Ct K1 Form 2019

What is the Ct K1 Form

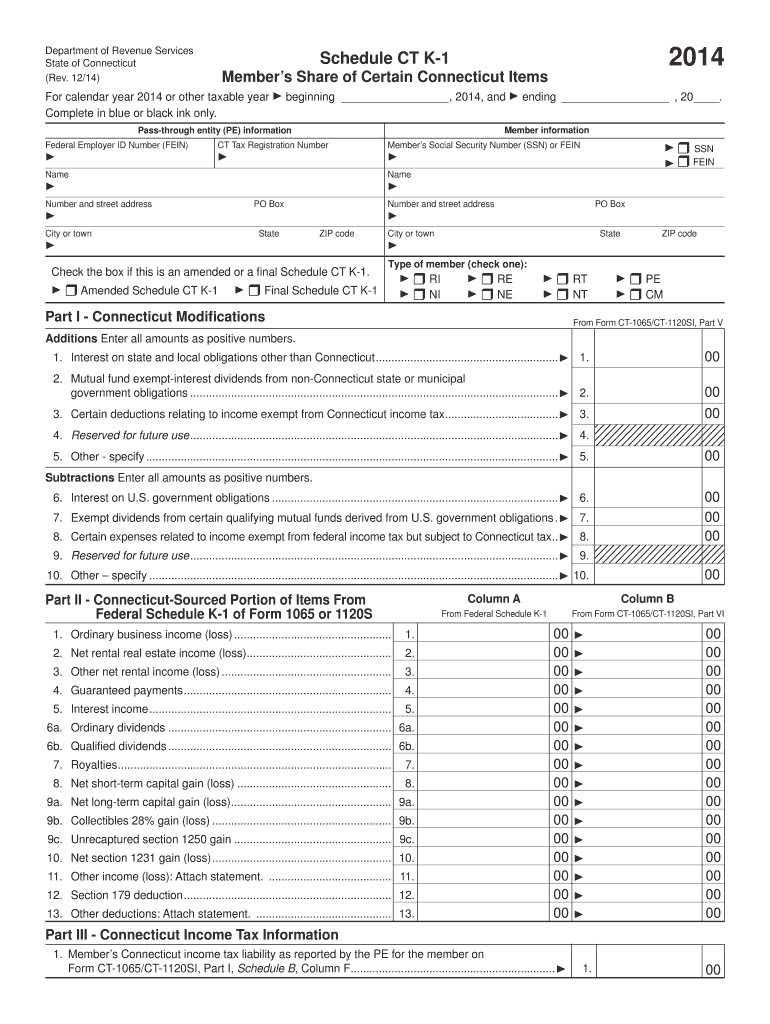

The Ct K1 Form is a tax document used in the United States to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form is essential for individuals who receive income from these entities, as it provides detailed information necessary for accurate tax reporting. The form outlines each partner's or shareholder's share of the entity's income, which must be reported on their personal tax returns. Understanding the Ct K1 Form is crucial for compliance with IRS regulations and for ensuring that all income is properly accounted for during tax season.

How to use the Ct K1 Form

Using the Ct K1 Form involves several key steps. First, you should receive the form from the partnership or S corporation in which you are a member or shareholder. Once you have the form, review the information provided, including your share of income, deductions, and credits. It is important to accurately report these figures on your personal tax return. The form may also include instructions for specific entries, so be sure to follow them closely. If you have questions about the information on your Ct K1 Form, consulting a tax professional can provide clarity.

Steps to complete the Ct K1 Form

Completing the Ct K1 Form involves the following steps:

- Gather necessary information, including your tax identification number and details about the partnership or S corporation.

- Fill in your name, address, and identifying information as required on the form.

- Report your share of income, deductions, and credits as indicated on the form.

- Review all entries for accuracy and completeness.

- Attach the completed form to your personal tax return when filing.

Ensuring that each step is followed carefully will help avoid potential issues with the IRS.

Legal use of the Ct K1 Form

The legal use of the Ct K1 Form is governed by IRS regulations. It must be accurately completed and filed to report income from partnerships and S corporations. Failure to report income from these sources can lead to penalties and interest on unpaid taxes. The form serves as a legal document that substantiates your income claims, making it essential to maintain accurate records and ensure compliance with tax laws. Additionally, the form must be provided to all partners or shareholders to fulfill legal obligations associated with income reporting.

Who Issues the Form

The Ct K1 Form is issued by partnerships, S corporations, estates, and trusts. These entities are responsible for preparing and distributing the form to their partners or shareholders by the IRS deadline. It is important for these entities to ensure that the information reported on the form is accurate, as it directly affects the tax obligations of the recipients. Recipients should expect to receive their forms by the end of February each year, allowing sufficient time to incorporate the information into their personal tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Ct K1 Form are crucial for compliance. Partnerships and S corporations must provide the form to their partners or shareholders by March 15 of each year. Recipients of the form should incorporate the information into their personal tax returns, which are typically due on April 15. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Staying aware of these dates helps ensure timely filing and avoids potential penalties.

Quick guide on how to complete ct k1 2014 form

Complete Ct K1 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents promptly without holdups. Manage Ct K1 Form on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The simplest method to modify and eSign Ct K1 Form with ease

- Locate Ct K1 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Ct K1 Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct k1 2014 form

Create this form in 5 minutes!

How to create an eSignature for the ct k1 2014 form

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is a Ct K1 Form?

The Ct K1 Form is a tax document used to report income, deductions, and credits for partners in a partnership. It provides essential information that partners need to accurately file their individual tax returns. With airSlate SignNow, you can easily prepare and eSign your Ct K1 Form securely and efficiently.

-

How does airSlate SignNow help with the Ct K1 Form preparation?

airSlate SignNow streamlines the process of preparing the Ct K1 Form by allowing users to create, edit, and eSign documents online. Our platform ensures that you have access to templates and tools that can help you complete your tax documents quickly. This means less time spent on paperwork and more time focusing on your business.

-

Is airSlate SignNow a cost-effective solution for managing Ct K1 Forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses looking to manage their Ct K1 Forms. With flexible pricing plans, you can choose what works best for your needs without sacrificing quality or functionality. Investing in airSlate SignNow helps you save on costs associated with traditional document handling.

-

Can I integrate airSlate SignNow with other accounting software for Ct K1 Forms?

Absolutely! airSlate SignNow offers integrations with various accounting software platforms to enhance your workflow for managing Ct K1 Forms. This allows you to seamlessly transfer data and ensure consistency across all documents, making your tax preparation process much smoother.

-

What features does airSlate SignNow offer for eSigning Ct K1 Forms?

airSlate SignNow provides robust features for eSigning Ct K1 Forms, including secure signing, real-time tracking, and customizable workflows. Users can invite partners to eSign documents from anywhere, simplifying the collaboration process. These features ensure that your forms are signed promptly and securely.

-

How secure is the eSigning process for my Ct K1 Form with airSlate SignNow?

The security of your Ct K1 Form is a top priority at airSlate SignNow. We implement industry-standard encryption and security protocols to protect your sensitive information during the eSigning process. Additionally, you can access audit trails that provide details on who signed the document and when.

-

Can I access my Ct K1 Form on different devices with airSlate SignNow?

Yes, airSlate SignNow is accessible on various devices, including desktops, tablets, and smartphones. This flexibility allows you to manage your Ct K1 Form from anywhere, ensuring that you can complete your tax documents efficiently, whether at home or on the go.

Get more for Ct K1 Form

Find out other Ct K1 Form

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile