Catholic Charities Receipt Form

What is the Catholic Charities Receipt

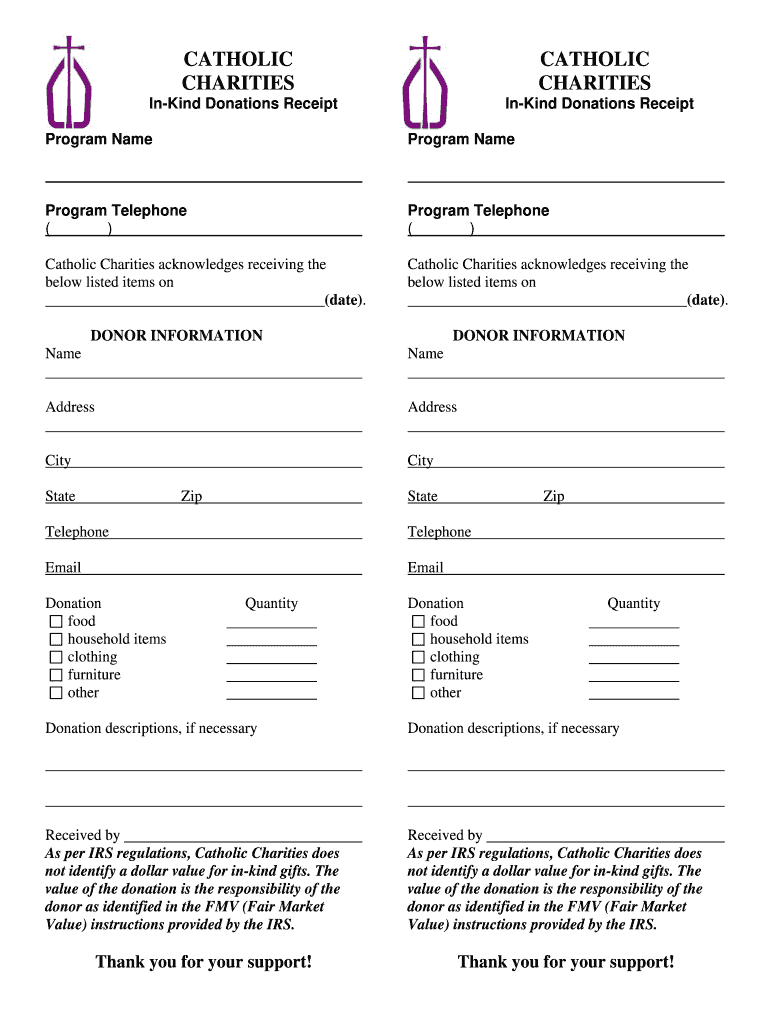

The Catholic Charities receipt is a formal document provided to donors who contribute to Catholic Charities in Chicago. This receipt serves as proof of the donation made, which is essential for tax purposes. It includes important details such as the donor's name, the amount donated, the date of the donation, and the purpose of the contribution. This documentation is crucial for individuals seeking to claim deductions on their tax returns, as it demonstrates charitable giving in compliance with IRS regulations.

How to obtain the Catholic Charities Receipt

To obtain a Catholic Charities receipt, donors can follow a straightforward process. After making a donation, individuals typically receive a receipt via email or physical mail, depending on their preference. If a receipt is not received, donors can contact Catholic Charities directly through their website or customer service line. Providing details such as the donation date and amount can expedite the process of obtaining a duplicate receipt. It is advisable to keep all correspondence and transaction records for future reference.

Key elements of the Catholic Charities Receipt

A valid Catholic Charities receipt must contain specific key elements to ensure it meets IRS requirements. These include:

- Donor Information: The name and address of the donor.

- Donation Amount: The total contribution made by the donor.

- Date of Donation: The exact date when the donation was made.

- Organization Details: The name and address of Catholic Charities.

- Purpose of Donation: A brief description of what the donation supports, if applicable.

Having these elements clearly outlined on the receipt helps ensure that it is legally valid and can be used for tax deduction purposes.

Steps to complete the Catholic Charities Receipt

Completing the Catholic Charities receipt involves a few simple steps. First, ensure that all required information is accurately filled out, including donor details and donation specifics. If completing the receipt electronically, utilize a reliable platform to ensure the document is secure and compliant with eSignature laws. Once all information is entered, review the receipt for accuracy before submitting or saving it. Keeping a copy for personal records is also recommended, as it can be useful for future tax filings.

Legal use of the Catholic Charities Receipt

The legal use of the Catholic Charities receipt is primarily tied to its role in tax deductions. Donors can use this receipt to substantiate their charitable contributions when filing their taxes. It is important to ensure that the receipt is properly formatted and includes all necessary information to comply with IRS guidelines. Additionally, the receipt must be retained for a minimum of three years from the date of filing the tax return, in case of an audit or review by tax authorities.

IRS Guidelines

The IRS has specific guidelines regarding charitable contributions, which apply to the use of the Catholic Charities receipt. According to IRS regulations, donations of $250 or more require a written acknowledgment from the charity, which is fulfilled by the receipt. Donors should ensure that their contributions are made to qualified organizations, and they must maintain proper documentation to support their claims. Familiarizing oneself with IRS Publication 526 can provide further insights into the requirements for charitable donations.

Quick guide on how to complete catholic charities receipt

Effortlessly prepare Catholic Charities Receipt on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing for secure online storage of the necessary forms. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage Catholic Charities Receipt on any device with the airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

How to edit and electronically sign Catholic Charities Receipt with ease

- Find Catholic Charities Receipt and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections or redact sensitive information with the tools designed specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of delivery for your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Catholic Charities Receipt to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the catholic charities receipt

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What types of donations can I make to Catholic Charities Chicago?

You can make various types of Catholic Charities Chicago donations, including one-time gifts, recurring contributions, and in-kind donations. Additionally, you can designate your donation for specific programs or services that align with your values. Every contribution plays a signNow role in supporting the community.

-

How do I ensure my Catholic Charities Chicago donations are used effectively?

Catholic Charities Chicago is committed to transparency and effectiveness in utilizing funds. They provide annual reports detailing how donations are allocated to various programs. By checking these reports, you can see the direct impact of your Catholic Charities Chicago donations.

-

Are there any tax advantages for Catholic Charities Chicago donations?

Yes, donations made to Catholic Charities Chicago are tax-deductible, as they are a registered 501(c)(3) nonprofit organization. You'll receive a receipt for your contributions, which you can use to claim your tax deductions. This way, your charitable giving can benefit both the community and your financial situation.

-

How can I make a donation to Catholic Charities Chicago online?

To make a donation to Catholic Charities Chicago, you can visit their official website and navigate to the donation section. The process is straightforward and secure, allowing you to choose the amount and frequency of your Catholic Charities Chicago donations. They also offer options to dedicate your donation in honor or memory of someone special.

-

What programs are supported by Catholic Charities Chicago donations?

Catholic Charities Chicago donations support a wide range of programs, including food pantries, housing support, mental health services, and youth development initiatives. By donating, you help fund essential services that uplift individuals and families in need. Your contribution directly supports these impactful programs.

-

Can I donate my time as well as money to Catholic Charities Chicago?

Absolutely! In addition to monetary contributions, Catholic Charities Chicago welcomes volunteers willing to donate their time and skills. Volunteering can enhance the effectiveness of Catholic Charities Chicago donations and provide you with a meaningful way to engage with the community. It's a great opportunity to make a real difference.

-

What methods of payment do you accept for Catholic Charities Chicago donations?

Catholic Charities Chicago accepts a variety of payment methods for donations, including credit cards, debit cards, bank transfers, and even checks. This flexibility ensures that it’s easy for donors to contribute in a way that suits them best. No matter the method, every donation signNowly impacts the community.

Get more for Catholic Charities Receipt

Find out other Catholic Charities Receipt

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF