A W 9 Form University of Rhode Island Urifoundation

What is the W-9 Form?

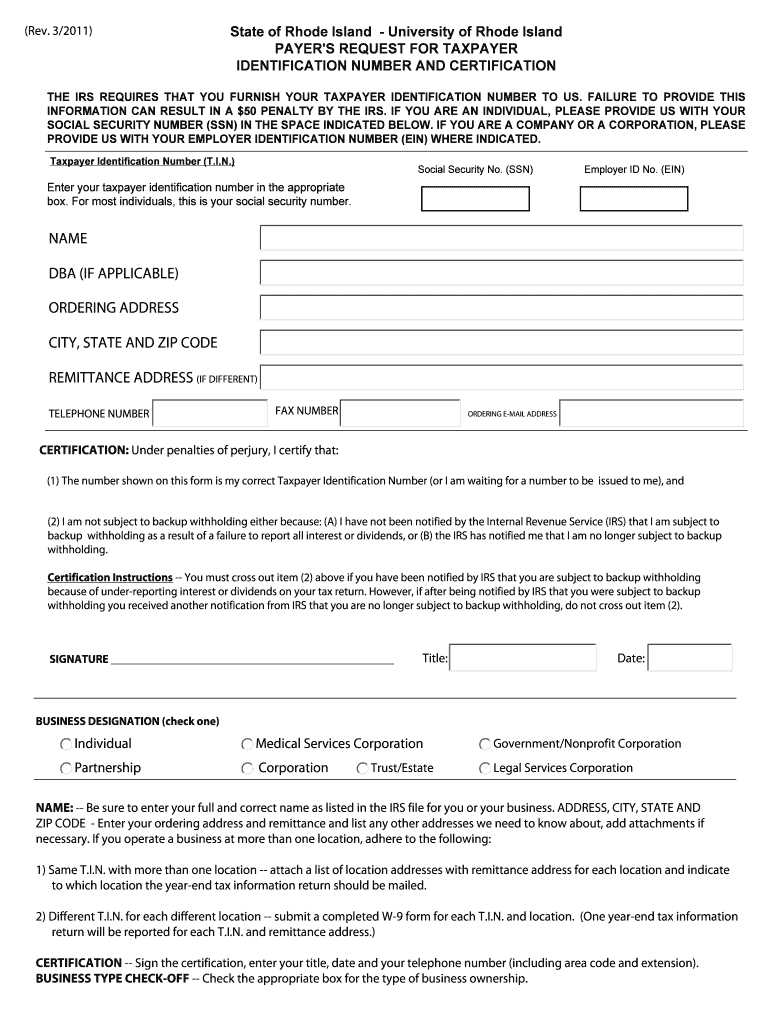

The W-9 form is an Internal Revenue Service (IRS) document used in the United States for tax purposes. It is primarily utilized by individuals and businesses to provide their Taxpayer Identification Number (TIN) to entities that will be paying them income. This form is essential for freelancers, contractors, and vendors who need to report their earnings to the IRS. By completing the W-9, the requester can accurately report payments made to the individual or business, ensuring compliance with tax regulations.

Key Elements of the W-9 Form

The W-9 form includes several important sections that need to be filled out correctly. Key elements include:

- Name: The legal name of the individual or business entity.

- Business Name: If applicable, the name under which the business operates.

- Tax Classification: This section identifies whether the entity is an individual, corporation, partnership, etc.

- Taxpayer Identification Number (TIN): This can be a Social Security Number (SSN) or Employer Identification Number (EIN).

- Address: The complete address where the individual or business can be reached.

Steps to Complete the W-9 Form

Filling out the W-9 form requires careful attention to detail. Here are the steps to complete it:

- Download the W-9 form from the IRS website or obtain a copy from the requester.

- Fill in your name and business name, if applicable, in the designated fields.

- Select your tax classification by checking the appropriate box.

- Provide your TIN, either your SSN or EIN.

- Enter your address, ensuring it is accurate and up to date.

- Sign and date the form to certify that the information provided is correct.

Legal Use of the W-9 Form

The W-9 form is legally binding once it is signed. It serves as a declaration of your TIN and tax status, which the requester will use to report payments to the IRS. It is important to ensure that all information is accurate to avoid penalties or issues with the IRS. The form should be submitted securely to protect sensitive information.

Obtaining the W-9 Form

The W-9 form can be easily obtained through the IRS website. It is available for download in PDF format, making it accessible for anyone needing to complete it. Additionally, many businesses may provide their own copies of the form for convenience.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the W-9 form. It is crucial to follow these guidelines to ensure compliance. The form should be completed accurately and submitted when requested by a payer. The IRS may require this form for various reasons, including verifying taxpayer information and ensuring proper reporting of income.

Quick guide on how to complete a w 9 form university of rhode island urifoundation

Effortlessly Prepare A W 9 Form University Of Rhode Island Urifoundation on Any Device

Digital document handling has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, amend, and electronically sign your documents quickly and without issues. Manage A W 9 Form University Of Rhode Island Urifoundation on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and electronically sign A W 9 Form University Of Rhode Island Urifoundation seamlessly

- Locate A W 9 Form University Of Rhode Island Urifoundation and click on Get Form to begin.

- Make use of the tools provided to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your alterations.

- Choose your preferred method for sharing your form, whether by email, text (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes requiring new document prints. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and electronically sign A W 9 Form University Of Rhode Island Urifoundation to ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

Why does my property management ask me to fill out a W-9 form?

To collect data on you in case they want to sue you and enforce a judgment.If the management co is required to pay inerest on security deposits then they need to account to ou for that interest income.If you are in a coop or condo they may apportion tax benefits or capital costs to you for tax purposes.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

Why do you need to fill out a W-9 form to get back a broker fee from renting an apartment?

Is the person requesting that you fill out this form going to be cutting you a check for this fee? In other words, is this broker fee a payment to you for services you rendered? Money that you need to declare as income and thus pay income taxes to the IRS?If not, if this check is for some other reason, then I don’t believe that you should complete this form.I’m not a lawyer, so there could very well be something that I am unaware of, but it looks suspicious to me. I sure would like to know more about this issue.

-

How do I fill out the exam form for a due paper of Rajasthan University?

Either through your college or contact to exam section window (depends on your course) with your previous exam result, fee receipt, etc.

Create this form in 5 minutes!

How to create an eSignature for the a w 9 form university of rhode island urifoundation

How to generate an electronic signature for the A W 9 Form University Of Rhode Island Urifoundation online

How to create an electronic signature for your A W 9 Form University Of Rhode Island Urifoundation in Chrome

How to make an electronic signature for signing the A W 9 Form University Of Rhode Island Urifoundation in Gmail

How to create an eSignature for the A W 9 Form University Of Rhode Island Urifoundation straight from your smart phone

How to create an electronic signature for the A W 9 Form University Of Rhode Island Urifoundation on iOS devices

How to generate an eSignature for the A W 9 Form University Of Rhode Island Urifoundation on Android

People also ask

-

What is the A W 9 Form University Of Rhode Island Urifoundation used for?

The A W 9 Form University Of Rhode Island Urifoundation is primarily used to provide taxpayer identification information to the university for tax reporting purposes. This form is essential for independent contractors and vendors who need to report their income accurately. By completing the A W 9 Form, you ensure compliance with IRS regulations.

-

How can I complete the A W 9 Form University Of Rhode Island Urifoundation electronically?

You can easily complete the A W 9 Form University Of Rhode Island Urifoundation electronically using airSlate SignNow. Our user-friendly platform allows you to fill out and eSign documents securely and efficiently. Simply upload the form, fill in the necessary information, and send it for signature.

-

What are the benefits of using airSlate SignNow for the A W 9 Form University Of Rhode Island Urifoundation?

Using airSlate SignNow for the A W 9 Form University Of Rhode Island Urifoundation streamlines the entire process. You benefit from a cost-effective solution that allows for quick document turnaround, secure eSignature capabilities, and easy tracking of submissions. This enhances efficiency and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the A W 9 Form University Of Rhode Island Urifoundation?

Yes, there is a nominal fee for using airSlate SignNow, but it is competitively priced compared to traditional methods of document handling. Investing in our service for the A W 9 Form University Of Rhode Island Urifoundation results in long-term savings through increased productivity and reduced paper costs.

-

Can I integrate airSlate SignNow with other software for the A W 9 Form University Of Rhode Island Urifoundation?

Absolutely! airSlate SignNow offers seamless integrations with various platforms, allowing you to manage the A W 9 Form University Of Rhode Island Urifoundation alongside your existing tools. Whether you use CRM systems, cloud storage, or accounting software, our integrations enhance your workflow.

-

What security measures are in place for the A W 9 Form University Of Rhode Island Urifoundation?

airSlate SignNow prioritizes the security of your documents, including the A W 9 Form University Of Rhode Island Urifoundation. We employ advanced encryption protocols and secure cloud storage to protect your sensitive information, ensuring that your data remains confidential and compliant.

-

How do I track the status of my A W 9 Form University Of Rhode Island Urifoundation submissions?

With airSlate SignNow, you can easily track the status of your A W 9 Form University Of Rhode Island Urifoundation submissions in real time. Our platform provides notifications and updates, so you always know when your document has been viewed, signed, or completed.

Get more for A W 9 Form University Of Rhode Island Urifoundation

- Information for parents ampampamp families student financial

- Image and recording authorization and release form

- Crdwcomampquot keyword found websites listingkeyword suggestions form

- Or group form

- Igetc form

- Non degree registration uconns department of public policy form

- Ae department of pediatrics faculty off form

- Graduate student handbook academic university of houston form

Find out other A W 9 Form University Of Rhode Island Urifoundation

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online