Schedule H Form 990 Hospitals Irs 2020

What is the Schedule H Form 990 Hospitals IRS

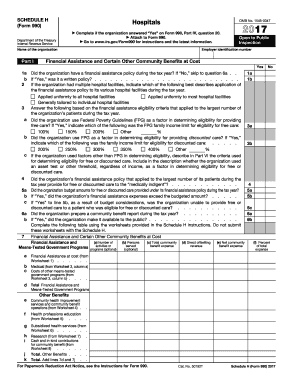

The Schedule H Form 990 is a crucial document for hospitals that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code. This form is used by hospitals to report information regarding their community benefit activities, including the financial assistance they provide to low-income patients, the costs incurred for charity care, and other community health initiatives. The Schedule H is an integral part of the Form 990, which is the annual return filed by tax-exempt organizations to the IRS. By completing this form, hospitals demonstrate their commitment to serving the community and fulfilling their tax-exempt status requirements.

How to use the Schedule H Form 990 Hospitals IRS

Using the Schedule H Form 990 involves several steps to ensure accurate reporting of community benefits and compliance with IRS regulations. First, gather all necessary financial data and documentation related to community services provided. This may include records of charity care, community health programs, and outreach activities. Next, complete the form by filling out sections that detail the hospital's financial assistance policies, the amount of charity care provided, and any other relevant community benefits. Finally, ensure that the completed Schedule H is submitted along with the main Form 990 by the designated filing deadline.

Steps to complete the Schedule H Form 990 Hospitals IRS

Completing the Schedule H Form 990 requires careful attention to detail. Follow these steps:

- Gather financial records related to community benefits.

- Review the hospital's charity care policies and procedures.

- Fill out the form sections, including community benefit descriptions and financial data.

- Ensure all calculations are accurate and reflect the hospital's activities for the reporting year.

- Attach any necessary documentation to support claims made on the form.

- Submit the completed Schedule H with the Form 990 by the filing deadline.

Legal use of the Schedule H Form 990 Hospitals IRS

The Schedule H Form 990 is legally required for tax-exempt hospitals to maintain their status. It serves as a tool for the IRS to assess compliance with community benefit obligations. Accurate and truthful reporting on this form is essential, as any discrepancies or omissions can lead to penalties or loss of tax-exempt status. Hospitals must ensure that they adhere to all relevant laws and regulations when completing this form, including those related to patient privacy and financial reporting.

Filing Deadlines / Important Dates

The Schedule H Form 990 must be filed annually, typically on the fifteenth day of the fifth month after the end of the hospital's fiscal year. For hospitals with a fiscal year ending on December 31, the deadline is May 15 of the following year. If additional time is needed, hospitals can apply for a six-month extension, which would push the deadline to November 15. It is important to be aware of these dates to avoid late filing penalties and ensure compliance with IRS requirements.

Required Documents

To complete the Schedule H Form 990, hospitals need to gather several documents, including:

- Financial statements detailing revenue and expenses.

- Records of charity care provided to patients.

- Documentation of community health initiatives and outreach programs.

- Policies regarding financial assistance and patient eligibility criteria.

- Any relevant correspondence with the IRS or state regulatory agencies.

Quick guide on how to complete 2017 schedule h form 990 hospitals irs

Complete Schedule H Form 990 Hospitals Irs effortlessly on any device

Web-based document administration has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, as you can access the correct template and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly without delays. Manage Schedule H Form 990 Hospitals Irs on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to alter and electronically sign Schedule H Form 990 Hospitals Irs without hassle

- Locate Schedule H Form 990 Hospitals Irs and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight signNow sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your updates.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule H Form 990 Hospitals Irs and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 schedule h form 990 hospitals irs

Create this form in 5 minutes!

How to create an eSignature for the 2017 schedule h form 990 hospitals irs

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is the Schedule H Form 990 for Hospitals issued by the IRS?

The Schedule H Form 990 is a comprehensive report required by the IRS from non-profit hospitals, detailing their community benefit activities. It ensures transparency about how hospitals support their communities, including charity care and outsignNow programs. Understanding this form is crucial for compliance and demonstrates a hospital's commitment to serving the public.

-

How can airSlate SignNow help with submitting the Schedule H Form 990 Hospitals IRS?

airSlate SignNow simplifies the process of preparing and submitting the Schedule H Form 990 Hospitals IRS by allowing users to eSign and send documents securely. This streamlines the workflow, reducing the risk of errors and ensuring timely submission. Our platform ensures that all documents are properly signed and organized for easy access and compliance.

-

What are the pricing options for airSlate SignNow services?

airSlate SignNow offers various pricing plans to meet the needs of different organizations, ranging from basic to advanced features. Each plan includes essential tools for managing documents efficiently, including those specific to the Schedule H Form 990 Hospitals IRS. Choosing the right plan allows hospitals to maximize their cost-effectiveness and streamline their administrative tasks.

-

Does airSlate SignNow provide integrations for hospital management systems?

Yes, airSlate SignNow integrates seamlessly with various hospital management systems and tools, enhancing operational efficiency. These integrations allow hospitals to manage documents related to the Schedule H Form 990 Hospitals IRS directly within their existing workflows. This interconnectivity aids in maintaining accuracy and reduces processing time.

-

What features does airSlate SignNow offer for managing the Schedule H Form 990?

airSlate SignNow includes features such as advanced eSignature capabilities, document templates specific to the Schedule H Form 990 Hospitals IRS, and audit trails for compliance tracking. These tools ensure that all submissions are secure and verifiable, minimizing the risk of discrepancies. Our platform is designed to streamline the document management process for healthcare organizations.

-

How does airSlate SignNow enhance the security of sensitive documents like Schedule H Form 990?

airSlate SignNow prioritizes security with bank-level encryption and two-factor authentication to protect sensitive documents, including the Schedule H Form 990 Hospitals IRS. Our platform ensures that all data is securely stored and accessible only by authorized personnel, safeguarding the integrity of your submissions. This security is crucial for maintaining patient and organizational confidentiality.

-

What are the benefits of using airSlate SignNow for hospitals?

Using airSlate SignNow allows hospitals to save time and reduce costs associated with document management, specifically for the Schedule H Form 990 Hospitals IRS. Our user-friendly platform provides tools to streamline eSigning and document storage, ensuring compliance and improving collaboration among staff. Additionally, it enhances overall efficiency, making administrative tasks less burdensome.

Get more for Schedule H Form 990 Hospitals Irs

Find out other Schedule H Form 990 Hospitals Irs

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney