Fa$trak Borrower Information Form Ameris Bank 2020-2026

What is the Fa$trak Borrower Information Form Ameris Bank

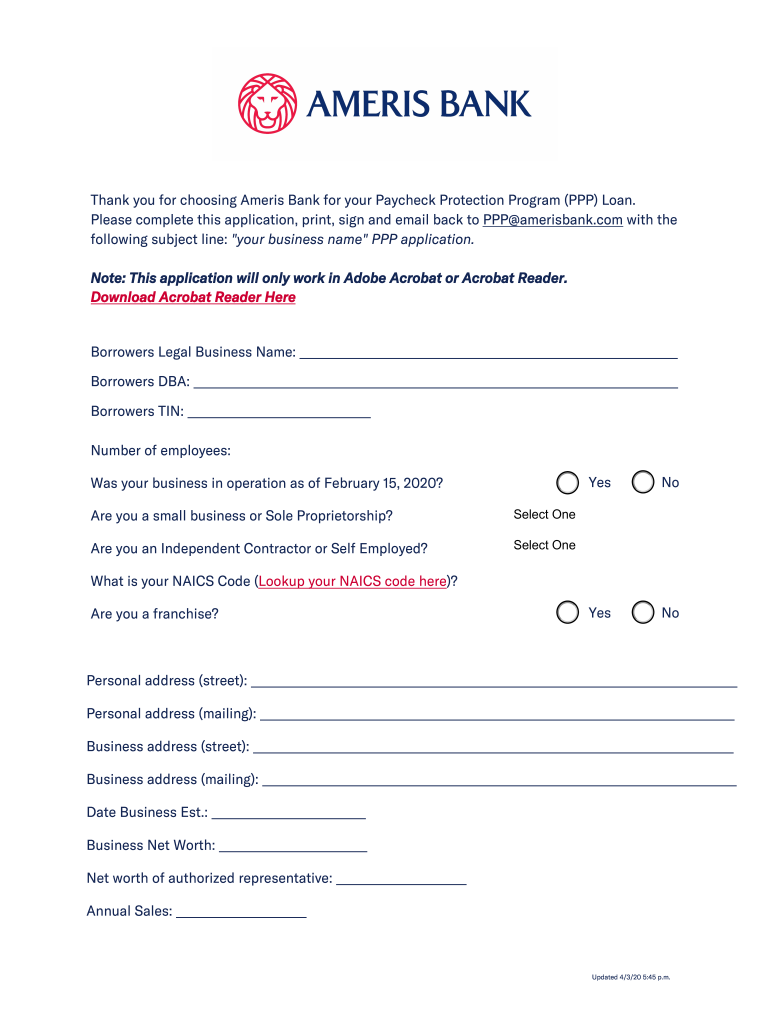

The Fa$trak Borrower Information Form Ameris Bank is a document designed to collect essential information from borrowers seeking financial assistance. This form serves as a critical component in the loan application process, allowing Ameris Bank to assess the borrower's financial situation and eligibility for various loan products. It typically includes sections for personal identification, income details, employment history, and other relevant financial information.

How to use the Fa$trak Borrower Information Form Ameris Bank

Using the Fa$trak Borrower Information Form Ameris Bank involves several straightforward steps. First, borrowers should ensure they have all necessary personal and financial information readily available. Next, they can access the form through Ameris Bank's official website or request a physical copy. Once the form is obtained, borrowers should fill it out completely, ensuring accuracy to avoid delays in processing. After completing the form, it can be submitted electronically or via traditional mail, depending on the borrower's preference and the bank's submission guidelines.

Steps to complete the Fa$trak Borrower Information Form Ameris Bank

Completing the Fa$trak Borrower Information Form Ameris Bank involves the following steps:

- Gather personal identification documents, such as a driver's license or Social Security number.

- Collect financial documents, including pay stubs, bank statements, and tax returns.

- Access the form through the Ameris Bank website or request a physical copy.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or missing information.

- Submit the completed form electronically or by mail, following the bank's submission instructions.

Key elements of the Fa$trak Borrower Information Form Ameris Bank

The key elements of the Fa$trak Borrower Information Form Ameris Bank include personal identification information, employment details, income verification, and financial obligations. Each section is crucial for determining the borrower's creditworthiness and ability to repay the loan. Additionally, the form may require disclosures regarding any existing debts or financial commitments, which help the bank evaluate the overall financial health of the borrower.

Legal use of the Fa$trak Borrower Information Form Ameris Bank

The Fa$trak Borrower Information Form Ameris Bank is legally binding when completed accurately and submitted in compliance with applicable laws. This form must adhere to federal and state regulations regarding lending practices and borrower rights. Ensuring that all information is truthful and complete is essential, as any discrepancies may lead to legal implications or denial of the loan application.

Form Submission Methods (Online / Mail / In-Person)

Borrowers have multiple options for submitting the Fa$trak Borrower Information Form Ameris Bank. The most efficient method is online submission, which allows for immediate processing. Alternatively, borrowers can mail the completed form to the designated address provided by the bank. In-person submission is also an option at local Ameris Bank branches, where borrowers can receive assistance if needed. Each method has its own processing times and requirements, so borrowers should choose the one that best suits their needs.

Quick guide on how to complete fatrak borrower information form ameris bank

Complete Fa$trak Borrower Information Form Ameris Bank effortlessly on any device

Digital document management has gained traction among businesses and users alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to find the necessary form and securely store it online. airSlate SignNow offers you all the tools required to create, edit, and eSign your documents promptly without any delays. Manage Fa$trak Borrower Information Form Ameris Bank on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign Fa$trak Borrower Information Form Ameris Bank without any hassle

- Find Fa$trak Borrower Information Form Ameris Bank and click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Fa$trak Borrower Information Form Ameris Bank and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fatrak borrower information form ameris bank

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for an Ameris Bank borrower?

airSlate SignNow provides Ameris Bank borrowers with a comprehensive suite of eSigning features, including customizable templates, document tracking, and secure cloud storage. These tools enhance the signing experience, ensuring that borrowers can sign documents swiftly and securely from any device. The platform's user-friendly interface makes it easy for all users, regardless of their tech skills.

-

How does airSlate SignNow streamline the signing process for Ameris Bank borrowers?

For Ameris Bank borrowers, airSlate SignNow streamlines the signing process by allowing users to send, sign, and manage documents electronically. This reduces the hassle of printing and scanning, enabling quicker turnaround times. With real-time notifications, borrowers stay updated on document status, ensuring a smoother transaction experience.

-

Is airSlate SignNow affordable for Ameris Bank borrowers?

Yes, airSlate SignNow offers a cost-effective solution tailored for Ameris Bank borrowers looking to save on printing and mailing costs. Different pricing plans are available to accommodate various business needs, making it accessible for borrowers at different budget levels. This value proposition, combined with its robust features, makes it a great investment for efficient document management.

-

How can Ameris Bank borrowers integrate airSlate SignNow with their existing systems?

Ameris Bank borrowers can easily integrate airSlate SignNow with a variety of existing systems, such as CRM and ERP solutions, to enhance workflow efficiency. The platform offers a range of integrations through APIs and pre-built connectors with popular applications. This seamless integration capability allows borrowers to continue using their preferred applications while benefiting from electronic signing.

-

What security measures does airSlate SignNow have for Ameris Bank borrowers?

Security is a top priority for airSlate SignNow, particularly for Ameris Bank borrowers handling sensitive information. The platform employs advanced security measures, including encryption, multi-factor authentication, and secure data storage. These features ensure that all documents and signatures are safe from unauthorized access, giving borrowers peace of mind.

-

Can Ameris Bank borrowers sign documents on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing Ameris Bank borrowers to sign documents on-the-go. The mobile application ensures that users have the same easy-to-use features as on desktop, enabling quick and convenient signing anytime, anywhere. This flexibility enhances productivity and suits the busy lifestyles of today's borrowers.

-

What support does airSlate SignNow offer to Ameris Bank borrowers?

airSlate SignNow offers extensive support to Ameris Bank borrowers, including a comprehensive knowledge base, tutorials, and customer service. Whether users have questions about functionalities or need troubleshooting assistance, help is readily available. The dedicated support team ensures that borrowers can utilize the platform effectively without disruptions.

Get more for Fa$trak Borrower Information Form Ameris Bank

- Com i may confirm the address that is on file and track the status of this withdrawal request form

- Complete ambulance license application form

- Lcs 8dot form

- Tax year wage tax refund petition 20 philagov form

- Authorization for verification of state of louisiana form

- Allianz life withdrawal request form education educationaznet

- Disabled dependent application for state health plan disabled dependent application for state health plan form

- A separate claim form must be submitted for each patient

Find out other Fa$trak Borrower Information Form Ameris Bank

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself