Personal Fund Threshold PFT Notification Revenue Commissioners Revenue Form

What is the Personal Fund Threshold PFT Notification?

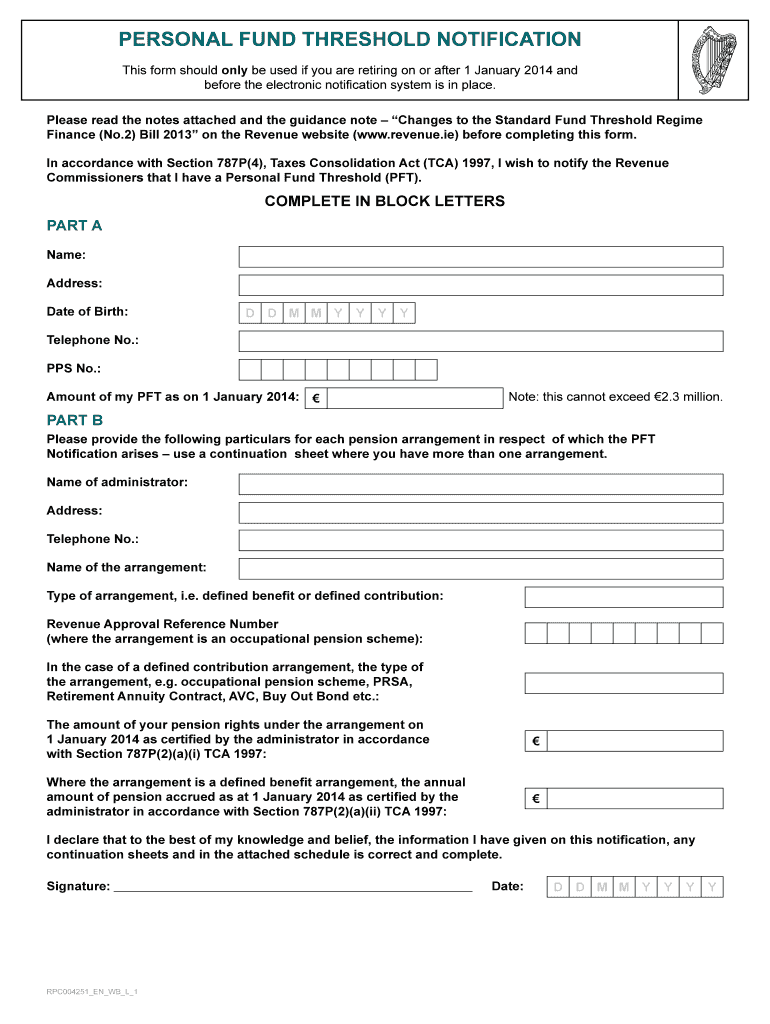

The Personal Fund Threshold (PFT) Notification is a crucial document for individuals and businesses that need to report specific financial thresholds to the Revenue Commissioners. This form serves to inform the relevant authorities about the financial status and compliance of the taxpayer. Understanding the PFT Notification is essential for maintaining transparency and fulfilling legal obligations, especially in the context of U.S. tax regulations.

How to Use the Personal Fund Threshold PFT Notification

Using the Personal Fund Threshold Notification involves several key steps. First, gather all necessary financial documents that reflect your current financial status. Next, accurately fill out the form, ensuring that all information is correct and complete. Once completed, you can submit the form electronically or via traditional mail, depending on your preference and the specific requirements set by the Revenue Commissioners.

Steps to Complete the Personal Fund Threshold PFT Notification

Completing the Personal Fund Threshold Notification requires careful attention to detail. Follow these steps:

- Collect all relevant financial documentation, including income statements and previous tax returns.

- Fill out the form with accurate information, ensuring that all fields are completed as required.

- Review the form for any errors or omissions before submission.

- Choose your submission method: online or by mail, based on your convenience.

Legal Use of the Personal Fund Threshold PFT Notification

The legal use of the Personal Fund Threshold Notification is governed by U.S. tax laws and regulations. It is essential that taxpayers understand the legal implications of submitting this form. Compliance with the guidelines ensures that the document is recognized as valid and binding. Failure to adhere to these regulations may result in penalties or legal repercussions.

Key Elements of the Personal Fund Threshold PFT Notification

Several key elements must be included in the Personal Fund Threshold Notification for it to be valid:

- Accurate personal and financial information.

- Signature or electronic signature of the individual submitting the form.

- Date of submission.

- Any required supporting documentation that verifies the information provided.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Personal Fund Threshold Notification. Missing these deadlines can lead to penalties or complications with the Revenue Commissioners. Generally, the deadlines align with the annual tax filing dates, but it is advisable to verify specific dates each year to ensure compliance.

Quick guide on how to complete personal fund threshold pft notification revenue commissioners revenue

Complete Personal Fund Threshold PFT Notification Revenue Commissioners Revenue effortlessly on any device

Digital document management has become increasingly favored by enterprises and individuals alike. It offers an ideal environmentally-friendly substitute to conventional printed and signed paperwork, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents rapidly without delays. Manage Personal Fund Threshold PFT Notification Revenue Commissioners Revenue across any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Personal Fund Threshold PFT Notification Revenue Commissioners Revenue with ease

- Locate Personal Fund Threshold PFT Notification Revenue Commissioners Revenue and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Adjust and eSign Personal Fund Threshold PFT Notification Revenue Commissioners Revenue and guarantee seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal fund threshold pft notification revenue commissioners revenue

How to create an eSignature for the Personal Fund Threshold Pft Notification Revenue Commissioners Revenue in the online mode

How to make an electronic signature for the Personal Fund Threshold Pft Notification Revenue Commissioners Revenue in Chrome

How to generate an electronic signature for putting it on the Personal Fund Threshold Pft Notification Revenue Commissioners Revenue in Gmail

How to create an electronic signature for the Personal Fund Threshold Pft Notification Revenue Commissioners Revenue straight from your smart phone

How to generate an eSignature for the Personal Fund Threshold Pft Notification Revenue Commissioners Revenue on iOS

How to generate an electronic signature for the Personal Fund Threshold Pft Notification Revenue Commissioners Revenue on Android

People also ask

-

What is the Personal Fund Threshold (PFT) Notification from Revenue Commissioners?

The Personal Fund Threshold (PFT) Notification from Revenue Commissioners is a communication that informs individuals about their pension fund limits. This notification is crucial for ensuring compliance with tax regulations related to pension contributions and benefits. Understanding your PFT is essential for financial planning and avoiding unexpected tax liabilities.

-

How can airSlate SignNow help with the PFT Notification process?

airSlate SignNow simplifies the process of handling Personal Fund Threshold (PFT) Notifications by providing a streamlined way to eSign and manage documents. With our platform, you can easily prepare, send, and store your PFT-related documents securely online. This not only saves time but also enhances accuracy and compliance with Revenue Commissioners guidelines.

-

Is there a cost associated with using airSlate SignNow for PFT notifications?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our pricing is competitive, providing a cost-effective solution for managing Personal Fund Threshold (PFT) Notifications and other document needs. You can choose a plan that best fits your budget while ensuring compliance with Revenue Commissioners regulations.

-

What features does airSlate SignNow offer for managing PFT Notifications?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows specifically designed for handling Personal Fund Threshold (PFT) Notifications. These features enhance efficiency and ensure that your documents are processed in compliance with Revenue Commissioners requirements. Additionally, our platform provides real-time tracking and notifications for better management.

-

Can I integrate airSlate SignNow with other software for PFT Notification management?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing for efficient management of Personal Fund Threshold (PFT) Notifications. Popular integrations include CRM systems, accounting software, and cloud storage services, ensuring that your workflow remains uninterrupted and compliant with Revenue Commissioners protocols.

-

What benefits does airSlate SignNow provide for businesses handling PFT Notifications?

By using airSlate SignNow for Personal Fund Threshold (PFT) Notifications, businesses can enhance their operational efficiency, reduce paperwork, and ensure compliance with Revenue Commissioners standards. The platform provides a user-friendly interface that simplifies document management and improves turnaround times, ultimately saving businesses time and resources.

-

How secure is the airSlate SignNow platform for PFT Notifications?

Security is a priority at airSlate SignNow, especially when managing sensitive documents like Personal Fund Threshold (PFT) Notifications. Our platform uses advanced encryption methods and complies with industry standards to protect your data. You can trust that your information is safe while you engage with Revenue Commissioners for compliance.

Get more for Personal Fund Threshold PFT Notification Revenue Commissioners Revenue

- Field 17 form

- As you know i have been asked by name and name to perform the legal work necessary to

- The name of the trust is form

- Agreed termination of lease agreement and surrender of leased form

- Mobile home purchase agreement federal truth in lending disclosure statement form

- Debt settlement terms of agreement please read carefully form

- Property leasing and management services agreement form

- Business opportunity purchase and sale agreement 1 form

Find out other Personal Fund Threshold PFT Notification Revenue Commissioners Revenue

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now