T2 Tax ReturnT2 Corporate Income Tax Software 2019-2026

What is the T2 Tax Return

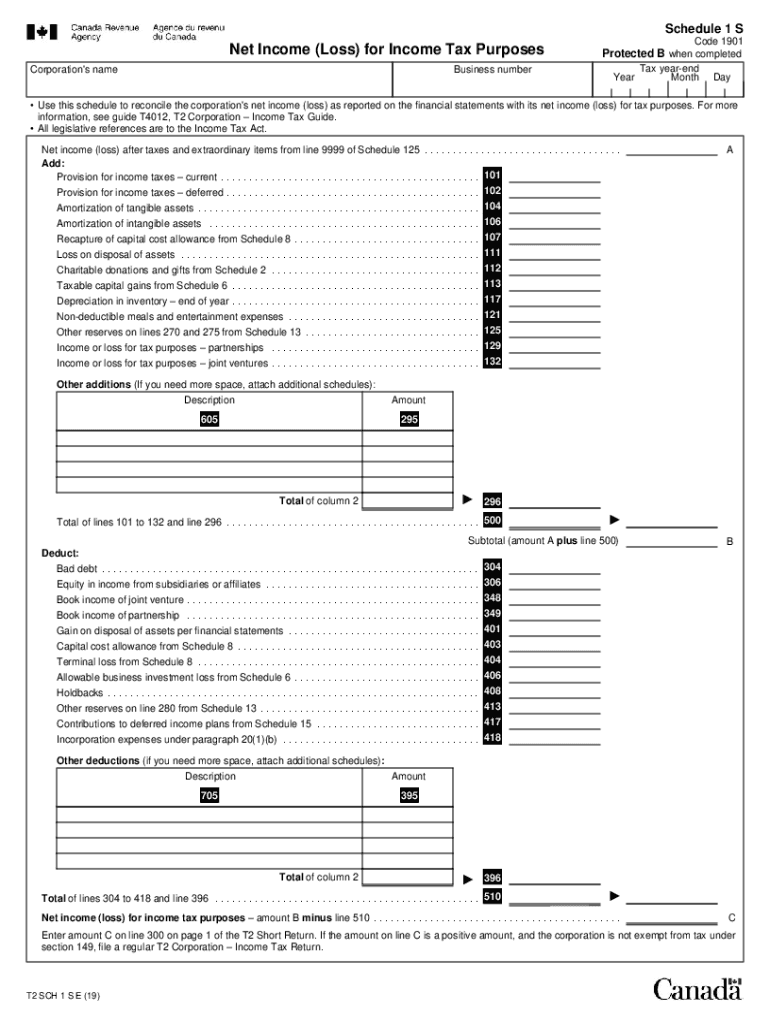

The T2 tax return is a corporate income tax form required by the Canada Revenue Agency (CRA) for corporations operating in Canada. This form is essential for reporting a corporation's income, deductions, and tax payable. While the T2 return is primarily used by Canadian corporations, understanding its structure and requirements can be beneficial for U.S. businesses with cross-border operations or interests in Canadian markets. The T2 form must be completed accurately to ensure compliance with Canadian tax laws and regulations.

Steps to Complete the T2 Tax Return

Completing the T2 tax return involves several key steps to ensure accuracy and compliance. Here are the essential steps:

- Gather necessary financial documents, including income statements, balance sheets, and previous tax returns.

- Determine the appropriate T2 form variant based on your corporation's specific situation, such as the T2 short return for smaller corporations.

- Accurately fill out the required sections, including income, deductions, and tax credits.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or by mail to the appropriate CRA office.

Legal Use of the T2 Tax Return

The T2 tax return is legally binding and must be filed in accordance with Canadian tax laws. Corporations are required to file their T2 returns within six months of the end of their fiscal year. Failure to file accurately and on time can result in penalties, interest charges, and potential audits. It is crucial for corporations to maintain proper records and ensure that all information submitted is truthful and complete to avoid legal complications.

Required Documents

To complete the T2 tax return, corporations must gather several key documents, including:

- Financial statements, including income statements and balance sheets.

- Details of any tax credits or deductions claimed.

- Previous year’s T2 return for reference.

- Any supporting documentation for expenses and income sources.

Form Submission Methods

The T2 tax return can be submitted through various methods, allowing corporations flexibility in how they file their taxes. The primary submission methods include:

- Electronic filing through the CRA's online portal, which is the preferred method for many corporations.

- Mailing a paper copy of the T2 return to the designated CRA office.

- In-person submission at a local CRA office, though this option may be limited.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines to remain compliant with CRA regulations. The general deadline for filing the T2 tax return is six months after the end of the corporation's fiscal year. It is important to note that late filings may incur penalties and interest charges. Corporations should also be aware of any changes to deadlines that may occur due to special circumstances or government announcements.

Quick guide on how to complete t2 tax returnt2 corporate income tax software

Easily Prepare T2 Tax ReturnT2 Corporate Income Tax Software on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage T2 Tax ReturnT2 Corporate Income Tax Software on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Edit and Electronically Sign T2 Tax ReturnT2 Corporate Income Tax Software with Ease

- Obtain T2 Tax ReturnT2 Corporate Income Tax Software and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize key sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional signed signature.

- Review all details and click on the Done button to finalize your changes.

- Select your preferred method for sending your form, whether through email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors requiring new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device of your choice. Edit and electronically sign T2 Tax ReturnT2 Corporate Income Tax Software and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t2 tax returnt2 corporate income tax software

Create this form in 5 minutes!

How to create an eSignature for the t2 tax returnt2 corporate income tax software

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is the process for submitting a 2017 return T2 using airSlate SignNow?

To submit a 2017 return T2 using airSlate SignNow, simply upload your T2 form and invite relevant parties to eSign. The platform ensures that all signatures are legally binding and securely stored. Once all signatures are collected, you can easily download or send the completed document.

-

How much does airSlate SignNow cost for filing a 2017 return T2?

The pricing for airSlate SignNow starts at a competitive rate which makes it a cost-effective option for businesses. Specific plans may vary based on features needed for the 2017 return T2. Our flexible pricing allows you to choose the best option for your business needs.

-

What features does airSlate SignNow offer for managing my 2017 return T2?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking that are perfect for managing your 2017 return T2. These tools streamline the filing process and enhance collaboration among your team. Additionally, you can access the platform from anywhere, ensuring flexibility.

-

Are there integrations available with airSlate SignNow for 2017 return T2?

Yes, airSlate SignNow integrates seamlessly with various accounting and business applications, making it easier to manage your 2017 return T2. This helps you connect with tools you already use, enhancing workflow efficiency. Check the integration list on our website to learn more.

-

Is airSlate SignNow secure for handling sensitive 2017 return T2 documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive information related to your 2017 return T2. We prioritize your data security, ensuring that your documents are safe from unauthorized access.

-

Can I use airSlate SignNow for multiple years of T2 returns?

Yes, with airSlate SignNow, you can manage and eSign multiple years of T2 returns, including the 2017 return T2. Our platform is designed for scalability, accommodating a range of document submissions for your accounting needs. This allows for streamlined document management all in one place.

-

What support is available if I encounter issues with my 2017 return T2 on airSlate SignNow?

If you encounter issues while using airSlate SignNow for your 2017 return T2, our customer support team is here to help. We provide various support options, including live chat, email, and comprehensive resources on our website. Our goal is to ensure you have a smooth experience.

Get more for T2 Tax ReturnT2 Corporate Income Tax Software

- Show cause hearing form

- Ju 130720 order on hearing re contempt washington form

- Ju 130800 motion to assume jurisdiction and order assuming jurisdiction washington form

- Washington motion order form

- Wa order custody form

- Wpf ju 02 0150 form

- Shelter hearing form

- Ju 020220 order authorizing continued shelter care washington form

Find out other T2 Tax ReturnT2 Corporate Income Tax Software

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form