Oklahoma Non Resident Tax Form

What is the Oklahoma Non Resident Tax Form

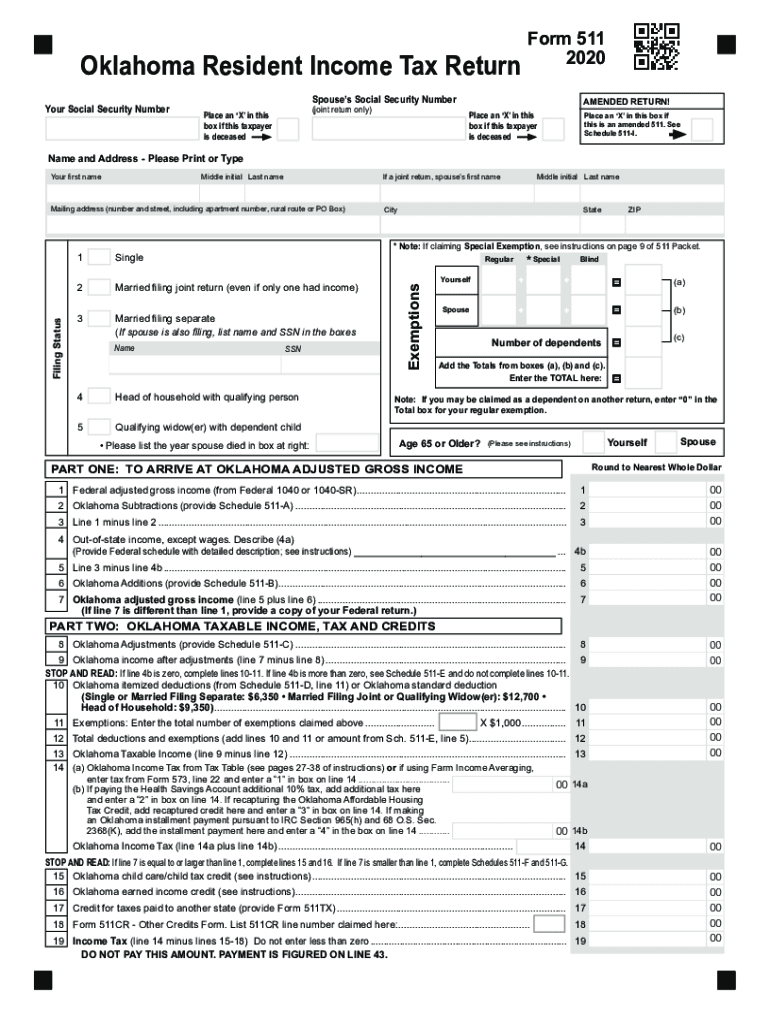

The Oklahoma Non Resident Tax Form, commonly referred to as Form 511, is a tax document used by individuals who are not residents of Oklahoma but have earned income from sources within the state. This form allows non-residents to report their income and calculate their tax liability to ensure compliance with state tax laws. It is essential for non-residents to accurately fill out this form to avoid penalties and ensure they pay the correct amount of tax based on their Oklahoma-sourced income.

Steps to complete the Oklahoma Non Resident Tax Form

Completing the Oklahoma Non Resident Tax Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s and 1099s that report income earned in Oklahoma. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your total income earned in Oklahoma and any deductions you may qualify for. After completing the form, review it for accuracy before submitting it to the appropriate tax authority.

Legal use of the Oklahoma Non Resident Tax Form

The Oklahoma Non Resident Tax Form is legally binding and must be completed in accordance with Oklahoma tax laws. It is crucial to ensure that all information provided is accurate and truthful, as any discrepancies can lead to audits or penalties. The form serves as a declaration of income earned in the state and is subject to verification by the Oklahoma Tax Commission. Utilizing a reliable eSignature solution can enhance the legal validity of the form when submitting it electronically.

Filing Deadlines / Important Dates

Filing deadlines for the Oklahoma Non Resident Tax Form are critical to avoid late fees and penalties. Typically, the deadline for submitting the form aligns with the federal tax filing deadline, which is usually April fifteenth. It is advisable to check for any specific extensions or changes announced by the Oklahoma Tax Commission each tax year. Staying informed about these dates ensures timely compliance and helps avoid unnecessary complications.

Required Documents

To successfully complete the Oklahoma Non Resident Tax Form, several documents are required. These include W-2 forms from employers reporting Oklahoma income, 1099 forms for any freelance or contract work, and documentation for any deductions claimed. Additionally, it may be necessary to provide proof of residency in another state to substantiate non-resident status. Having these documents ready will streamline the filing process and ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The Oklahoma Non Resident Tax Form can be submitted through various methods, providing flexibility for taxpayers. It can be filed online using the Oklahoma Tax Commission's electronic filing system, which is efficient and secure. Alternatively, taxpayers may choose to mail the completed form to the designated address provided by the tax authority. In-person submissions are also an option at local tax offices, where assistance may be available for any questions regarding the form.

Quick guide on how to complete oklahoma 2020 non resident tax form 2020

Effortlessly prepare Oklahoma Non Resident Tax Form on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to locate the right form and securely store it on the internet. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Handle Oklahoma Non Resident Tax Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and electronically sign Oklahoma Non Resident Tax Form with ease

- Locate Oklahoma Non Resident Tax Form and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize relevant portions of your documents or cover sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Oklahoma Non Resident Tax Form while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma 2020 non resident tax form 2020

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is a form 511 return?

A form 511 return is a tax return form used primarily by businesses to report income and calculate tax liabilities. It is essential for proper tax compliance and ensures that businesses stay in good standing with tax authorities. Understanding this form is crucial for accurate filing.

-

How can airSlate SignNow help with my form 511 return?

airSlate SignNow provides a streamlined solution for digitally signing and sending your form 511 return documents. Our platform ensures that you can manage this important form efficiently, minimizing delays and increasing accuracy in your submissions. Enjoy peace of mind with secure and verified eSignatures.

-

What are the pricing options for using airSlate SignNow for form 511 returns?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes, ensuring that you can handle form 511 returns without breaking the bank. We provide flexible subscription options, allowing you to select the plan that best meets your needs, whether you're a small business or a larger enterprise.

-

Is airSlate SignNow secure for filing form 511 returns?

Absolutely! airSlate SignNow prioritizes security, employing top-level encryption to protect sensitive data during the filing of your form 511 return. Our platform is designed with compliance in mind, so you can trust that your documents are safe and meet all legal requirements.

-

Can I integrate airSlate SignNow with other accounting software for my form 511 return?

Yes, airSlate SignNow offers seamless integrations with various accounting software, making it easier to retrieve and send your form 511 return data. This connectivity helps streamline your workflow, ensuring that you can manage all aspects of your business’s tax responsibilities efficiently.

-

What features does airSlate SignNow offer for managing form 511 returns?

airSlate SignNow includes features like eSignature capabilities, document management, and automated workflows specifically designed to assist with form 511 returns. These tools help simplify the process, making it easier to track and manage your submissions while enhancing collaboration among team members.

-

Can I access my saved form 511 return documents from multiple devices?

Yes, with airSlate SignNow, your saved form 511 return documents are accessible from any device with an internet connection. This flexibility allows you to work anytime, anywhere, ensuring you can always manage your returns conveniently whether you are in the office or on the go.

Get more for Oklahoma Non Resident Tax Form

Find out other Oklahoma Non Resident Tax Form

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF