Form Ct 1041 2019

What is the Form Ct 1041

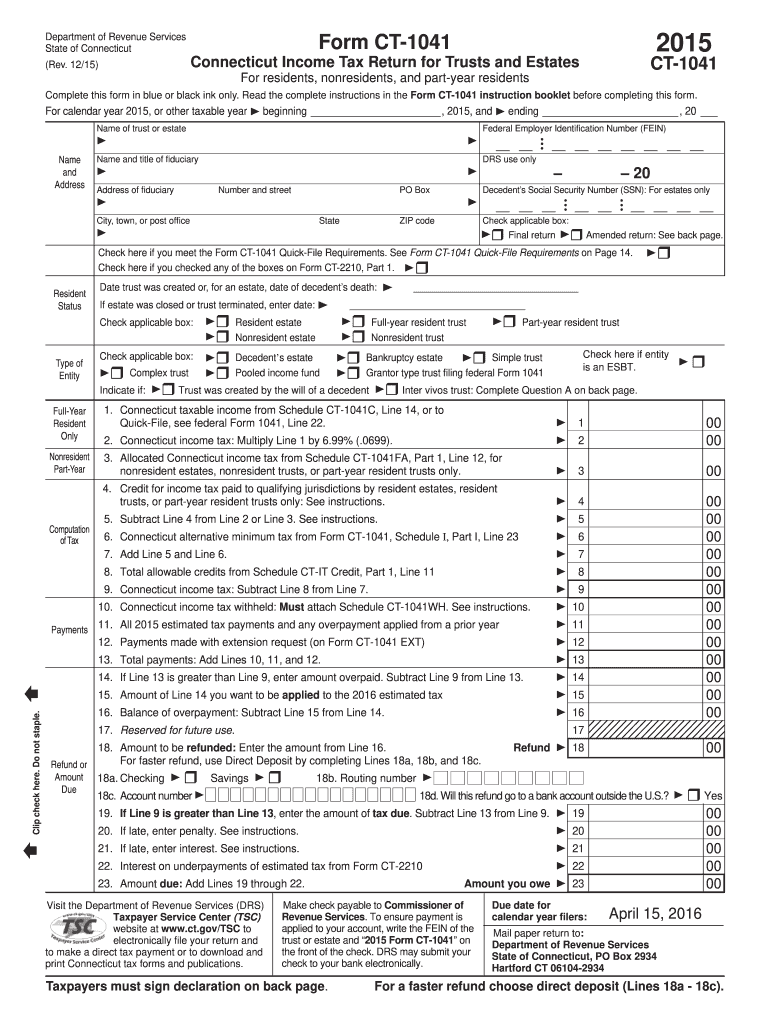

The Form Ct 1041 is a tax form used in the United States for reporting income, deductions, and tax liability for estates and trusts. This form is essential for fiduciaries managing the financial affairs of estates or trusts, ensuring compliance with federal and state tax laws. The information reported on this form helps the Internal Revenue Service (IRS) and state tax authorities assess the tax obligations of the estate or trust.

How to use the Form Ct 1041

To use the Form Ct 1041 effectively, fiduciaries must gather all necessary financial information related to the estate or trust. This includes income generated, expenses incurred, and any distributions made to beneficiaries. The form requires detailed reporting of these figures, along with supporting documentation. It is crucial to ensure that all information is accurate to avoid penalties or delays in processing.

Steps to complete the Form Ct 1041

Completing the Form Ct 1041 involves several key steps:

- Gather all relevant financial documents, including income statements, expense receipts, and prior tax returns.

- Fill out the identification section with the estate or trust's name, address, and taxpayer identification number.

- Report all income received by the estate or trust, including interest, dividends, and rental income.

- Detail all deductions, such as administrative expenses, legal fees, and charitable contributions.

- Calculate the total tax liability and determine any payments due or refunds owed.

Legal use of the Form Ct 1041

The legal use of the Form Ct 1041 is governed by IRS regulations and state laws. It must be filed by the fiduciary responsible for managing the estate or trust, and it must accurately reflect the financial activities during the tax year. Failure to file this form can result in penalties, including fines and interest on unpaid taxes. It is vital to adhere to all filing requirements to ensure compliance and avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct 1041 are typically aligned with the tax year of the estate or trust. Generally, the form is due on the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this means the form is due by April 15 of the following year. It is essential to be aware of these deadlines to avoid late filing penalties.

Required Documents

When preparing to file the Form Ct 1041, several documents are required to ensure accurate reporting. These include:

- Financial statements detailing income and expenses.

- Records of distributions made to beneficiaries.

- Documentation of any deductions claimed.

- Previous tax returns for the estate or trust, if applicable.

Quick guide on how to complete 2015 form ct 1041

Complete Form Ct 1041 seamlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can find the right form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form Ct 1041 on any platform with the airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The easiest way to modify and electronically sign Form Ct 1041 effortlessly

- Find Form Ct 1041 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form—via email, text message (SMS), or a shareable link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form Ct 1041 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form ct 1041

Create this form in 5 minutes!

How to create an eSignature for the 2015 form ct 1041

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is Form Ct 1041 and why is it important?

Form Ct 1041 is used for the Connecticut income tax return for estates and trusts. It is essential for reporting income, deductions, and tax liabilities for an estate or trust in Connecticut. Filing this form correctly can help avoid penalties and ensure compliance with state tax laws.

-

How can airSlate SignNow assist in filling out Form Ct 1041?

airSlate SignNow simplifies the process of completing Form Ct 1041 by providing easy access to fillable templates. Users can add necessary information, eSign the document, and securely send it to all required parties, ensuring a hassle-free filing experience.

-

Is there a cost associated with using airSlate SignNow for Form Ct 1041?

Yes, airSlate SignNow offers various pricing plans suitable for different business needs. Users can choose a plan that fits their budget while gaining access to features that make completing Form Ct 1041 and other documents easy and efficient.

-

What features does airSlate SignNow offer for completing Form Ct 1041?

airSlate SignNow offers features such as multi-party eSigning, customizable templates, and document tracking that streamline the process of completing Form Ct 1041. These tools enhance collaboration and ensure that all necessary signatures are collected promptly.

-

Can I integrate airSlate SignNow with other software for Form Ct 1041?

Yes, airSlate SignNow offers integration capabilities with popular software platforms. This allows users to seamlessly input data into Form Ct 1041 from other applications, making the overall process more efficient and reducing the likelihood of errors.

-

What are the benefits of using airSlate SignNow for Form Ct 1041?

Using airSlate SignNow for Form Ct 1041 offers numerous benefits, including enhanced efficiency, secure document handling, and reduced turnaround times. Users can manage their estate and trust documents more effectively, ensuring compliance with state regulations.

-

How secure is my data when using airSlate SignNow for Form Ct 1041?

airSlate SignNow prioritizes the security of your data through state-of-the-art encryption and compliance with industry standards. This means that your information submitted on Form Ct 1041 is kept secure during the signing and filing process.

Get more for Form Ct 1041

Find out other Form Ct 1041

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer