Kembel Tax Service New Client Info Kembel Tax Services 2017-2026

What is the Kembel Tax Service New Client Info?

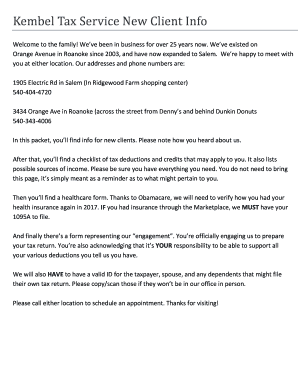

The Kembel Tax Service New Client Info is a comprehensive form designed for individuals seeking to engage Kembel Tax Services for their tax preparation needs. This form collects essential information from new clients, including personal details, financial data, and specific tax-related queries. By completing this form, clients can ensure that Kembel Tax Services has all the necessary information to provide tailored tax assistance.

Steps to complete the Kembel Tax Service New Client Info

Completing the Kembel Tax Service New Client Info involves several straightforward steps:

- Begin by gathering all relevant personal and financial information, such as Social Security numbers, income details, and deductions.

- Access the Kembel Tax Service New Client Info form online through the Kembel Tax Services website.

- Fill out the form accurately, ensuring all required fields are completed. Pay attention to any specific instructions provided.

- Review the completed form for accuracy and completeness to avoid any delays in processing.

- Submit the form electronically or print it out for submission by mail or in person, depending on your preference.

Legal use of the Kembel Tax Service New Client Info

Utilizing the Kembel Tax Service New Client Info is legally valid when certain conditions are met. The form must be filled out with accurate information, and it should be submitted in compliance with relevant tax laws. Electronic submissions are recognized as legally binding under the ESIGN Act, provided that the eSignature used complies with established regulations. This ensures that the information provided is protected and that the client's rights are upheld.

Required Documents

When completing the Kembel Tax Service New Client Info, clients should have the following documents ready:

- Proof of identity, such as a driver's license or passport.

- Social Security card or number for all individuals listed on the tax return.

- Income statements, including W-2s and 1099 forms.

- Documentation for any deductions or credits being claimed, such as mortgage interest statements or medical expenses.

- Previous year’s tax return, if available, to provide context on income and deductions.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Kembel Tax Service New Client Info is crucial for timely tax submission. Typically, individual tax returns must be filed by April fifteenth of each year. However, clients should also be aware of any extensions or specific state deadlines that may apply. Keeping track of these dates helps ensure that clients avoid penalties and can take full advantage of available deductions and credits.

Examples of using the Kembel Tax Service New Client Info

The Kembel Tax Service New Client Info can be used in various scenarios, including:

- First-time filers who need assistance navigating the tax process.

- Individuals with complex financial situations, such as self-employed individuals or those with multiple income streams.

- Clients seeking to maximize deductions and credits by providing detailed financial information.

- Returning clients who need to update their information or change their filing status.

Quick guide on how to complete kembel tax service new client info kembel tax services

Complete Kembel Tax Service New Client Info Kembel Tax Services effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, revise, and eSign your documents swiftly without interruptions. Handle Kembel Tax Service New Client Info Kembel Tax Services on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Kembel Tax Service New Client Info Kembel Tax Services without effort

- Find Kembel Tax Service New Client Info Kembel Tax Services and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your papers or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Kembel Tax Service New Client Info Kembel Tax Services and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kembel tax service new client info kembel tax services

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What are the key features of airSlate SignNow that customers highlight in kembel tax service reviews?

Many kembel tax service reviews point out the user-friendly interface and robust eSigning capabilities of airSlate SignNow. Customers appreciate features like document templates, customizable workflows, and real-time tracking, which enhance efficiency. The platform's ease of integration with other tools also receives positive mentions.

-

How does airSlate SignNow compare in pricing according to kembel tax service reviews?

Kembel tax service reviews often highlight the competitive pricing of airSlate SignNow compared to other eSigning solutions. Users mention that it offers various pricing tiers to fit different business needs, making it cost-effective for small to large enterprises. Many feel they receive excellent value for the features included.

-

What benefits do customers of airSlate SignNow report in their kembel tax service reviews?

In their kembel tax service reviews, customers repeatedly mention the time-saving benefits of using airSlate SignNow. The streamlined document signing process helps them close deals faster and reduces the need for physical paperwork. Additionally, users appreciate the enhanced security features that protect their sensitive data.

-

Are there any integrations available with airSlate SignNow as noted in kembel tax service reviews?

Yes, kembel tax service reviews often mention the wide array of integrations airSlate SignNow offers with popular applications like Google Drive, Salesforce, and Zapier. These integrations simplify the creation and signing of documents, making workflows more efficient. Customers find that they can easily connect their existing tools with SignNow.

-

Is airSlate SignNow suitable for small businesses according to kembel tax service reviews?

Absolutely! Many kembel tax service reviews indicate that small businesses find airSlate SignNow particularly beneficial. The platform's affordable pricing, ease of use, and scalability make it an ideal choice for smaller enterprises looking to streamline document management without breaking the bank.

-

What do users say about the customer support for airSlate SignNow in kembel tax service reviews?

Kembel tax service reviews often highlight the responsive customer support provided by airSlate SignNow. Users report that the support team is helpful and knowledgeable in addressing issues or questions promptly. This assurance of solid support is a signNow factor for many when choosing an eSigning solution.

-

Can airSlate SignNow help with compliance as noted in kembel tax service reviews?

Yes, airSlate SignNow is designed with compliance in mind, and this is often noted in kembel tax service reviews. Customers mention features like audit trails, secure storage, and adherence to industry-standard regulations. This helps businesses ensure that their electronic signatures are legally binding and compliant with laws.

Get more for Kembel Tax Service New Client Info Kembel Tax Services

- Opinions us district court and us court of appeals form

- Transcript ampamp record on appeal transcript order form

- Nis elements ar advanced research users guide ver450 form

- Nis elements advanced research users guide ver 400 form

- Name of plaintiff or plaintiffs form

- Software installation uc davis computer science form

- Diocesan financial management internal control form

- Revise the document text form

Find out other Kembel Tax Service New Client Info Kembel Tax Services

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple