Vat 264 2010-2026

What is the VAT 264?

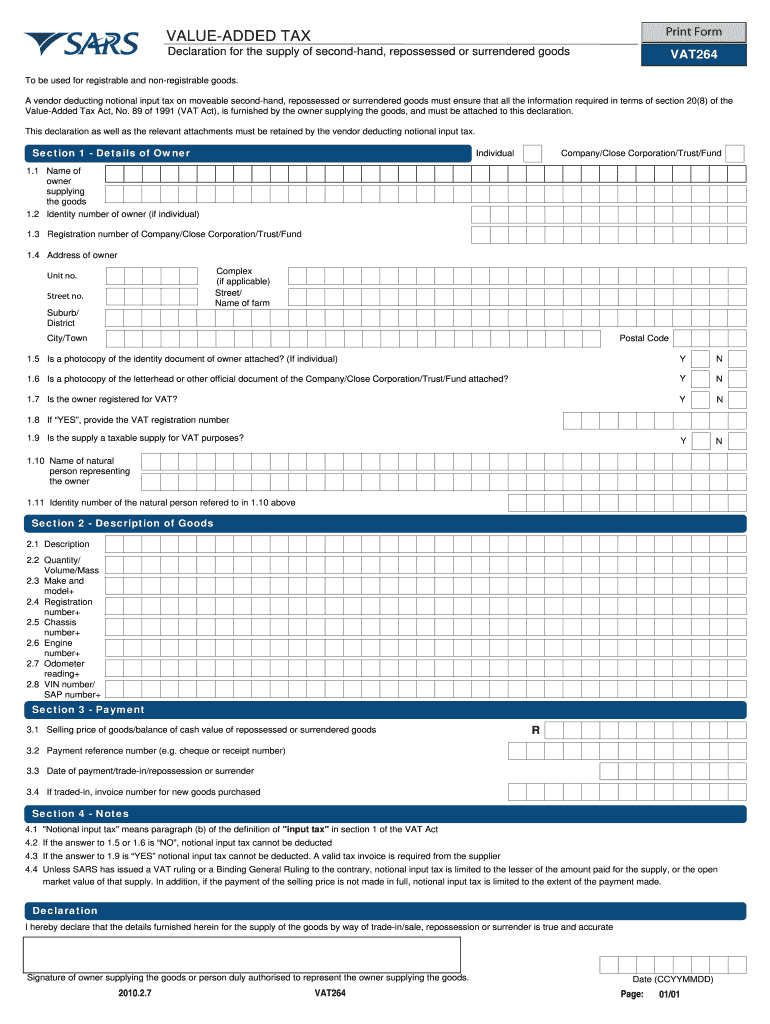

The VAT 264 form is a critical document used primarily for tax purposes, specifically related to the Value Added Tax (VAT) in the United States. This form is essential for businesses that need to report VAT liabilities and claim refunds. Understanding its purpose and function is vital for compliance with tax regulations. The VAT 264 form serves as a formal declaration of VAT obligations, ensuring that businesses adhere to the legal requirements set forth by the Internal Revenue Service (IRS) and state tax authorities.

How to Use the VAT 264

Using the VAT 264 form involves several steps to ensure accurate reporting and compliance. First, gather all necessary financial records that pertain to your VAT transactions. This includes sales invoices, purchase receipts, and any other relevant documentation. Next, fill out the VAT 264 form with precise details regarding your VAT collected and paid. After completing the form, review it for accuracy before submission. It is crucial to keep a copy of the submitted form for your records, as this may be needed for future reference or audits.

Steps to Complete the VAT 264

Completing the VAT 264 form requires careful attention to detail. Here are the essential steps involved:

- Gather all relevant financial documents, including invoices and receipts.

- Enter your business information at the top of the form, ensuring accuracy.

- Detail your VAT collected from sales and VAT paid on purchases.

- Calculate the net VAT amount due or refundable.

- Sign and date the form to certify its accuracy.

Once completed, the form can be submitted according to the guidelines provided by the IRS or your state tax authority.

Legal Use of the VAT 264

The VAT 264 form is legally binding when filled out correctly and submitted in accordance with tax laws. To ensure its legal standing, it is important to comply with all relevant regulations, including those set by the IRS. The form must be signed by an authorized representative of the business, and the information provided must be truthful and accurate. Failure to comply with these legal requirements can result in penalties and complications during audits.

Required Documents

When preparing to complete the VAT 264 form, certain documents are necessary to support your claims. These include:

- Sales invoices that detail VAT collected from customers.

- Purchase receipts showing VAT paid on business expenses.

- Previous VAT returns, if applicable, for reference.

- Any correspondence with tax authorities related to VAT.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in your reporting.

Form Submission Methods

The VAT 264 form can be submitted through various methods, depending on the requirements of your state tax authority. Common submission methods include:

- Online submission through the tax authority's official website.

- Mailing a physical copy of the form to the designated tax office.

- In-person submission at local tax offices, if available.

It is essential to check the specific submission guidelines for your state to ensure compliance and timely processing.

Quick guide on how to complete vat 264

Prepare Vat 264 effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources to create, edit, and electronically sign your documents swiftly and without holdups. Manage Vat 264 on any device using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

The easiest way to modify and electronically sign Vat 264 with ease

- Locate Vat 264 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or obscure confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and then tap the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Vat 264 and ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat 264

Create this form in 5 minutes!

How to create an eSignature for the vat 264

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the vat264 pdf and how is it used?

The vat264 pdf is a document that businesses use for filing VAT returns. It provides a streamlined format for reporting VAT amounts to tax authorities. Using the vat264 pdf can simplify your tax processes and ensure compliance with regulations.

-

How can airSlate SignNow help me with the vat264 pdf?

airSlate SignNow allows you to easily upload, sign, and send the vat264 pdf securely. Our platform ensures that your VAT returns are organized and can be signed electronically, saving you time and reducing paperwork. This feature is especially useful for businesses looking to enhance their document management.

-

Is there a cost associated with using the vat264 pdf on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include unlimited access to features like the vat264 pdf management. Our cost-effective solutions ensure that you can manage your documents, including the vat264 pdf, without breaking the bank. It's a worthwhile investment for enhancing your business operations.

-

Can I integrate the vat264 pdf with other software using airSlate SignNow?

Absolutely! airSlate SignNow offers seamless integrations with popular software, enabling you to connect your existing applications with the vat264 pdf process. This integration helps you streamline workflows, making it easier to manage your VAT documentation alongside other business processes.

-

What are the security features of airSlate SignNow when handling vat264 pdf files?

Security is a top priority at airSlate SignNow. When handling your vat264 pdf files, we employ industry-leading encryption and secure cloud storage. This ensures that your sensitive VAT information is protected, giving you peace of mind while managing your documents.

-

How easy is it to edit the vat264 pdf in airSlate SignNow?

Editing the vat264 pdf is straightforward with airSlate SignNow. Our user-friendly interface allows you to make necessary changes quickly and accurately. You can annotate, add text, or sign documents with ease, ensuring your VAT returns are always accurate and up-to-date.

-

What are the benefits of using airSlate SignNow for the vat264 pdf?

Using airSlate SignNow for your vat264 pdf offers numerous benefits, including faster document turnaround and reduced need for physical paperwork. Our platform simplifies the signing process, making it easy for all parties to complete and return documents. This efficiency can help you focus more on your core business.

Get more for Vat 264

- Void cheque rbc form

- Final decree of divorce form

- Statement of services rendered form

- Form rc325

- Declaration of intent to evict for landlord occupancy form

- Chl 6 form

- Hipaa authorization form georgia

- Form it 2658 nys attachment to form it 2658 report of estimated personal income tax for nonresident individuals year

Find out other Vat 264

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy