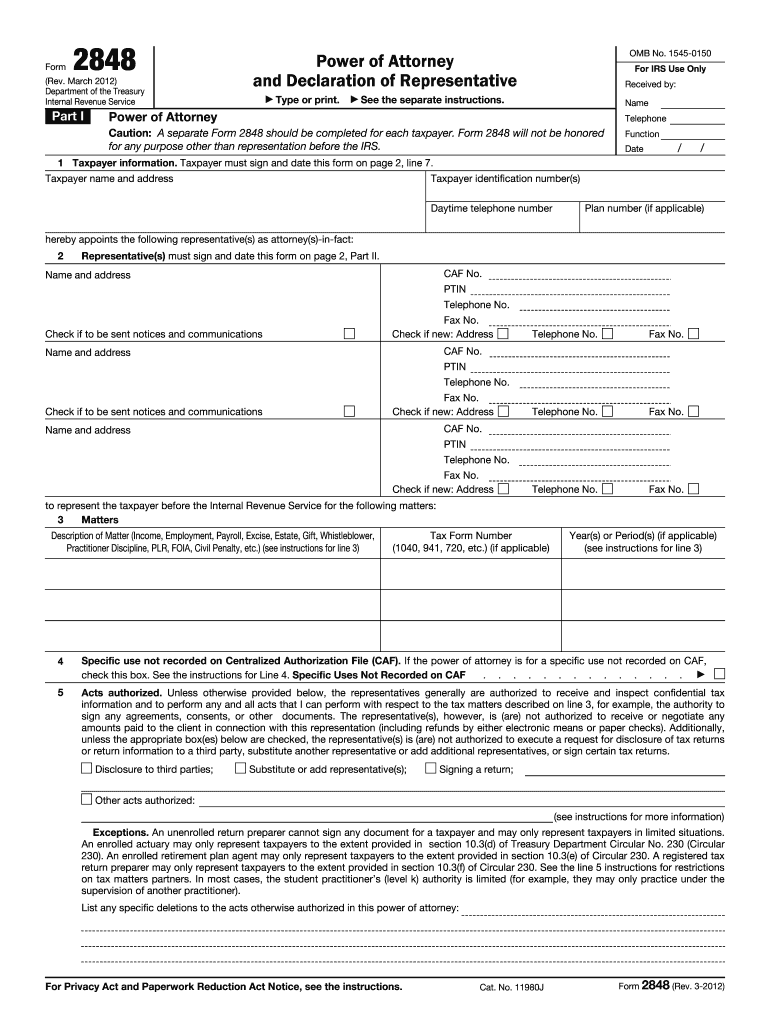

The 2848 Form, also known as the Power of Attorney and Declaration of Representative, is a crucial document used by taxpayers in the United States to authorize an individual to represent them before the Internal Revenue Service (IRS). This form allows the designated representative to act on behalf of the taxpayer in various matters, including tax returns, audits, and disputes. By completing this form, taxpayers can ensure that their chosen representative has the authority to communicate with the IRS and handle tax-related issues effectively.

How to obtain the 2848 Form

To obtain the 2848 Form, individuals can visit the official IRS website where the form is available for download. The form is typically provided in a PDF format, making it easy to print and fill out. Additionally, taxpayers can request a physical copy by contacting the IRS directly or visiting a local IRS office. It is important to ensure that you are using the most current version of the form, as updates may occur periodically.

Steps to complete the 2848 Form

Completing the 2848 Form involves several straightforward steps:

- Provide taxpayer information: Fill in your name, address, and taxpayer identification number (TIN).

- Designate a representative: Include the name, address, and identification number of the individual you are authorizing.

- Select the type of tax matters: Specify the tax types and years for which the authorization applies.

- Sign and date the form: Ensure that you sign and date the form to validate it.

Once completed, the form can be submitted to the IRS either electronically or via mail, depending on your preference.

Legal use of the 2848 Form

The legal use of the 2848 Form is essential for ensuring that the authorization granted to a representative is recognized by the IRS. The form must be filled out accurately and signed by the taxpayer to be considered valid. It is important to understand that the representative's authority is limited to the specific tax matters and periods indicated on the form. This legal framework helps protect taxpayer rights while allowing designated individuals to act on their behalf in tax-related matters.

Key elements of the 2848 Form

Several key elements are included in the 2848 Form that are important for its proper completion:

- Taxpayer information: Accurate details about the taxpayer are required.

- Representative details: Information about the authorized individual must be provided.

- Tax matters: Clearly specify the types of taxes and tax years covered by the authorization.

- Signature: The taxpayer's signature is necessary to validate the form.

Ensuring that all these elements are correctly filled out helps facilitate a smooth process when dealing with the IRS.

Form Submission Methods

The 2848 Form can be submitted to the IRS in several ways. Taxpayers have the option to file the form electronically using the IRS e-Services platform, which allows for quicker processing. Alternatively, the form can be mailed to the appropriate IRS address based on the taxpayer's location and the type of tax matters involved. In-person submissions are also possible at local IRS offices, providing another avenue for taxpayers to ensure their forms are received and processed.

Quick guide on how to complete 2848 form 2012

Effortlessly Prepare 2848 Form on Any Device

Web-based document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly and without delays. Manage 2848 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign 2848 Form with Ease

- Locate 2848 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you would like to deliver your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from your chosen device. Edit and eSign 2848 Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2848 form 2012

Create this form in 5 minutes!

How to create an eSignature for the 2848 form 2012

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the 2848 Form and how can I use it with airSlate SignNow?

The 2848 Form, also known as the Power of Attorney and Declaration of Representative, allows individuals to authorize someone to act on their behalf for tax purposes. With airSlate SignNow, you can easily upload, sign, and send the 2848 Form electronically, ensuring a secure and efficient process for managing your tax representation.

-

Is there a cost associated with using airSlate SignNow for the 2848 Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for handling documents like the 2848 Form. You can choose a plan that fits your budget while enjoying the benefits of unlimited eSigning and secure document management.

-

What features does airSlate SignNow offer for the 2848 Form?

airSlate SignNow provides a range of features for the 2848 Form, including customizable templates, secure cloud storage, and advanced eSignature options. These features streamline the process of completing and signing the 2848 Form, making it faster and more efficient for users.

-

Can I integrate airSlate SignNow with other software to manage the 2848 Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems, allowing you to manage your 2848 Form alongside other critical documents. This integration enhances workflow efficiency and keeps all your documents organized in one place.

-

What are the benefits of using airSlate SignNow for the 2848 Form?

Using airSlate SignNow for the 2848 Form offers several benefits, including time savings, enhanced security, and easy access from any device. The platform simplifies the signing process, ensuring that you can quickly authorize representatives without the hassle of paperwork.

-

Is airSlate SignNow secure for submitting the 2848 Form?

Yes, airSlate SignNow prioritizes security, utilizing advanced encryption and authentication measures to protect your documents, including the 2848 Form. You can trust that your sensitive information is safe when using our platform.

-

How can I track the status of my 2848 Form in airSlate SignNow?

With airSlate SignNow, you can easily track the status of your 2848 Form through our user-friendly dashboard. You'll receive notifications on when the document is viewed, signed, or completed, keeping you informed throughout the process.

Get more for 2848 Form

- Visit undcampus touruniversity of north dakota form

- Applicanttobecompletedbytheindividualapplyingforadmission form

- Education services student agreement form

- Assumption of risk indemnification agreement form

- Student participation in district sponsored form

- University of virginia childrens hospital pediatric form

- Rose hulman swim lessons form

- University of memphis intent to enroll form

Find out other 2848 Form

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online