Form Ct W3 Hhe Connecticut Annual Reconciliation of Withholding for Household Employers 2020

What is the Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers

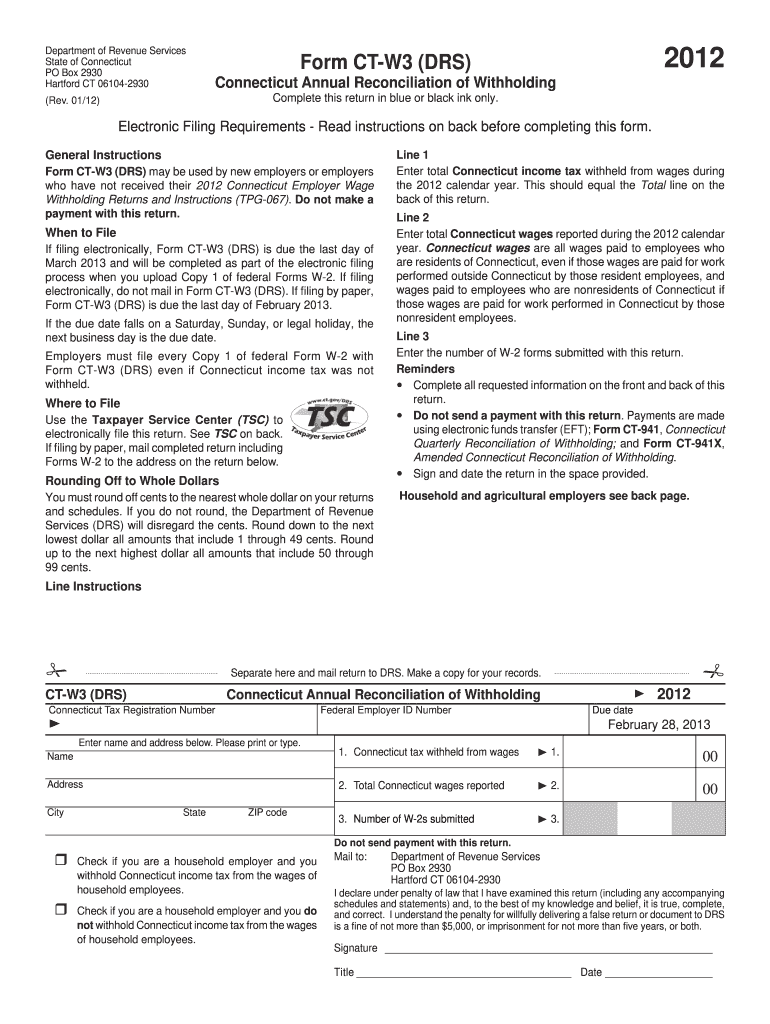

The Form Ct W3 Hhe is an essential document for household employers in Connecticut. It serves as the annual reconciliation of withholding for those who employ household workers, such as nannies, caregivers, or housekeepers. This form summarizes the total amount of state income tax withheld from employees over the year and is necessary for both the employer and the state tax authority. By filing this form, employers ensure compliance with state tax regulations and provide necessary information for their employees' tax records.

Steps to Complete the Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers

Completing the Form Ct W3 Hhe involves several key steps to ensure accuracy and compliance. First, gather all relevant payroll records for the year, including wages paid and taxes withheld. Next, accurately fill in the required fields on the form, including your employer information and the total amount withheld. It is crucial to double-check all entries to avoid errors that could lead to penalties. Once completed, the form must be submitted to the Connecticut Department of Revenue Services by the specified deadline.

Key Elements of the Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers

The Form Ct W3 Hhe includes several critical elements that must be accurately reported. These elements typically consist of:

- Employer Information: Name, address, and identification number.

- Employee Information: Total wages paid to household employees.

- Withholding Amount: Total state income tax withheld during the year.

- Signature: The employer must sign and date the form to validate it.

Legal Use of the Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers

The Form Ct W3 Hhe is legally binding once completed and submitted according to state regulations. It is crucial for household employers to understand that failing to file this form or providing inaccurate information can lead to penalties. The form serves as an official record of tax withholding and is necessary for both the employer's compliance with state tax laws and the employee's tax documentation.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct W3 Hhe are critical for compliance. Typically, the form must be submitted by January thirty-first of the following year after the tax year ends. It is advisable to keep track of any changes in deadlines announced by the Connecticut Department of Revenue Services to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form Ct W3 Hhe can be submitted through various methods to suit the employer's needs. Options typically include:

- Online Submission: Many employers prefer to file electronically through the Connecticut Department of Revenue Services website.

- Mail: The completed form can be printed and mailed to the appropriate state tax office.

- In-Person: Employers may also choose to deliver the form in person at designated state offices.

Quick guide on how to complete form ct w3 hhe 2012 connecticut annual reconciliation of withholding for household employers

Complete Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers seamlessly on any device

Managing documents online has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to adjust and electronically sign Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers effortlessly

- Locate Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize crucial sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct w3 hhe 2012 connecticut annual reconciliation of withholding for household employers

Create this form in 5 minutes!

How to create an eSignature for the form ct w3 hhe 2012 connecticut annual reconciliation of withholding for household employers

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers?

The Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers is a required form that reconciles the amount of withholding taxes from household employees for the year. It helps employers summarize the total taxes withheld to ensure compliance with state regulations. Using airSlate SignNow, you can easily fill out, sign, and submit this form online.

-

How can airSlate SignNow assist with completing the Form Ct W3 Hhe?

airSlate SignNow provides an intuitive platform for completing the Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers. With its user-friendly interface, you can quickly input the necessary information, electronically sign the document, and manage submissions effectively. This simplifies the process and saves valuable time for household employers.

-

Is there a cost associated with using airSlate SignNow for Form Ct W3 Hhe?

Using airSlate SignNow for the Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers comes with competitive pricing plans. Based on your business needs, you can choose from different subscription tiers which offer a range of features. We provide a cost-effective solution that ensures ease of use while remaining budget-friendly for household employers.

-

Are there features in airSlate SignNow that support the Form Ct W3 Hhe process?

Yes, airSlate SignNow offers several features that streamline the process of filing the Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers. Key features include electronic signatures, document templates, and secure storage, allowing you to manage all of your documents in one place efficiently. These tools enhance productivity while ensuring compliance with state requirements.

-

Can airSlate SignNow integrate with other tools for managing Form Ct W3 Hhe?

airSlate SignNow seamlessly integrates with various third-party applications to improve your workflow when managing the Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers. Integration with accounting software and other document management systems means you can keep track of your finances and documentation easily. This enhances overall efficiency for household employers.

-

What are the benefits of using airSlate SignNow for household employers?

Using airSlate SignNow for the Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers simplifies the tax reconciliation process for household employers. The platform not only saves time with easy document management but also offers security and compliance assurance. It allows employers to complete necessary forms efficiently, reducing the risk of errors.

-

How secure is my information when using airSlate SignNow for Form Ct W3 Hhe?

Your information is highly secure when using airSlate SignNow to manage the Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers. Our platform uses advanced encryption protocols to protect your documents and personal data. We prioritize your security and privacy, ensuring that all transactions and information are handled safely.

Get more for Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers

Find out other Form Ct W3 Hhe Connecticut Annual Reconciliation Of Withholding For Household Employers

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document