Construction Loan Trid Disclosures Form

What is the Construction Loan Trid Disclosures

The Construction Loan Trid Disclosures are essential documents that provide borrowers with crucial information about the terms and costs associated with their construction loans. These disclosures are part of the TILA-RESPA Integrated Disclosure (TRID) rule, which aims to simplify and clarify the borrowing process. They include the Loan Estimate and Closing Disclosure forms, which outline the loan terms, projected payments, and closing costs. Understanding these disclosures is vital for borrowers to make informed decisions and ensure transparency in their loan agreements.

Key elements of the Construction Loan Trid Disclosures

Several key elements are included in the Construction Loan Trid Disclosures that borrowers should pay attention to:

- Loan Estimate: This document provides an overview of the loan terms, including the interest rate, monthly payments, and estimated closing costs. It helps borrowers compare different loan offers.

- Closing Disclosure: This form is provided three days before closing and details the final terms of the loan, including actual closing costs and any changes from the Loan Estimate.

- Projected Payments: This section outlines the expected monthly payments over the life of the loan, including principal, interest, taxes, and insurance.

- Comparisons: The disclosures include comparisons to help borrowers understand the total costs associated with the loan, including interest paid over time.

Steps to complete the Construction Loan Trid Disclosures

Completing the Construction Loan Trid Disclosures involves several essential steps:

- Gather Information: Collect necessary personal and financial information, including income, assets, and credit history.

- Review Loan Estimates: Analyze the Loan Estimates provided by lenders to understand the terms and costs associated with each loan option.

- Ask Questions: Reach out to lenders for clarification on any terms or costs that are unclear.

- Complete the Closing Disclosure: Review the final Closing Disclosure carefully to ensure all details are accurate before signing.

- Sign and Submit: After verifying the information, sign the necessary documents and submit them as required.

Legal use of the Construction Loan Trid Disclosures

The legal use of the Construction Loan Trid Disclosures is governed by federal regulations, specifically the TILA-RESPA Integrated Disclosure rule. These disclosures must be provided to borrowers in a timely manner to ensure compliance. Lenders are required to deliver the Loan Estimate within three business days of receiving a loan application and the Closing Disclosure at least three business days prior to closing. Failure to comply with these regulations can result in penalties and delays in the loan process.

How to use the Construction Loan Trid Disclosures

Using the Construction Loan Trid Disclosures effectively involves a few straightforward practices:

- Compare Offers: Utilize the Loan Estimate to compare different lenders and their offers, focusing on interest rates and closing costs.

- Understand Costs: Pay close attention to the closing costs and any prepayment penalties outlined in the disclosures.

- Plan for Payments: Use the projected payments section to budget for future monthly payments, ensuring affordability.

- Seek Professional Advice: If needed, consult with a financial advisor or real estate professional to interpret the disclosures and make informed decisions.

Examples of using the Construction Loan Trid Disclosures

Examples of how borrowers can utilize the Construction Loan Trid Disclosures include:

- Evaluating Multiple Loans: A borrower can receive Loan Estimates from various lenders and compare them side by side to find the best deal.

- Identifying Hidden Costs: By carefully reviewing the Closing Disclosure, a borrower may discover unexpected fees that could affect their decision.

- Understanding Loan Terms: A borrower can clarify any confusing terms in the disclosures with their lender, ensuring they fully understand their obligations.

Quick guide on how to complete construction loan trid disclosures

Accomplish Construction Loan Trid Disclosures seamlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly without delays. Handle Construction Loan Trid Disclosures on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to alter and eSign Construction Loan Trid Disclosures effortlessly

- Find Construction Loan Trid Disclosures and click Obtain Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that function.

- Generate your signature using the Sign feature, which takes only moments and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Finished button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign Construction Loan Trid Disclosures and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the construction loan trid disclosures

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

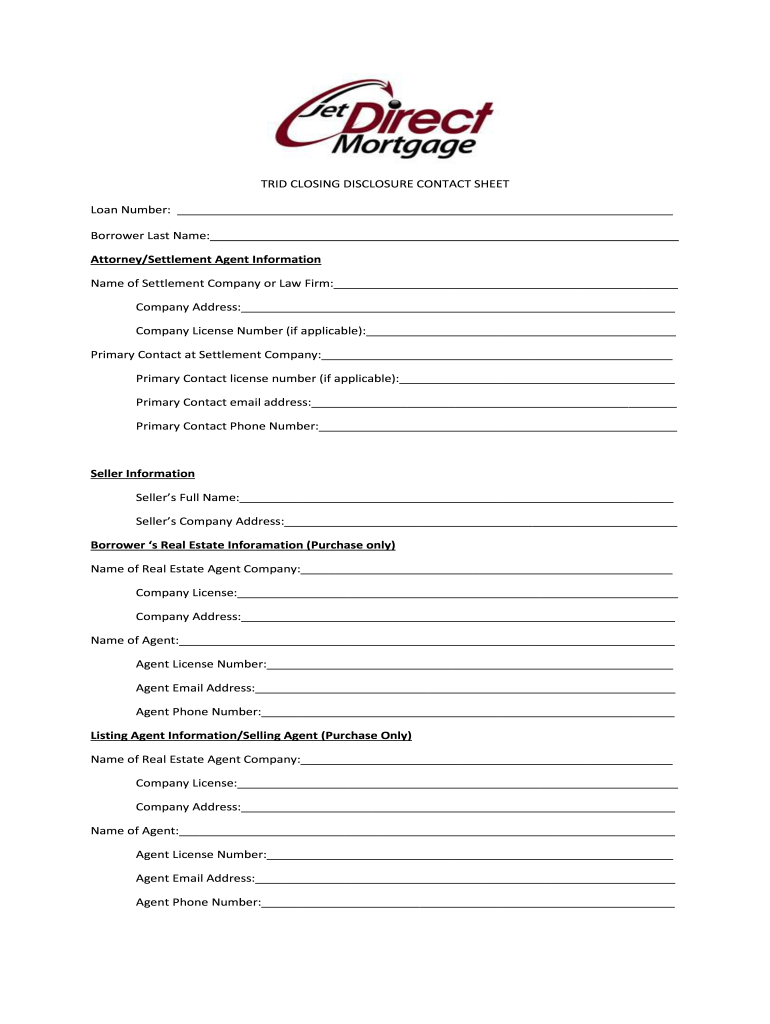

What is a TRID closing sheet?

A TRID closing sheet, also known as the Closing Disclosure, is a document that outlines the final terms and costs of your mortgage loan. It is designed to help borrowers understand their financial obligations before closing on a property. With airSlate SignNow, you can easily manage and eSign your TRID closing sheets, ensuring a smooth closing process.

-

How can airSlate SignNow help with TRID closing sheets?

airSlate SignNow provides an easy-to-use platform to create, manage, and eSign TRID closing sheets electronically. This streamlines the closing process, allowing you to access all necessary documents in one place and ensuring compliance with closing regulations. Our solution eliminates paperwork, making it quicker and more efficient.

-

Is airSlate SignNow affordable for managing TRID closing sheets?

Yes, airSlate SignNow offers a cost-effective solution for managing TRID closing sheets. Our pricing plans are designed to fit the budgets of businesses of all sizes, ensuring that you can benefit from our eSigning features without breaking the bank. Visit our pricing page to find the option that works best for you.

-

Can TRID closing sheets be customized in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize TRID closing sheets according to your business needs. You can easily modify templates, add logos, and include any necessary fields for a polished, professional document. This flexibility ensures that you are providing all the relevant information required at closing.

-

What features does airSlate SignNow offer for TRID closing sheets?

airSlate SignNow offers features such as document templates, secure eSigning, and real-time tracking for TRID closing sheets. These features empower users to manage their closing documents with ease, ensuring that all parties are up-to-date throughout the signing process. Enhanced security measures also protect sensitive information.

-

How does airSlate SignNow integrate with other software for TRID closing sheets?

airSlate SignNow seamlessly integrates with many popular software applications used in the real estate and mortgage industries, allowing for efficient management of TRID closing sheets. Integrating with your CRM, accounting software, or document management system enhances workflow efficiency and minimizes the steps required to complete transactions.

-

What are the benefits of using airSlate SignNow for TRID closing sheets?

Using airSlate SignNow for TRID closing sheets streamlines the entire closing process, reduces manual errors, and enhances compliance with legal requirements. This leads to increased efficiency and a better experience for your clients. Additionally, our electronic signature feature ensures that documents are signed quickly and securely.

Get more for Construction Loan Trid Disclosures

- Power of attorney and declaration of representative the tax adviser form

- 47110 form 990 t processinginternal revenue service irsgov

- Form st 390 2012

- Form i 309 nonresident shareholder or partner affidavit and

- Abl 901 2013 form

- Resale certificate iowa 2006 form

- South carolina st 3 2013 form

- Sc excise tax form 2008

Find out other Construction Loan Trid Disclosures

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile