T2 Short Return Form 2009

What is the T2 Short Return Form

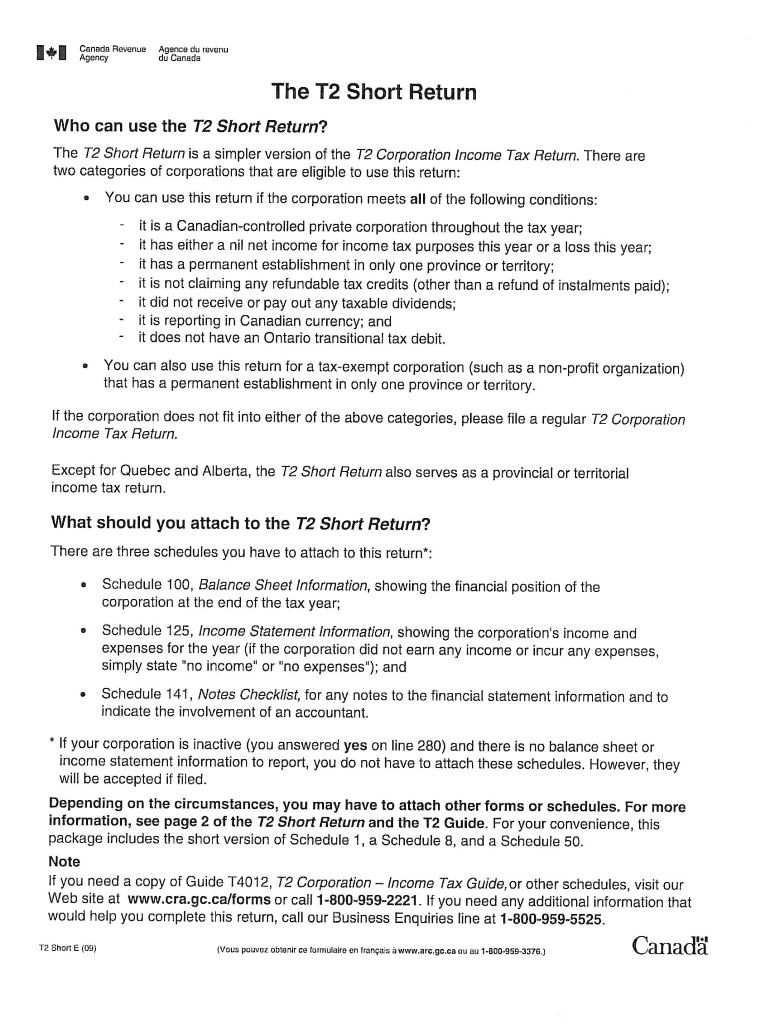

The T2 Short Return Form is a simplified tax form used by certain corporations in the United States to report their income, deductions, and taxes owed to the Internal Revenue Service (IRS). This form is specifically designed for corporations that meet specific criteria, allowing them to file a shorter and more straightforward return compared to the standard T2 form. The T2 Short Return Form streamlines the filing process, making it easier for eligible corporations to comply with tax regulations while ensuring that they provide all necessary financial information to the IRS.

How to use the T2 Short Return Form

Utilizing the T2 Short Return Form involves several key steps. First, ensure that your corporation qualifies to use this form by meeting the eligibility criteria set by the IRS. Next, gather all necessary financial documents, including income statements and expense reports. Once you have the required information, fill out the form accurately, ensuring that all figures are correct and complete. After completing the form, review it for any errors before submitting it to the IRS by the specified deadline. Using digital tools can streamline this process, allowing for easier completion and submission.

Steps to complete the T2 Short Return Form

Completing the T2 Short Return Form involves a series of straightforward steps:

- Verify your eligibility to use the T2 Short Return Form.

- Collect all relevant financial documents, including income and expense records.

- Fill out the form, ensuring that all sections are completed accurately.

- Double-check all figures and calculations for accuracy.

- Submit the completed form to the IRS by the deadline.

Following these steps carefully can help ensure a smooth filing process and compliance with tax regulations.

Legal use of the T2 Short Return Form

The T2 Short Return Form is legally recognized for filing corporate taxes, provided that it is completed accurately and submitted on time. To ensure its legal validity, corporations must adhere to IRS guidelines and maintain proper documentation to support the information reported on the form. Additionally, using electronic signatures through trusted platforms can enhance the legal standing of the submitted form, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the T2 Short Return Form are critical for compliance. Typically, corporations must submit their tax returns by the 15th day of the third month following the end of their fiscal year. For corporations operating on a calendar year, this means the deadline is March 15. It is essential to be aware of any changes to these deadlines and to plan accordingly to avoid penalties for late filing.

Required Documents

To complete the T2 Short Return Form, several documents are necessary. These include:

- Income statements detailing revenue earned during the tax year.

- Expense reports outlining all business-related costs.

- Previous tax returns, if applicable, to provide context for current filings.

- Any additional documentation required by the IRS for specific deductions or credits.

Having these documents ready can facilitate a smoother completion process and ensure accurate reporting.

Quick guide on how to complete t2 short return 2007 2009 form

Effortlessly Prepare T2 Short Return Form on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed papers, allowing you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools needed to create, revise, and eSign your documents swiftly and without delays. Manage T2 Short Return Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign T2 Short Return Form with Ease

- Find T2 Short Return Form and click Acquire Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and possesses the same legal validity as a conventional handwritten signature.

- Review all the details and click the Complete button to save your changes.

- Choose your preferred method of delivering your form: via email, SMS, or invite link, or download it to your computer.

No more concerns about lost or misplaced files, tiring document searches, or errors that necessitate printing fresh copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Alter and eSign T2 Short Return Form to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t2 short return 2007 2009 form

Create this form in 5 minutes!

How to create an eSignature for the t2 short return 2007 2009 form

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What is a T2 Short Return Form?

The T2 Short Return Form is a simplified version of the standard T2 corporate income tax return used by Canadian corporations. It is designed for businesses that have straightforward financial situations, making it easier to file taxes efficiently. Utilizing the T2 Short Return Form can also expedite processing times with the Canada Revenue Agency.

-

How can airSlate SignNow assist with the T2 Short Return Form?

airSlate SignNow facilitates the efficient signing and management of your T2 Short Return Form by allowing you to send and eSign documents seamlessly. With its user-friendly interface, you can quickly prepare and distribute your forms for electronic signatures, ensuring a hassle-free filing process. This makes it an ideal solution for businesses looking to streamline tax submissions.

-

Is there a cost associated with using airSlate SignNow for the T2 Short Return Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs, which include features for handling the T2 Short Return Form. There are flexible billing options available, enabling your business to choose a plan that works best for your budget. Investing in airSlate SignNow can ultimately save you time and improve your document workflows.

-

What features does airSlate SignNow offer for the T2 Short Return Form?

airSlate SignNow provides features such as customizable templates, secure electronic signatures, and document tracking for your T2 Short Return Form. These tools help ensure that your forms are completed accurately and efficiently. Additionally, it integrates seamlessly with popular productivity software, enhancing your existing workflows.

-

Can I integrate airSlate SignNow with other applications for managing the T2 Short Return Form?

Absolutely! airSlate SignNow offers integrations with various applications such as Google Drive, Salesforce, and Zapier, allowing for a smooth flow of document management related to the T2 Short Return Form. This means you can work within your preferred tools while leveraging the powerful signing capabilities of airSlate SignNow. Such integrations enhance productivity and streamline your business processes.

-

What are the benefits of using airSlate SignNow for my T2 Short Return Form?

Using airSlate SignNow for your T2 Short Return Form offers numerous benefits, such as increased efficiency and faster turnaround times for document processing. The platform ensures legal compliance and signNowly reduces printing and mailing costs associated with traditional form submission. Overall, it simplifies the tax return process for businesses of all sizes.

-

Is airSlate SignNow secure for handling sensitive T2 Short Return Form information?

Yes, airSlate SignNow prioritizes the security of your documents, including the T2 Short Return Form. It employs advanced encryption protocols and complies with industry standards to protect sensitive information. You can feel confident that your data is secure while utilizing airSlate SignNow for your tax documents.

Get more for T2 Short Return Form

- Fl 666 form

- Jv 820 form

- Gc 240 order appointing guardian of minor judicial council forms courts ca

- Jv 403 sibling attachment contact and placement judicial council forms courts ca

- Court transfer form

- Tr 510 notice and waiver of rights and request for remote video proceeding judicial council forms courts ca

- Jv826 form

- 417 placement code pdf form

Find out other T2 Short Return Form

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF