Ct Release of Mortgage Form

What is the Connecticut Release of Mortgage

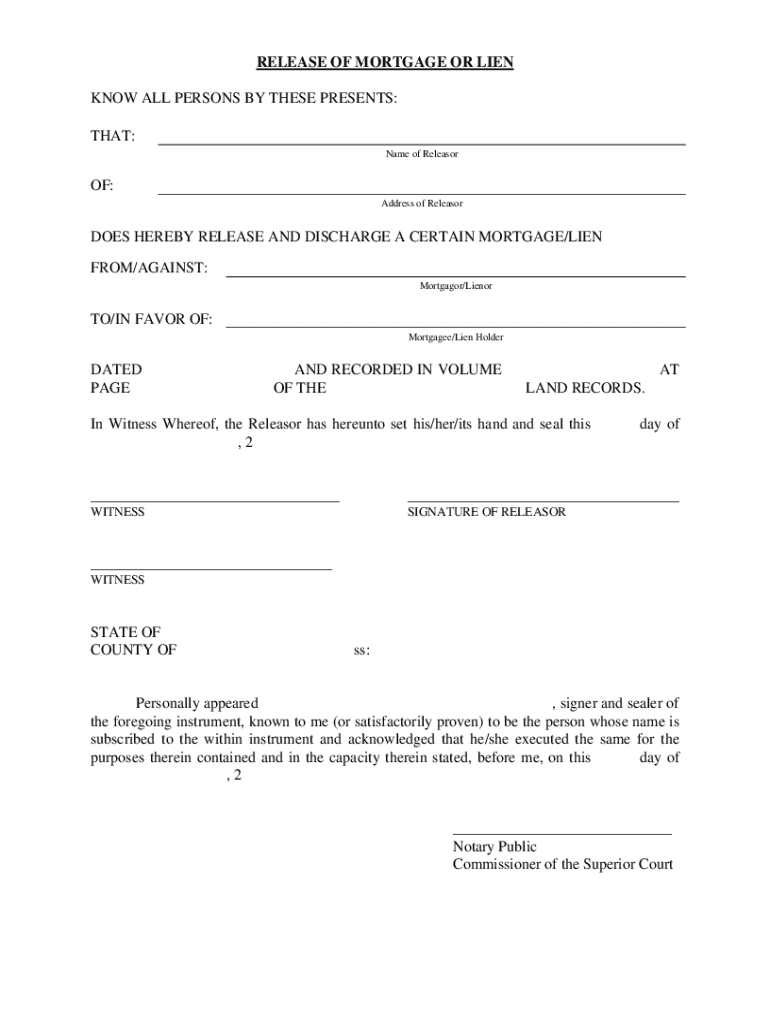

The Connecticut release of mortgage is a legal document that signifies the termination of a mortgage agreement between a borrower and a lender. When a borrower pays off their mortgage, the lender must formally release the lien on the property, allowing the borrower to regain full ownership without encumbrances. This document is essential for clearing the title of the property, ensuring that the borrower can sell or refinance the property without any outstanding mortgage claims. It is often recorded with the local land records office to provide public notice of the release.

How to Use the Connecticut Release of Mortgage

To effectively use the Connecticut release of mortgage, the borrower must first ensure that the mortgage has been fully paid. After payment, the lender prepares the release document, which should include specific information such as the names of the parties involved, the property description, and the date of the mortgage. The borrower should then review the document for accuracy before signing. Once signed, the release must be filed with the appropriate local land records office to officially remove the lender's claim on the property.

Steps to Complete the Connecticut Release of Mortgage

Completing the Connecticut release of mortgage involves several key steps:

- Confirm that the mortgage has been paid in full.

- Request the release document from the lender, ensuring it includes all necessary details.

- Review the document for accuracy, checking names, property details, and dates.

- Sign the document as required, which may include additional notarization.

- File the signed release with the local land records office to ensure it is officially recorded.

Key Elements of the Connecticut Release of Mortgage

Important elements to include in the Connecticut release of mortgage are:

- Names of the parties: Clearly state the names of the borrower (releasor) and the lender (mortgagee).

- Property description: Provide a detailed description of the property, including the address and any relevant identifiers.

- Mortgage details: Reference the original mortgage document, including the date it was executed and the recording information.

- Signatures: Ensure that both parties sign the document, along with any necessary notarization.

- Recording information: Include a statement indicating that the release will be recorded with the local land records office.

Legal Use of the Connecticut Release of Mortgage

The Connecticut release of mortgage serves a critical legal function by formally terminating the lender's interest in the property. This document is recognized under state law and must comply with specific legal requirements to be valid. It is essential for protecting the rights of the borrower, ensuring that they can freely transfer or encumber the property without any lingering claims from the lender. Failure to properly execute or record the release can result in complications for the borrower in future transactions.

Form Submission Methods for the Connecticut Release of Mortgage

The Connecticut release of mortgage can be submitted through various methods:

- Online submission: Some counties may allow electronic filing of the release document through their official websites.

- Mail: The completed and signed document can be mailed to the local land records office for recording.

- In-person: Borrowers can also submit the document in person at the local land records office, ensuring immediate processing.

Quick guide on how to complete ct release of mortgage

Effortlessly prepare Ct Release Of Mortgage on any device

Managing documents online has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, since you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents promptly without any hold-ups. Handle Ct Release Of Mortgage on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The simplest way to edit and eSign Ct Release Of Mortgage with ease

- Obtain Ct Release Of Mortgage and press Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with special tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Edit and eSign Ct Release Of Mortgage and guarantee clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct release of mortgage

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is a Connecticut release of mortgage?

A Connecticut release of mortgage is a legal document that formally releases a borrower from their mortgage obligations after the loan has been paid off. This document is crucial as it clears the title of the property, allowing the borrower to sell or refinance without any issues associated with the mortgage. Using airSlate SignNow, you can easily digitally sign and manage your Connecticut release of mortgage documents.

-

How do I prepare a Connecticut release of mortgage?

To prepare a Connecticut release of mortgage, you typically need to gather the mortgage documents and ensure that the loan has been paid in full. With airSlate SignNow, you can streamline this process by uploading your documents, filling in the necessary information, and getting them eSigned by the required parties. This makes the preparation of a Connecticut release of mortgage quick and efficient.

-

What are the benefits of using airSlate SignNow for a Connecticut release of mortgage?

Using airSlate SignNow for your Connecticut release of mortgage offers numerous benefits, including a user-friendly interface and cost-effective solutions. The platform ensures that your documents are signed securely and quickly, eliminating the hassle of traditional paperwork. Additionally, you can track the status of your release of mortgage in real-time, enhancing your workflow.

-

Does airSlate SignNow integrate with other software for managing Connecticut release of mortgage?

Yes, airSlate SignNow offers seamless integrations with a variety of popular software applications. This allows you to easily manage your Connecticut release of mortgage alongside your existing tools, enhancing productivity and collaboration. With these integrations, you can keep all your important documents in one accessible location.

-

What is the pricing for using airSlate SignNow for a Connecticut release of mortgage?

Pricing for airSlate SignNow is competitive and offers various plans to suit different business needs. Whether you're a small business or a larger enterprise, you can find a plan that fits your budget, allowing you to efficiently handle your Connecticut release of mortgage and other documents without breaking the bank. It's a cost-effective solution for eSigning and document management.

-

How secure is the airSlate SignNow platform for a Connecticut release of mortgage?

airSlate SignNow prioritizes security and employs advanced encryption methods to safeguard your documents, including the Connecticut release of mortgage. Your sensitive information is protected throughout the signing process, ensuring that only authorized individuals can access the documents. Trusting airSlate SignNow means you're securing your legal and financial information.

-

Can I track the status of my Connecticut release of mortgage with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your documents, including your Connecticut release of mortgage. You will receive notifications when documents are viewed and signed, which helps you stay organized and ensures that all parties are kept in the loop throughout the signing process.

Get more for Ct Release Of Mortgage

- Form or stt 2 statewide transit tax employee detail report 150 206 006

- 08 03 20 ver form

- Icfid form

- Pdf publication or 40 ext instructions for automatic extension of time form

- 2020 form or 40 n oregon individual income tax return for

- 41373 form

- Mt 903 mn instructions 2020 form

- Customer data sheet form

Find out other Ct Release Of Mortgage

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure