Tax 1041 Form 2017-2026

What is the Tax 1041 Form

The Tax 1041 Form, officially known as the Internal Revenue Service Form 1041, is a federal tax form used to report income, deductions, gains, and losses for estates and trusts. This form is essential for fiduciaries, who are responsible for managing the assets of the estate or trust. The form allows the fiduciary to report the income earned by the estate or trust and determine the tax liability. It is important to understand that the Tax 1041 Form is distinct from individual tax returns, as it specifically addresses the financial activities of estates and trusts.

Steps to Complete the Tax 1041 Form

Completing the Tax 1041 Form involves several key steps to ensure accuracy and compliance with IRS regulations. Here is a simplified outline of the process:

- Gather necessary documents: Collect all relevant financial information, including income statements, deductions, and records of distributions made to beneficiaries.

- Fill out the form: Begin by entering the basic information about the estate or trust, including its name, address, and Employer Identification Number (EIN).

- Report income: Detail all sources of income received by the estate or trust during the tax year, including interest, dividends, and rental income.

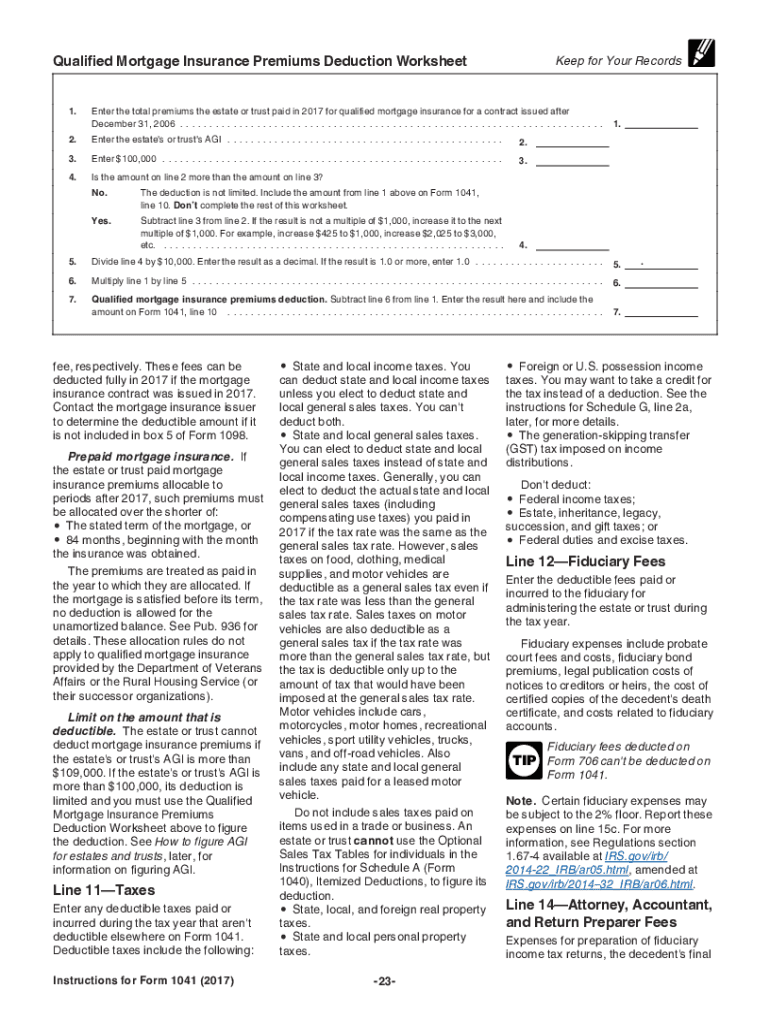

- Claim deductions: Identify and claim any allowable deductions, such as administrative expenses and distributions to beneficiaries.

- Calculate tax liability: Use the information provided to determine the total tax owed, applying the appropriate tax rates.

- Review and sign: Carefully review the completed form for accuracy, then sign and date it before submission.

IRS Guidelines

The IRS provides specific guidelines for completing the Tax 1041 Form, which must be adhered to in order to avoid penalties. These guidelines include:

- Understanding the filing requirements based on the type of estate or trust.

- Filing the form by the due date, which is typically the fifteenth day of the fourth month following the end of the tax year.

- Ensuring all income and deductions are accurately reported and supported by documentation.

- Using the correct version of the form for the applicable tax year, as instructions may change annually.

Filing Deadlines / Important Dates

Timely filing of the Tax 1041 Form is crucial to avoid penalties. The standard deadline for filing is the fifteenth day of the fourth month after the end of the tax year. For estates and trusts operating on a calendar year, this means the form is due on April 15 of the following year. If additional time is needed, an automatic six-month extension can be requested, but this must be filed before the original due date. It is important to keep track of these deadlines to ensure compliance with IRS regulations.

Required Documents

To accurately complete the Tax 1041 Form, certain documents are required. These may include:

- Financial statements showing income and expenses of the estate or trust.

- Records of distributions made to beneficiaries during the tax year.

- Documentation of any deductions claimed, such as receipts for administrative expenses.

- The estate or trust's EIN, which is necessary for tax identification purposes.

Form Submission Methods (Online / Mail / In-Person)

The Tax 1041 Form can be submitted through various methods, depending on the preference of the fiduciary. Options include:

- Online submission: Many tax preparation software programs allow for electronic filing of the form, which can expedite processing.

- Mail: The completed form can be printed and mailed to the appropriate IRS address based on the estate or trust's location.

- In-person: While not common, some individuals may choose to deliver their forms directly to a local IRS office.

Quick guide on how to complete tax 1041 form

Effortlessly prepare Tax 1041 Form on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Tax 1041 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Tax 1041 Form effortlessly

- Obtain Tax 1041 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that function.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax 1041 Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax 1041 form

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is IRS Form 1041 for 2019 instructions?

IRS Form 1041 for 2019 instructions provide guidelines for fiduciaries to report income, deductions, gains, and losses of estates and trusts. Understanding these instructions is crucial for compliance and accurate tax reporting.

-

How can airSlate SignNow assist with completing IRS Form 1041 for 2019?

airSlate SignNow simplifies the process of completing IRS Form 1041 for 2019 by enabling users to create, fill out, and eSign necessary documents quickly and securely. This ensures that all information is captured accurately, minimizing errors.

-

Are there any costs associated with using airSlate SignNow for IRS Form 1041 for 2019?

airSlate SignNow offers various pricing plans to fit different business needs, allowing you to choose a plan that fits your budget while managing documents like IRS Form 1041 for 2019 efficiently. There’s also a free trial available to explore its features.

-

What features are available on airSlate SignNow for IRS Form 1041 for 2019?

airSlate SignNow includes features such as document templates, secure eSigning, and the ability to store and manage IRS Form 1041 for 2019 instructions electronically. These tools help streamline the completion and submission process.

-

Can I integrate airSlate SignNow with other tools for handling IRS Form 1041 for 2019?

Yes, airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Zapier, and more, allowing for a straightforward way to manage IRS Form 1041 for 2019 alongside other documents and services in your workflow.

-

Is airSlate SignNow secure for handling IRS Form 1041 for 2019?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Your data, including IRS Form 1041 for 2019, will be handled securely to protect sensitive information.

-

What benefits does eSigning provide for IRS Form 1041 for 2019?

eSigning through airSlate SignNow offers convenience and speed, allowing you to sign IRS Form 1041 for 2019 electronically from anywhere. It signNowly reduces the turnaround time compared to traditional paper methods and enhances document tracking.

Get more for Tax 1041 Form

Find out other Tax 1041 Form

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice