Blank Mortgage Payoff Request Form

What is the Blank Mortgage Payoff Request Form

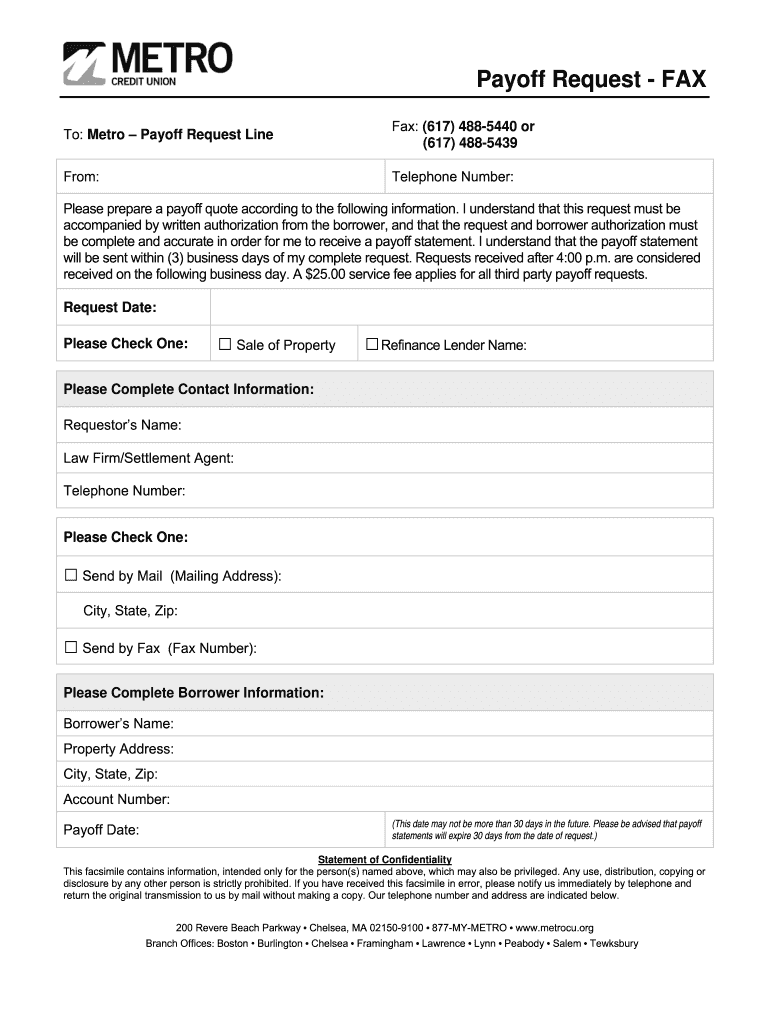

The Blank Mortgage Payoff Request Form is an essential document used by borrowers to request the total amount needed to pay off their mortgage. This form typically includes details such as the loan number, property address, and borrower information. It serves as a formal request to the lender, enabling the borrower to understand their financial obligations and plan for the payoff process effectively. By completing this form, borrowers can ensure they receive accurate information regarding their remaining balance and any applicable fees.

How to Use the Blank Mortgage Payoff Request Form

Using the Blank Mortgage Payoff Request Form involves a few straightforward steps. First, gather necessary information, including your mortgage account number and personal identification details. Next, fill in the form accurately, ensuring all required fields are completed. Once the form is filled out, submit it to your lender via the preferred method, which may include online submission, fax, or traditional mail. By following these steps, you can efficiently initiate the payoff process and receive the necessary details from your lender.

Steps to Complete the Blank Mortgage Payoff Request Form

Completing the Blank Mortgage Payoff Request Form requires attention to detail to ensure accuracy. Begin by entering your personal information, such as your name, address, and contact details. Include your mortgage account number and the property address associated with the loan. Specify the date by which you wish to receive the payoff amount. Review the form for any errors before submitting it to your lender. Taking these steps will help facilitate a smooth and timely response from your lender.

Key Elements of the Blank Mortgage Payoff Request Form

The Blank Mortgage Payoff Request Form contains several key elements that are crucial for its effectiveness. These include:

- Borrower Information: Name, address, and contact details.

- Loan Information: Mortgage account number and property address.

- Requested Payoff Date: The date by which the borrower wants the payoff amount.

- Signature: The borrower's signature to authorize the request.

These elements ensure that the lender has all the necessary information to process the request accurately and efficiently.

Legal Use of the Blank Mortgage Payoff Request Form

The Blank Mortgage Payoff Request Form is legally recognized as a formal document that obligates the lender to provide the requested payoff information. When completed and submitted correctly, it serves as a binding request for the total amount due on the mortgage. It is essential to comply with any specific lender requirements and state regulations to ensure the form's legality and effectiveness. Proper execution of this form can help prevent disputes and facilitate a smooth transaction.

Form Submission Methods

Submitting the Blank Mortgage Payoff Request Form can be done through various methods, depending on the lender's preferences. Common submission methods include:

- Online Submission: Many lenders offer secure online portals for submitting forms electronically.

- Fax: Sending the completed form via fax is another option, allowing for quick transmission.

- Mail: Traditional mail can be used for those who prefer a physical submission, but it may take longer for processing.

Choosing the appropriate submission method can help ensure timely responses from your lender.

Quick guide on how to complete blank mortgage payoff request form

Complete Blank Mortgage Payoff Request Form effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle Blank Mortgage Payoff Request Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to alter and electronically sign Blank Mortgage Payoff Request Form with ease

- Find Blank Mortgage Payoff Request Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you prefer to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements with just a few clicks from any device you choose. Modify and electronically sign Blank Mortgage Payoff Request Form to ensure exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank mortgage payoff request form

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is a payoff form and how is it used?

A payoff form is a document that outlines the remaining balance owed on a loan or debt. It is typically used by borrowers when they wish to pay off their loans early. With airSlate SignNow, you can easily create, send, and eSign your payoff form, streamlining the process and ensuring all parties have a record of the transaction.

-

How can airSlate SignNow help with the creation of a payoff form?

airSlate SignNow provides user-friendly templates to help you create a payoff form quickly and efficiently. You can customize your form with essential details such as the loan amount, interest rate, and payoff date. This means you can focus on your business needs without worrying about the complexities of document creation.

-

Are there any fees associated with using the payoff form feature?

Using the payoff form feature with airSlate SignNow comes at a competitive and transparent pricing model. There are no hidden fees, and you can choose a plan that fits your business budget. This allows you to manage your documents and signing process efficiently while keeping costs under control.

-

What are the benefits of using an eSigned payoff form?

An eSigned payoff form offers several benefits, including enhanced security and a timestamped record of the transaction. This digital approach saves time, reduces paper waste, and simplifies document management. With airSlate SignNow, your eSigned payoff form can be accessed from anywhere, making it convenient for both parties.

-

Can I integrate airSlate SignNow with other software for my payoff form needs?

Yes, airSlate SignNow integrates seamlessly with various business applications like Salesforce, Google Drive, and Zapier. This means you can connect your payoff form to your existing systems, enhancing workflow efficiency and data management. Integration ensures that you can manage all relevant documents easily within your preferred environment.

-

Is there customer support available for questions about my payoff form?

Absolutely! airSlate SignNow offers robust customer support to assist you with any queries regarding your payoff form. Whether you need help with document setup, signing processes, or troubleshooting, our dedicated team is here to help you every step of the way.

-

How secure is the information in a payoff form created with airSlate SignNow?

Security is a top priority at airSlate SignNow. We employ advanced encryption methods to protect your data in your payoff form and during the signing process. Additionally, we comply with industry standards to ensure that your documents remain confidential and secure.

Get more for Blank Mortgage Payoff Request Form

- Mississippi register vehicle form

- Power attorney healthcare form

- Ms lease agreement template form

- Mississippi special or limited power of attorney for real estate sales transaction by seller form

- Montana agreement form

- Montana residential rental lease agreement 481378102 form

- Montana living will form

- Montana special or limited power of attorney for real estate sales transaction by seller form

Find out other Blank Mortgage Payoff Request Form

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online