New Mexico Limited Liability Company LLC Operating Agreement Form

What is the New Mexico Limited Liability Company LLC Operating Agreement

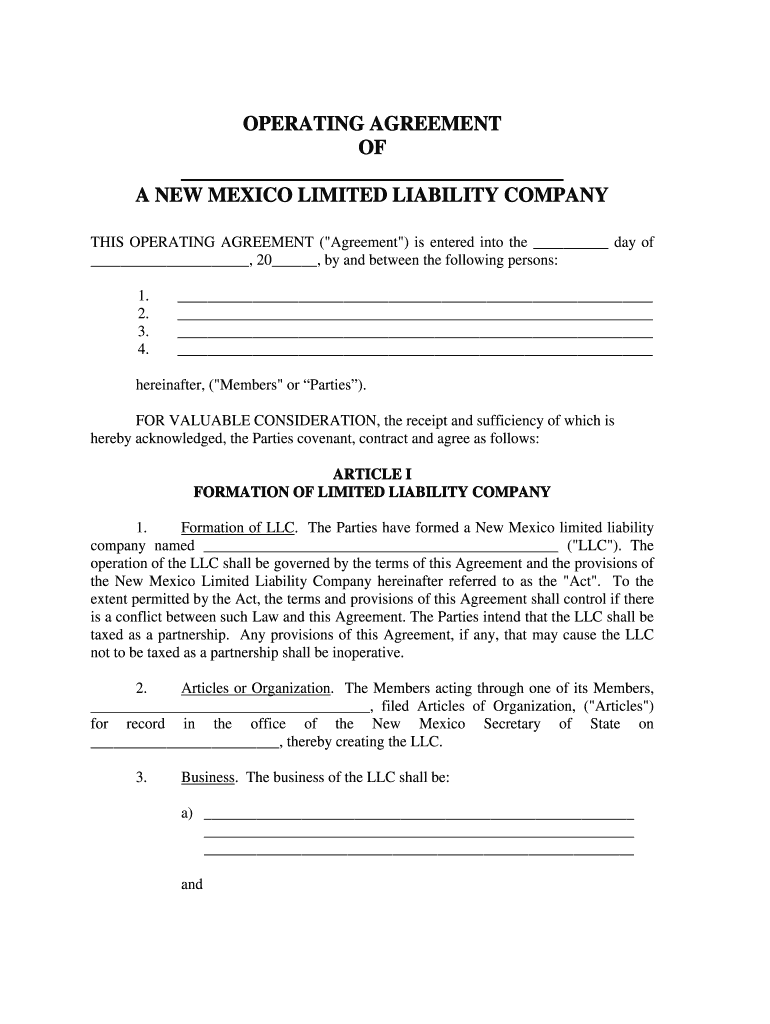

The New Mexico LLC operating agreement is a crucial legal document that outlines the management structure and operational procedures of a limited liability company (LLC) in New Mexico. This agreement serves as an internal guideline for the members of the LLC, detailing the rights, responsibilities, and obligations of each member. It is not required by state law but is highly recommended as it helps to clarify the business's operational framework and can protect personal assets from business liabilities. The agreement can cover various aspects, including profit distribution, decision-making processes, and procedures for adding or removing members.

How to use the New Mexico Limited Liability Company LLC Operating Agreement

Using the New Mexico LLC operating agreement involves several key steps. First, members should gather to discuss and agree on the terms that will govern the LLC. This may include decisions on management roles, profit sharing, and procedures for resolving disputes. Once the terms are agreed upon, they should be documented in the operating agreement. It is essential that all members review the document carefully before signing to ensure that it accurately reflects their understanding and agreements. After signing, each member should retain a copy for their records, as this document may be required for banking, legal, and tax purposes.

Key elements of the New Mexico Limited Liability Company LLC Operating Agreement

A comprehensive New Mexico LLC operating agreement typically includes several key elements. These may consist of:

- Company Information: Name, principal address, and formation date of the LLC.

- Member Details: Names and addresses of all members, along with their ownership percentages.

- Management Structure: Outline of whether the LLC will be member-managed or manager-managed.

- Profit Distribution: Guidelines on how profits and losses will be allocated among members.

- Voting Rights: Procedures for decision-making and voting thresholds required for various actions.

- Amendment Procedures: Steps to modify the agreement in the future.

- Dissolution Procedures: Conditions under which the LLC may be dissolved and the process for winding up affairs.

Steps to complete the New Mexico Limited Liability Company LLC Operating Agreement

Completing the New Mexico LLC operating agreement involves a systematic approach:

- Gather Information: Collect necessary details about the LLC, including member names, addresses, and ownership percentages.

- Draft the Agreement: Use a template or create a customized document that includes all key elements discussed.

- Review with Members: Share the draft with all members for feedback and ensure everyone agrees on the terms.

- Finalize the Document: Make any necessary revisions based on member input.

- Sign the Agreement: All members should sign the document to indicate their acceptance of the terms.

- Store the Agreement: Keep copies of the signed agreement in a secure location for future reference.

Legal use of the New Mexico Limited Liability Company LLC Operating Agreement

The New Mexico LLC operating agreement is legally binding among the members of the LLC once it is signed. While the state does not require this document for the formation of an LLC, having one can provide significant legal protections. It helps to establish clear expectations and responsibilities, which can prevent disputes among members. In legal proceedings, the operating agreement can serve as evidence of the agreed-upon terms, reinforcing the members' intentions and decisions. It is advisable to consult with a legal professional to ensure that the agreement complies with state laws and adequately protects the interests of all members.

Quick guide on how to complete new mexico limited liability company llc operating agreement

Effortlessly Prepare New Mexico Limited Liability Company LLC Operating Agreement on Any Gadget

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and sign your documents promptly without delays. Handle New Mexico Limited Liability Company LLC Operating Agreement on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

Steps to Modify and Sign New Mexico Limited Liability Company LLC Operating Agreement with Ease

- Locate New Mexico Limited Liability Company LLC Operating Agreement and click Acquire Form to initiate.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent parts of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click the Finish button to preserve your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and sign New Mexico Limited Liability Company LLC Operating Agreement and guarantee seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How is a Delaware limited liability company (LLC) without members and without an operating agreement dissolved?

A2ASection 18–801 of the Delaware Code states, among other provisions, that a limited liability company without members may be dissolved.The state-provided Certificate of Cancellation is to be signed by an “authorized person” before it is filed. Under the circumstances described in this question, the logical authorized person would be the authorized person who formed the LLC.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the new mexico limited liability company llc operating agreement

How to generate an eSignature for your New Mexico Limited Liability Company Llc Operating Agreement online

How to generate an eSignature for the New Mexico Limited Liability Company Llc Operating Agreement in Chrome

How to make an eSignature for signing the New Mexico Limited Liability Company Llc Operating Agreement in Gmail

How to make an eSignature for the New Mexico Limited Liability Company Llc Operating Agreement right from your smartphone

How to create an eSignature for the New Mexico Limited Liability Company Llc Operating Agreement on iOS

How to make an electronic signature for the New Mexico Limited Liability Company Llc Operating Agreement on Android

People also ask

-

What is a New Mexico Limited Liability Company LLC Operating Agreement?

A New Mexico Limited Liability Company LLC Operating Agreement is a crucial document that outlines the ownership structure, operational procedures, and management responsibilities of an LLC in New Mexico. It serves as a foundational contract among members, detailing how the company will operate and how decisions will be made.

-

Why do I need a New Mexico Limited Liability Company LLC Operating Agreement?

Having a New Mexico Limited Liability Company LLC Operating Agreement is essential for establishing clear guidelines for your business operations. It helps prevent disputes among members, protects your personal assets, and ensures compliance with state laws, making it a vital part of your LLC formation.

-

How can airSlate SignNow help me create a New Mexico Limited Liability Company LLC Operating Agreement?

airSlate SignNow simplifies the process of creating a New Mexico Limited Liability Company LLC Operating Agreement by providing customizable templates and an easy-to-use interface. You can quickly fill in your company details, ensuring that your agreement meets all legal requirements for New Mexico.

-

What features does airSlate SignNow offer for LLC agreements?

airSlate SignNow offers features such as document templates, eSignature capabilities, and cloud storage to streamline the management of your New Mexico Limited Liability Company LLC Operating Agreement. Additionally, you can collaborate with members in real-time, making it easier to finalize and execute your agreement.

-

Is airSlate SignNow affordable for creating a New Mexico Limited Liability Company LLC Operating Agreement?

Yes, airSlate SignNow provides a cost-effective solution for creating a New Mexico Limited Liability Company LLC Operating Agreement. With flexible pricing plans, you can choose the option that best fits your business needs without overspending.

-

Can I integrate airSlate SignNow with other business tools?

Absolutely! airSlate SignNow can seamlessly integrate with various business applications, enhancing the efficiency of managing your New Mexico Limited Liability Company LLC Operating Agreement. Whether you use CRM systems, cloud storage, or project management tools, integration options are available to streamline your workflow.

-

How long does it take to create a New Mexico Limited Liability Company LLC Operating Agreement using airSlate SignNow?

Creating a New Mexico Limited Liability Company LLC Operating Agreement using airSlate SignNow is quick and efficient. Most users can complete the process in just a few minutes, thanks to our user-friendly templates and pre-defined fields that simplify data entry.

Get more for New Mexico Limited Liability Company LLC Operating Agreement

Find out other New Mexico Limited Liability Company LLC Operating Agreement

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF