Form 1125 a 2004-2026

What is the Form 1125 A

The Form 1125 A is a tax form used by businesses to report the cost of labor for various activities related to their operations. This form is particularly relevant for entities that are required to disclose their labor costs as part of their tax filings. It helps the Internal Revenue Service (IRS) understand the expenses incurred by businesses in relation to their workforce, ensuring compliance with tax regulations.

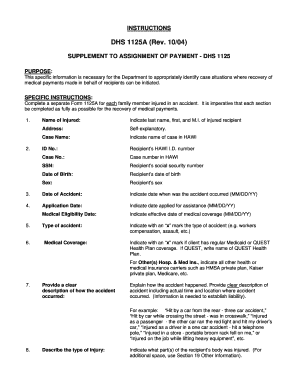

Steps to complete the Form 1125 A

Completing the Form 1125 A requires careful attention to detail. Here are the key steps involved:

- Gather necessary documentation, including payroll records and expense reports.

- Fill out the identification section, providing your business name, address, and Employer Identification Number (EIN).

- Report the total labor costs, ensuring to categorize them appropriately based on the nature of the work performed.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Sign and date the form before submission.

How to obtain the Form 1125 A

The Form 1125 A can be obtained directly from the IRS website. It is available in a downloadable PDF format, which allows for easy printing and completion. Additionally, businesses may also find the form through various tax preparation software that includes IRS forms as part of their offerings.

Legal use of the Form 1125 A

Using the Form 1125 A legally involves adhering to IRS guidelines regarding labor cost reporting. It is essential for businesses to ensure that the information provided is accurate and complete, as discrepancies can lead to penalties or audits. The form must be submitted along with the appropriate tax return, and businesses should retain copies for their records.

Required Documents

When completing the Form 1125 A, certain documents are necessary to ensure accurate reporting. These include:

- Payroll records detailing employee wages and hours worked.

- Expense reports that outline additional labor-related costs.

- Any relevant contracts or agreements that pertain to labor costs.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the Form 1125 A. Generally, the form must be submitted alongside the business's income tax return, which is typically due on March 15 for corporations and April 15 for partnerships and sole proprietors. Extensions may be available, but it is important to check IRS guidelines for specific dates.

Quick guide on how to complete form 1125 a

Complete Form 1125 A effortlessly on any device

Managing documents online has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without interruptions. Handle Form 1125 A on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Form 1125 A without breaking a sweat

- Find Form 1125 A and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant parts of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which only takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1125 A and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1125 a

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What are the form 1125a instructions?

The form 1125a instructions provide guidance on how to complete Form 1125-A, which is used to report the cost of goods sold. Understanding these instructions is crucial for businesses to ensure compliance and accuracy in their tax filings. By following the form 1125a instructions, you can streamline the process and minimize errors.

-

How can airSlate SignNow help with completing form 1125a?

airSlate SignNow offers an efficient platform for managing and eSigning documents related to form 1125a. With our user-friendly interface, you can quickly gather necessary information and signatures to complete your form accurately. This not only simplifies the process but also helps ensure that you follow the form 1125a instructions correctly.

-

What features does airSlate SignNow offer for managing forms?

airSlate SignNow includes features like document templates, electronic signatures, and streamlined workflows that enhance your experience in managing forms. These features allow you to quickly access the necessary form 1125a instructions and ensure that everyone involved in the process can execute their tasks efficiently. This leads to more accurate submissions and improved compliance.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the diverse needs of businesses. Depending on the features you require, plans range from basic to premium options that include advanced functionalities for document management. By choosing the right plan, you can enhance your ability to handle form 1125a instructions more effectively.

-

Can I integrate airSlate SignNow with other software for tax filing?

Yes, airSlate SignNow allows for seamless integrations with various accounting and tax software. This capability enables you to streamline your tax filing process, including the completion of form 1125a instructions. By integrating with other systems, you can reduce data entry efforts and enhance overall productivity.

-

Is airSlate SignNow secure for eSigning sensitive documents?

Absolutely! airSlate SignNow employs industry-standard security measures to ensure that your sensitive documents are protected. Whether you're handling form 1125a instructions or any other important paperwork, you can trust that your data is secure during the eSigning process, giving you peace of mind.

-

How does airSlate SignNow improve efficiency in document workflows?

airSlate SignNow improves efficiency by automating document workflows, reducing the time spent on manual tasks. This means you can focus more on completing critical documents like form 1125a instructions instead of getting bogged down in paperwork. With quicker turnaround times, you'll enhance your operational efficiency.

Get more for Form 1125 A

- Ct 1040 ext 2014 application for extension of time to file ct form

- Withholding tax nys tax department issues nys and yonkers form

- New york state e file signature authorization for tax year for forms it 204 and it 204 ll 695248725

- New transfer renewal form

- Telephone 614 644 2431 httpwww form

- Horse lease agreementpdf fox trot farm form

- Pdf form 26a north carolina industrial commission nc gov

- Affidavit as to debts and liens form

Find out other Form 1125 A

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF