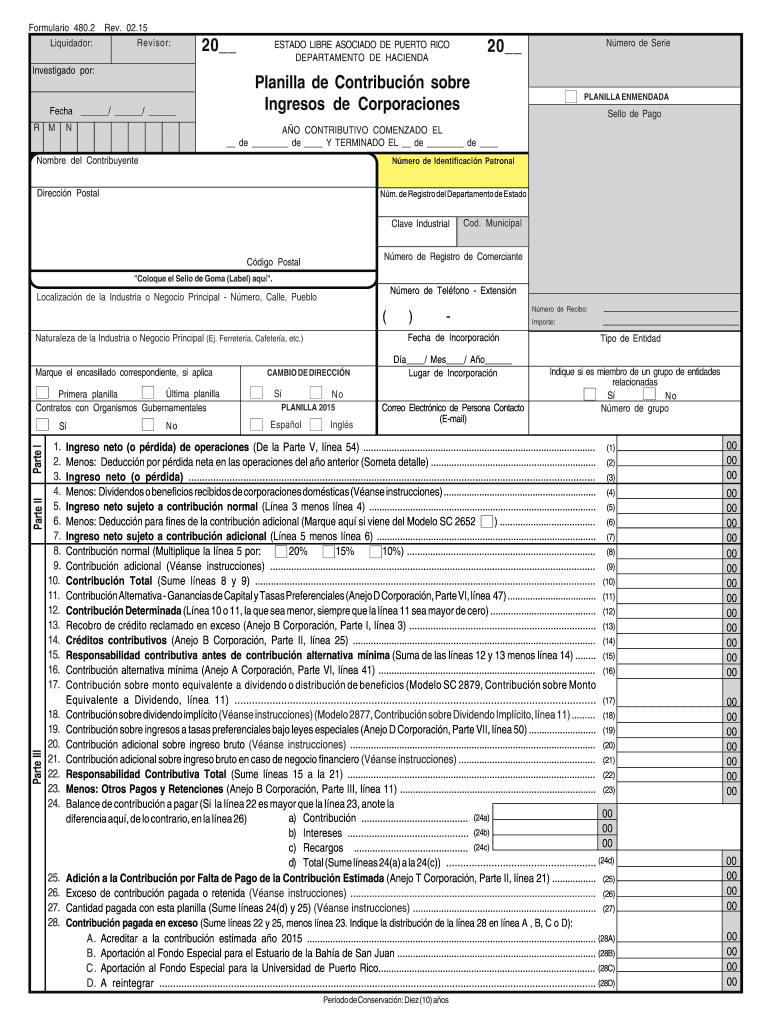

Puerto Rico 480 2 Form 2015

What is the Puerto Rico 480 2 Form

The Puerto Rico 480 2 Form is a tax document used to report income received by individuals and businesses in Puerto Rico. This form is essential for taxpayers who earn income from sources within Puerto Rico, as it helps the Puerto Rico Department of Treasury track income for tax purposes. The form is specifically designed for reporting various types of income, including wages, salaries, and other compensations. Understanding the purpose of this form is crucial for ensuring compliance with local tax regulations.

How to obtain the Puerto Rico 480 2 Form

To obtain the Puerto Rico 480 2 Form, individuals can visit the official website of the Puerto Rico Department of Treasury. The form is typically available for download in PDF format, allowing users to print it for completion. Additionally, taxpayers may also find the form at local tax offices or through authorized tax preparation services. Ensuring you have the correct and most recent version of the form is important for accurate reporting.

Steps to complete the Puerto Rico 480 2 Form

Completing the Puerto Rico 480 2 Form involves several key steps:

- Gather necessary documentation, including income statements and previous tax returns.

- Fill in personal information such as your name, address, and taxpayer identification number.

- Report all applicable income sources in the designated sections of the form.

- Calculate the total income and any deductions or credits you may qualify for.

- Review the completed form for accuracy before submission.

Following these steps helps ensure that your tax filing is accurate and compliant with local regulations.

Legal use of the Puerto Rico 480 2 Form

The Puerto Rico 480 2 Form is legally binding when completed and submitted according to the guidelines set by the Puerto Rico Department of Treasury. It is crucial for taxpayers to understand that submitting this form accurately is a legal requirement. Failure to comply with the regulations surrounding this form may result in penalties or legal repercussions. Utilizing a reliable platform for electronic submissions can enhance the legal standing of your completed form.

Filing Deadlines / Important Dates

Filing deadlines for the Puerto Rico 480 2 Form typically align with the annual tax season. Taxpayers should be aware of the specific due dates to avoid penalties. Generally, the form must be filed by April 15 of the following tax year. However, it is advisable to check for any updates or changes in deadlines announced by the Puerto Rico Department of Treasury, especially in light of any special circumstances or extensions that may be applicable.

Form Submission Methods (Online / Mail / In-Person)

The Puerto Rico 480 2 Form can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online submission via the Puerto Rico Department of Treasury's official website, which is often the fastest method.

- Mailing the completed form to the designated tax office address provided on the form.

- In-person submission at local tax offices, allowing for immediate confirmation of receipt.

Choosing the appropriate submission method can help ensure timely processing of your tax return.

Quick guide on how to complete puerto rico 480 2 2015 form

Finish Puerto Rico 480 2 Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow offers you all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Puerto Rico 480 2 Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Puerto Rico 480 2 Form without hassle

- Locate Puerto Rico 480 2 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from any device of your choice. Modify and eSign Puerto Rico 480 2 Form and ensure excellent communication at any phase of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct puerto rico 480 2 2015 form

Create this form in 5 minutes!

How to create an eSignature for the puerto rico 480 2 2015 form

How to generate an electronic signature for the Puerto Rico 480 2 2015 Form online

How to create an electronic signature for your Puerto Rico 480 2 2015 Form in Chrome

How to make an electronic signature for putting it on the Puerto Rico 480 2 2015 Form in Gmail

How to make an electronic signature for the Puerto Rico 480 2 2015 Form right from your smart phone

How to create an eSignature for the Puerto Rico 480 2 2015 Form on iOS

How to create an electronic signature for the Puerto Rico 480 2 2015 Form on Android

People also ask

-

What is the Puerto Rico 480 2 Form, and why is it important?

The Puerto Rico 480 2 Form is a tax document used to report certain income, including dividends and interest earned in Puerto Rico. It's important for both individuals and businesses to correctly complete and submit this form to comply with local tax laws and avoid penalties. Using airSlate SignNow simplifies the signing and submission process, ensuring your form is completed efficiently.

-

How does airSlate SignNow help with the completion of the Puerto Rico 480 2 Form?

airSlate SignNow offers an intuitive platform that allows users to fill out, sign, and manage the Puerto Rico 480 2 Form digitally. With features like templates and easy editing, you can effectively complete your form while minimizing errors. Plus, our platform supports flawless document workflows to keep everything organized.

-

What features does airSlate SignNow offer for managing the Puerto Rico 480 2 Form?

With airSlate SignNow, you can easily create, edit, and send the Puerto Rico 480 2 Form for signing. Key features include cloud storage, document tracking, and real-time notifications, ensuring you never miss a deadline. Our eSignature functionality is legally binding, which secures your submissions.

-

Is there a cost associated with using airSlate SignNow for the Puerto Rico 480 2 Form?

Yes, airSlate SignNow offers a variety of pricing plans to fit different business needs. You can choose a plan based on the volume of documents you need to manage, including the Puerto Rico 480 2 Form. We also offer a free trial so you can explore our features at no initial cost.

-

Can I integrate airSlate SignNow with other applications while working on the Puerto Rico 480 2 Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM platforms. This allows you to store your Puerto Rico 480 2 Form alongside other important documents and access them from any system, streamlining your workflow.

-

What are the benefits of using airSlate SignNow for the Puerto Rico 480 2 Form?

Using airSlate SignNow for the Puerto Rico 480 2 Form provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your documents are encrypted and safely stored, while the eSignature feature speeds up the signing process, making tax compliance much easier.

-

How secure is the airSlate SignNow platform for handling the Puerto Rico 480 2 Form?

Security is our top priority at airSlate SignNow. Our platform utilizes advanced encryption protocols to safeguard all your documents, including the Puerto Rico 480 2 Form. Additionally, we comply with various global security standards, ensuring that your sensitive information remains protected.

Get more for Puerto Rico 480 2 Form

Find out other Puerto Rico 480 2 Form

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document