Procedure of Applying Commercial Letter of Credits 2008-2026

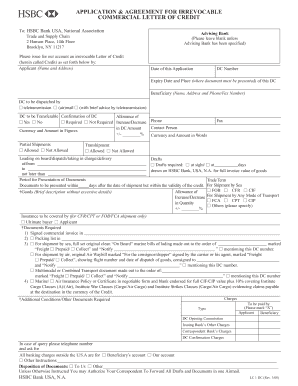

What is the procedure of applying for a commercial letter of credit?

The procedure for applying for a commercial letter of credit involves several key steps that ensure both the buyer and seller are protected in a transaction. Initially, the buyer must approach their bank to request the issuance of a letter of credit. This request typically includes details such as the amount, the beneficiary's information, and the terms of the transaction. The bank then reviews the buyer's creditworthiness and the transaction's legitimacy before proceeding.

Once approved, the bank issues the letter of credit, which is sent to the seller's bank. The seller can then rely on this document as a guarantee of payment, provided they meet the specified terms. This process helps facilitate international trade by reducing the risk of non-payment.

Steps to complete the procedure of applying for a commercial letter of credit

Completing the application for a commercial letter of credit involves several important steps:

- Gather necessary information, including details about the transaction, beneficiary, and terms.

- Submit a formal application to your bank, including all relevant documentation.

- Review the bank's terms and conditions associated with the letter of credit.

- Provide any additional information or documentation as requested by the bank.

- Receive the issued letter of credit and verify its accuracy before forwarding it to the seller.

Required documents for applying for a commercial letter of credit

When applying for a commercial letter of credit, specific documents are essential to facilitate the process:

- Application form provided by the bank.

- Pro forma invoice or sales contract detailing the transaction.

- Identification documents for both the buyer and seller.

- Any additional documents required by the bank, such as financial statements.

Legal use of the procedure of applying for a commercial letter of credit

The legal use of the procedure for applying for a commercial letter of credit is governed by various regulations that ensure compliance and protection for all parties involved. The letter of credit acts as a legally binding agreement between the buyer, seller, and banks, outlining the obligations and rights of each party. It is crucial to adhere to the Uniform Commercial Code (UCC) and other relevant laws to ensure the letter of credit is enforceable.

Key elements of the procedure of applying for a commercial letter of credit

Several key elements are essential to the procedure of applying for a commercial letter of credit:

- Creditworthiness of the buyer, as assessed by the issuing bank.

- Clear terms and conditions specified in the letter of credit.

- Timely communication between all parties involved.

- Compliance with international trade regulations, if applicable.

Who issues the commercial letter of credit?

The commercial letter of credit is typically issued by a bank or financial institution on behalf of the buyer. This bank, known as the issuing bank, evaluates the buyer's creditworthiness and the transaction's legitimacy before issuing the letter. The seller's bank, known as the advising bank, then receives this document and informs the seller of its issuance. This two-bank system helps ensure that both parties are protected throughout the transaction.

Quick guide on how to complete procedure of applying commercial letter of credits

Complete Procedure Of Applying Commercial Letter Of Credits effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed forms, as you can easily find the correct template and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Procedure Of Applying Commercial Letter Of Credits on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign Procedure Of Applying Commercial Letter Of Credits with minimal effort

- Find Procedure Of Applying Commercial Letter Of Credits and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your edits.

- Decide how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Procedure Of Applying Commercial Letter Of Credits and ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the procedure of applying commercial letter of credits

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is a form irrevocable credit?

A form irrevocable credit is a financial document that guarantees payment to a seller once specific conditions are met. This type of credit ensures that a buyer cannot alter or cancel the payment terms, providing security for both parties in a transaction.

-

How can airSlate SignNow help with managing form irrevocable credit?

airSlate SignNow simplifies the process of creating and signing form irrevocable credit by providing an intuitive platform for electronic signatures. Businesses can easily prepare these documents, obtain necessary signatures, and manage contracts all in one place, improving efficiency and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for form irrevocable credit?

airSlate SignNow offers various pricing plans to suit different business needs, including options for managing documents like form irrevocable credit. With a tiered pricing structure, businesses can choose a plan that fits their budget while enjoying access to essential features for document management and signing.

-

What features does airSlate SignNow offer for form irrevocable credit?

airSlate SignNow includes features such as templates, customizable fields, and automatic reminders that enhance the management of form irrevocable credit. These tools help streamline the signing process and ensure that all necessary information is captured efficiently.

-

Can I integrate airSlate SignNow with other applications for form irrevocable credit?

Yes, airSlate SignNow provides integration capabilities with various applications to enhance your workflow for form irrevocable credit. You can connect with popular CRMs, cloud storage services, and productivity tools, allowing for a seamless experience across your business operations.

-

How secure is the signing process for form irrevocable credit using airSlate SignNow?

The signing process for form irrevocable credit using airSlate SignNow is highly secure, utilizing advanced encryption and authentication measures. This ensures that sensitive information remains protected and that transactions are conducted safely, providing peace of mind for businesses and clients alike.

-

Are there any mobile options available for managing form irrevocable credit with airSlate SignNow?

Absolutely! airSlate SignNow offers mobile applications that allow users to create, send, and eSign form irrevocable credit documents on the go. This flexibility enables businesses to manage their document workflow anytime, anywhere, ensuring that important transactions are never delayed.

Get more for Procedure Of Applying Commercial Letter Of Credits

Find out other Procedure Of Applying Commercial Letter Of Credits

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed