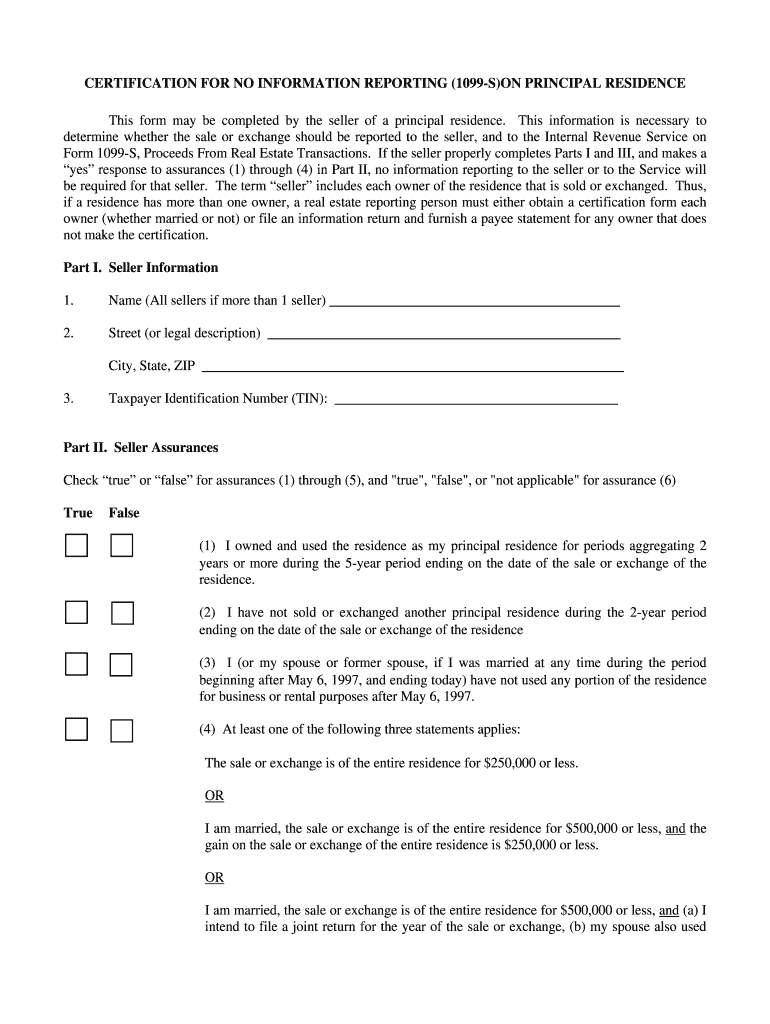

Certification for No Information Reporting

What is the certification for no information reporting?

The certification for no information reporting is a document that allows individuals and businesses to declare that they are not required to report certain income to the Internal Revenue Service (IRS). This certification is often associated with specific tax situations where income does not meet the reporting thresholds established by the IRS. It is crucial for ensuring compliance with tax laws while minimizing unnecessary reporting burdens.

Steps to complete the certification for no information reporting

Completing the certification for no information reporting involves several key steps:

- Gather necessary information, including your taxpayer identification number and details about the income in question.

- Review the IRS guidelines to ensure that your situation qualifies for no reporting.

- Fill out the certification form accurately, providing all required information.

- Sign and date the form to validate your certification.

- Submit the completed form to the appropriate entity, such as the IRS or a financial institution, as required.

Legal use of the certification for no information reporting

The legal use of the certification for no information reporting ensures that taxpayers comply with federal regulations while minimizing their reporting obligations. This certification is legally binding and must be filled out truthfully. Misrepresentation or failure to comply with the certification's requirements may result in penalties or legal repercussions.

IRS guidelines

The IRS provides specific guidelines regarding the certification for no information reporting. These guidelines outline the conditions under which the certification can be used, the types of income that qualify, and the required documentation. It is essential for taxpayers to familiarize themselves with these guidelines to ensure proper compliance and avoid potential issues with the IRS.

Required documents

When completing the certification for no information reporting, certain documents may be required to support your claim. These documents can include:

- Taxpayer identification number (TIN) or Social Security number (SSN).

- Proof of income or lack thereof, such as bank statements or financial records.

- Any relevant correspondence with the IRS or financial institutions.

Form submission methods

The certification for no information reporting can typically be submitted through various methods, depending on the requirements of the receiving entity. Common submission methods include:

- Online submission through secure portals.

- Mailing a physical copy of the form to the appropriate address.

- In-person submission at designated offices, if applicable.

Penalties for non-compliance

Failing to comply with the requirements of the certification for no information reporting can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is vital for individuals and businesses to understand their obligations and ensure accurate completion and submission of the certification to avoid these consequences.

Quick guide on how to complete certification for no information reporting

Complete Certification For No Information Reporting effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Certification For No Information Reporting on any device through airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Certification For No Information Reporting with ease

- Locate Certification For No Information Reporting and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you choose. Modify and electronically sign Certification For No Information Reporting to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the certification for no information reporting

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is a lead reporting form?

A lead reporting form is a tool used to collect and manage information about potential customers. It helps businesses track leads, ensuring that all relevant data is captured systematically. By utilizing a lead reporting form, companies can streamline their sales process and improve follow-up efforts.

-

How can airSlate SignNow enhance my lead reporting form process?

With airSlate SignNow, you can easily create and customize your lead reporting form, allowing for a smoother data collection process. The solution offers integrations with various CRMs to automate lead entry. This helps in reducing manual efforts and increasing efficiency in managing leads.

-

What are the pricing options for using lead reporting forms with airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate different business sizes and needs. You can choose a plan that includes features for creating lead reporting forms, with transparent pricing reflecting the tools and support provided. A free trial is also available to test the software's capabilities.

-

Can I customize my lead reporting form in airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize your lead reporting form to meet your specific requirements. You can add fields, adjust layouts, and even include branding elements, ensuring the form aligns with your business's unique identity.

-

What integrations are available for lead reporting forms with airSlate SignNow?

airSlate SignNow offers integrations with a range of popular CRM systems and marketing tools, making it easy to sync your lead reporting form data. This functionality ensures that all lead information collected flows seamlessly into your existing workflows. Automations can help enhance your lead management process.

-

What are the benefits of using airSlate SignNow for lead reporting forms?

Using airSlate SignNow for your lead reporting forms streamlines the document signing process and enhances the data collection experience. It provides a user-friendly interface and mobile accessibility, enabling leads to easily fill out forms on any device. This convenience can lead to higher conversion rates.

-

Is it secure to manage lead reporting forms with airSlate SignNow?

Yes, airSlate SignNow prioritizes security and compliance, offering robust features to protect your lead reporting form data. With encrypted communication and secure storage, you can confidently manage sensitive information. This peace of mind allows you to focus on converting leads into customers.

Get more for Certification For No Information Reporting

- Boston childrens hospital medical form

- Medstar doctors note form

- Outpatient physician order form high point regional

- Lung cancer questionnaire form

- Equal credit opportunity act forbuyersonlyrealtycom form

- Cincinnati false alarm reduction unit form

- Payment plan authorization form

- Trade references form

Find out other Certification For No Information Reporting

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors