Mileage Logs for Form 2012

What is the Mileage Logs For Form

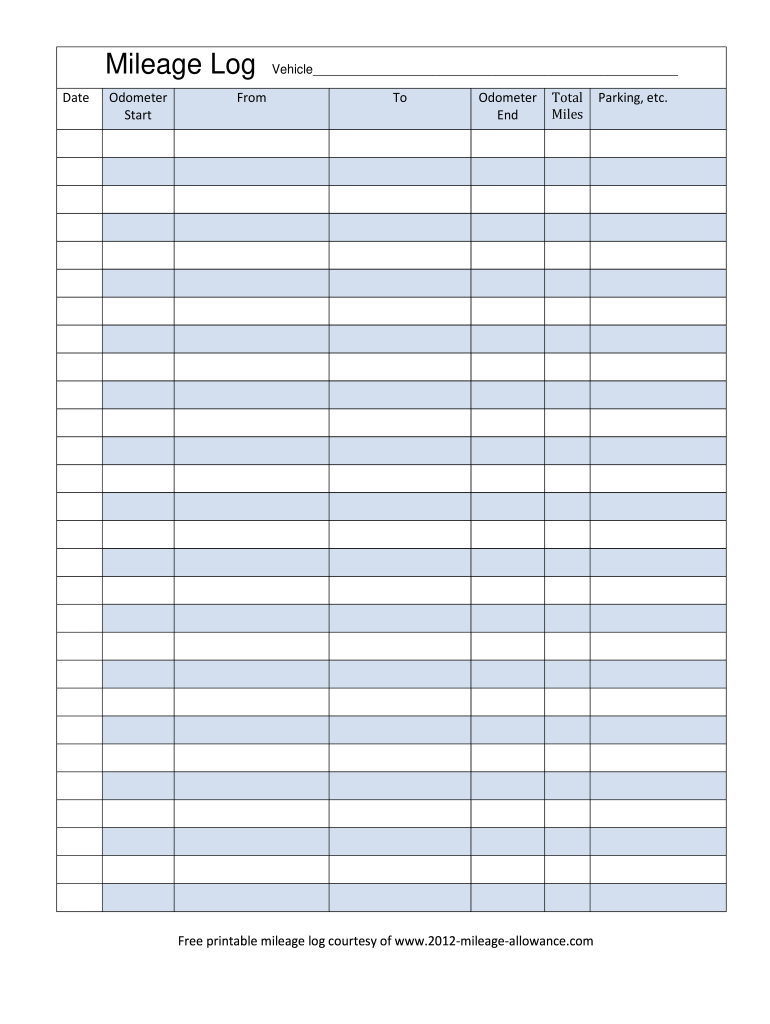

The Mileage Logs For Form is a document used primarily by individuals and businesses to track vehicle mileage for various purposes, including tax deductions and reimbursements. This form helps in accurately recording the distance traveled for business-related activities, ensuring compliance with IRS regulations. It typically includes essential details such as the date of travel, purpose of the trip, starting and ending odometer readings, and total miles driven.

How to use the Mileage Logs For Form

Using the Mileage Logs For Form involves a systematic approach to ensure all relevant information is captured. Begin by documenting each trip’s date and purpose. Next, record the starting and ending odometer readings to calculate the total mileage. It is crucial to maintain this log throughout the year to ensure accuracy during tax season. Digital solutions can streamline this process, allowing for easy updates and storage of records.

Steps to complete the Mileage Logs For Form

Completing the Mileage Logs For Form requires a few straightforward steps:

- Gather necessary information, including vehicle details and trip purposes.

- Record the date of each trip in the designated section.

- Note the starting odometer reading before the trip and the ending reading after.

- Calculate the total miles driven by subtracting the starting reading from the ending reading.

- Repeat this process for each business-related trip throughout the year.

Legal use of the Mileage Logs For Form

The Mileage Logs For Form holds legal significance, especially when used to substantiate claims for tax deductions. To ensure its legal standing, the form must be filled out accurately and maintained with supporting documentation, such as receipts or invoices. Compliance with IRS guidelines is essential to avoid potential penalties during audits.

IRS Guidelines

The IRS has specific guidelines regarding the use of mileage logs for tax deductions. According to IRS Publication 463, taxpayers must keep detailed records of their business mileage, including the date, destination, purpose, and mileage. The IRS requires that these logs be maintained in a consistent manner and must be available for review if requested during an audit.

Required Documents

When completing the Mileage Logs For Form, certain documents may be required to support the information provided. These may include:

- Receipts for travel-related expenses.

- Invoices related to business activities.

- Any correspondence that verifies the purpose of the trips.

Form Submission Methods

The Mileage Logs For Form can be submitted through various methods, depending on the requirements of the entity requesting it. Common submission methods include:

- Online submission via secure platforms that allow for eSigning.

- Mailing a physical copy to the requesting organization.

- In-person delivery, if required by the organization.

Quick guide on how to complete mileage logs for 2012 form

Complete Mileage Logs For Form effortlessly on any device

Digital document management has gained increased popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Mileage Logs For Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-related activity today.

How to modify and eSign Mileage Logs For Form effortlessly

- Locate Mileage Logs For Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Mileage Logs For Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mileage logs for 2012 form

Create this form in 5 minutes!

How to create an eSignature for the mileage logs for 2012 form

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What are Mileage Logs For Form and how do they work?

Mileage Logs For Form are digital documents that help users track and document their business mileage for tax and reimbursement purposes. They simplify the process of recording mileage by allowing users to input trips directly into a digital form, ensuring accuracy and compliance. Using airSlate SignNow, these logs can be created, shared, and signed electronically.

-

How can airSlate SignNow help with managing Mileage Logs For Form?

airSlate SignNow provides an efficient platform for creating and managing Mileage Logs For Form, allowing users to easily customize templates and automate data entry. The platform’s user-friendly interface and robust features make it simple to track mileage, ensuring that all necessary information is captured accurately. By utilizing airSlate SignNow, businesses can streamline their mileage tracking process.

-

Is there a cost associated with using Mileage Logs For Form on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including features for managing Mileage Logs For Form. The flexible pricing structure allows users to choose a plan that best fits their budget while accessing essential tools for document management and eSigning. Interested users can start with a free trial to explore the features before committing to a plan.

-

Can I integrate airSlate SignNow with other accounting software for Mileage Logs For Form?

Absolutely! airSlate SignNow can seamlessly integrate with popular accounting and expense management software, enhancing the usability of Mileage Logs For Form. This integration allows for automatic data transfer, reducing manual entry errors and saving time in your workflow. Explore the integration options available to optimize your mileage tracking process.

-

What features are included in the Mileage Logs For Form templates?

The Mileage Logs For Form templates in airSlate SignNow include fields for entering trip dates, distances travelled, starting and ending locations, and purpose of the trip. Additionally, users can add custom fields and upload supporting documentation for their mileage claims. These comprehensive features ensure that all necessary information is captured for tax or reimbursement purposes.

-

How secure are my Mileage Logs For Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow when managing Mileage Logs For Form. The platform employs advanced encryption and security protocols to protect your documents and data. This means that unauthorized access is minimized, and your sensitive information remains confidential and safe.

-

Can I access my Mileage Logs For Form from mobile devices?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing users to access their Mileage Logs For Form from any device, including smartphones and tablets. This flexibility ensures that you can manage and record your mileage on-the-go, making it easy to stay organized and compliant with mileage tracking requirements. The mobile app offers the same features as the desktop version for your convenience.

Get more for Mileage Logs For Form

Find out other Mileage Logs For Form

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT