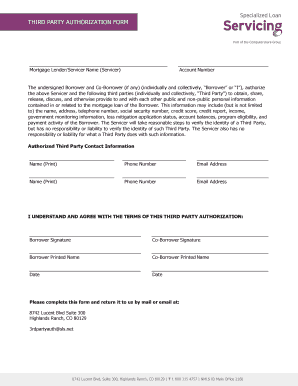

Servicing Third Party Authorization Form

What is the Servicing Third Party Authorization

The servicing third party authorization is a formal document that allows a third party to act on behalf of a borrower in relation to their loan. This authorization is essential for ensuring that the third party can access necessary information and communicate with the loan servicer, which is crucial for managing loan payments, modifications, or other inquiries. It helps streamline communication and provides clarity on who is authorized to handle specific aspects of the loan on behalf of the borrower.

How to Use the Servicing Third Party Authorization

To effectively use the servicing third party authorization, the borrower must first complete the form accurately. This involves providing essential details such as the borrower's name, loan number, and the third party's information. Once the form is filled out, it should be submitted to the loan servicer. The servicer will then verify the authorization and allow the designated third party to access the borrower's loan information. It is important for borrowers to ensure that they trust the third party they are authorizing, as this individual will have access to sensitive financial information.

Steps to Complete the Servicing Third Party Authorization

Completing the servicing third party authorization involves several key steps:

- Gather necessary information, including the borrower’s loan number and personal details.

- Provide the third party's name, contact information, and relationship to the borrower.

- Clearly specify the scope of the authorization, indicating what the third party is allowed to do.

- Sign and date the form to validate the authorization.

- Submit the completed form to the loan servicer through the designated method, whether online, by mail, or in person.

Legal Use of the Servicing Third Party Authorization

The legal use of the servicing third party authorization is governed by various regulations that ensure the protection of borrower information. For the authorization to be legally binding, it must comply with federal and state laws regarding privacy and data protection. This includes adhering to the Electronic Signatures in Global and National Commerce (ESIGN) Act, which validates electronic signatures, and the Uniform Electronic Transactions Act (UETA), which facilitates electronic transactions. Ensuring compliance with these laws helps protect both the borrower and the third party involved.

Key Elements of the Servicing Third Party Authorization

Several key elements must be included in the servicing third party authorization to ensure its effectiveness:

- Borrower's full name and contact information.

- Loan number associated with the authorization.

- Third party's name and contact information.

- A clear description of the authority granted to the third party.

- Signatures of both the borrower and the third party, along with the date of signing.

Examples of Using the Servicing Third Party Authorization

There are various scenarios where a servicing third party authorization may be utilized. For instance, a borrower may authorize a family member to manage their loan payments during a temporary financial hardship. Alternatively, a financial advisor may be authorized to negotiate loan modifications on behalf of the borrower. These examples illustrate how the authorization can facilitate effective communication and management of loan-related matters, ensuring that borrowers receive the assistance they need while maintaining control over their financial information.

Quick guide on how to complete servicing third party authorization

Complete Servicing Third Party Authorization effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents promptly, without any delays. Manage Servicing Third Party Authorization on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Servicing Third Party Authorization without difficulty

- Locate Servicing Third Party Authorization and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you would prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Servicing Third Party Authorization while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the servicing third party authorization

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is loan servicing third and how can it benefit my business?

Loan servicing third refers to the outsourcing of loan management processes to a third-party provider. This approach can streamline operations, reduce overhead costs, and enhance efficiency. By implementing loan servicing third, businesses can focus on core activities while ensuring that their loan management is handled by experts.

-

How does airSlate SignNow support loan servicing third?

airSlate SignNow offers advanced eSigning capabilities that integrate seamlessly with loan servicing third solutions. Our platform enables businesses to send and eSign documents securely, ensuring compliance and efficiency in loan processing. This helps reduce turnaround times and improve customer satisfaction.

-

What features does airSlate SignNow provide for loan servicing third?

airSlate SignNow includes features such as document templates, real-time tracking, and secure storage, all of which enhance the loan servicing third process. Users can manage their documents efficiently, enabling quicker responses to clients' needs. Additionally, customizable workflows ensure that every signing process is tailored to your business requirements.

-

Is airSlate SignNow affordable for small businesses using loan servicing third?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small companies utilizing loan servicing third. Our competitive pricing plans allow businesses to select options that fit their budget while still benefiting from comprehensive eSigning features. This enables small businesses to efficiently manage loans without signNow financial strain.

-

What integrations does airSlate SignNow offer for loan servicing third?

airSlate SignNow integrates with numerous platforms that support loan servicing third, including CRM systems and accounting software. This allows for seamless data transfer and management across various tools. Effective integration enhances the overall efficiency of the loan servicing process, making it easier for businesses to manage and track their loans.

-

Can airSlate SignNow help ensure compliance in loan servicing third workflows?

Absolutely! airSlate SignNow provides tools that help maintain compliance in loan servicing third workflows, including audit trails and secure data storage. These features ensure that all transactions are documented and regulatory requirements are met. Our platform is designed to safeguard sensitive information, providing peace of mind for businesses and their clients.

-

What are the benefits of using airSlate SignNow for loan servicing third compared to traditional methods?

Using airSlate SignNow for loan servicing third eliminates the need for paper documents, signNowly reducing processing time and costs associated with traditional methods. Our digital platform enhances collaboration and communication among stakeholders, ensuring all parties stay informed throughout the loan process. This not only boosts efficiency but also improves customer experiences.

Get more for Servicing Third Party Authorization

Find out other Servicing Third Party Authorization

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free