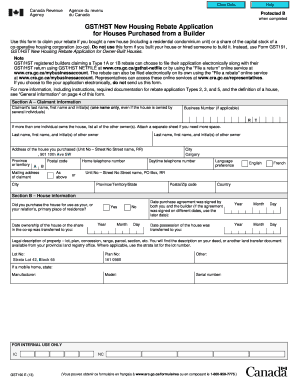

GSTHST New Housing Rebate Application for Houses Purchased from a Builder 2013-2026

What is the GST Rebate Form?

The GST rebate form is a document that allows eligible individuals and businesses to claim a rebate on the Goods and Services Tax (GST) paid on certain purchases. This form is particularly relevant for homeowners who have purchased new residential properties, as it enables them to recover a portion of the GST incurred during the purchase process. The rebate is designed to alleviate the financial burden associated with home ownership and encourage the construction of new homes.

Eligibility Criteria for the GST Rebate

To qualify for the GST rebate, applicants must meet specific criteria. Generally, the property must be a newly constructed home, and the buyer must be the first occupant. Additionally, the purchase price of the home must fall below a certain threshold. It is essential to review the eligibility requirements carefully to ensure compliance and maximize the potential rebate amount. Factors such as the type of property and the buyer's residency status may also influence eligibility.

Steps to Complete the GST Rebate Form

Completing the GST rebate form involves several key steps. First, gather all necessary documentation, including proof of purchase and any relevant identification. Next, fill out the form accurately, ensuring that all information is complete and correct. It is advisable to double-check the figures to avoid errors that could delay processing. Once the form is completed, submit it according to the instructions provided, either online or by mail, depending on the submission options available.

Required Documents for Submission

When submitting the GST rebate form, specific documents must accompany the application. These typically include:

- Proof of purchase, such as a sales agreement or invoice.

- Identification documents, like a driver's license or social security number.

- Any additional documentation that supports eligibility, such as builder's declarations.

Ensuring that all required documents are included can help expedite the approval process and reduce the likelihood of delays.

Form Submission Methods

The GST rebate form can be submitted through various methods, providing flexibility for applicants. Common submission options include:

- Online submission through the official government portal, which often allows for quicker processing.

- Mailing the completed form to the designated tax office.

- In-person submission at local government offices, where assistance may be available.

Choosing the right submission method can depend on personal preference and the urgency of the claim.

Application Process & Approval Time

The application process for the GST rebate typically involves submitting the completed form along with all required documents. After submission, the processing time can vary based on the volume of applications received. Generally, applicants can expect to receive a decision within a few weeks to a few months. Staying informed about the status of the application can help manage expectations and ensure timely follow-up if needed.

Quick guide on how to complete gsthst new housing rebate application for houses purchased from a builder

Effortlessly Prepare GSTHST New Housing Rebate Application For Houses Purchased From A Builder on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily find the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without hindrances. Manage GSTHST New Housing Rebate Application For Houses Purchased From A Builder on any platform using airSlate SignNow Android or iOS apps and enhance any document-centric process today.

The Easiest Way to Modify and eSign GSTHST New Housing Rebate Application For Houses Purchased From A Builder Seamlessly

- Find GSTHST New Housing Rebate Application For Houses Purchased From A Builder and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or cover sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method for sending your form, whether it be via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign GSTHST New Housing Rebate Application For Houses Purchased From A Builder to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gsthst new housing rebate application for houses purchased from a builder

How to create an eSignature for a PDF online

How to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is a GST rebate?

A GST rebate is a refund that businesses can claim on the Goods and Services Tax (GST) they have paid on purchases or expenses. This mechanism ensures that businesses are not unduly burdened by the tax, allowing for better cash flow management. Understanding how to effectively manage your GST rebate can benefit your financial planning.

-

How can airSlate SignNow help with GST rebate claims?

airSlate SignNow streamlines the document management process, making it easier for businesses to prepare and sign the necessary documents for their GST rebate claims. With its intuitive interface, users can create, send, and eSign documents related to their GST rebate, ensuring accuracy and compliance. The solution reduces time spent on paperwork, allowing for quicker claims processing.

-

What features does airSlate SignNow offer for managing GST rebate documents?

airSlate SignNow offers features like customizable templates, automated workflows, and secure eSigning to enhance the management of GST rebate documents. Users can create professional-looking invoices and forms that cater specifically to their needs. These features simplify the documentation process associated with GST rebates, ensuring everything is organized and easily accessible.

-

Is airSlate SignNow cost-effective for small businesses looking to process GST rebate?

Yes, airSlate SignNow provides a cost-effective solution suitable for small businesses aiming to manage their GST rebate efficiently. With flexible pricing plans, users can choose an option that fits their budget while enjoying powerful features for document management. Investing in airSlate SignNow can save time and reduce overhead costs related to GST rebate processing.

-

Can I integrate airSlate SignNow with other accounting software for GST rebate management?

Absolutely! airSlate SignNow offers integrations with a variety of accounting software, enhancing the workflow for GST rebate management. This allows for seamless data sharing between applications, making it easier to track expenses and claims. Integrations can help streamline the entire process for claims related to GST rebates.

-

How does eSigning work for GST rebate documents in airSlate SignNow?

eSigning in airSlate SignNow is straightforward and secure, allowing users to electronically sign documents related to their GST rebate hassle-free. Once a document is prepared, users can send it to signers through email, and they can sign from any device. This capability ensures that all parties can complete the paperwork quickly and securely, expediting the GST rebate claim process.

-

What are the benefits of using airSlate SignNow for GST rebate documentation?

Using airSlate SignNow for GST rebate documentation provides several benefits, including improved efficiency, reduced risk of errors, and enhanced security. The solution reduces the time taken to complete and submit claims by automating tasks and providing an integrated approach to document management. This not only streamlines the GST rebate process but also ensures compliance and accuracy in submissions.

Get more for GSTHST New Housing Rebate Application For Houses Purchased From A Builder

Find out other GSTHST New Housing Rebate Application For Houses Purchased From A Builder

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement