Mortgage Loan Origination Agreement Form

What is the Mortgage Loan Origination Agreement

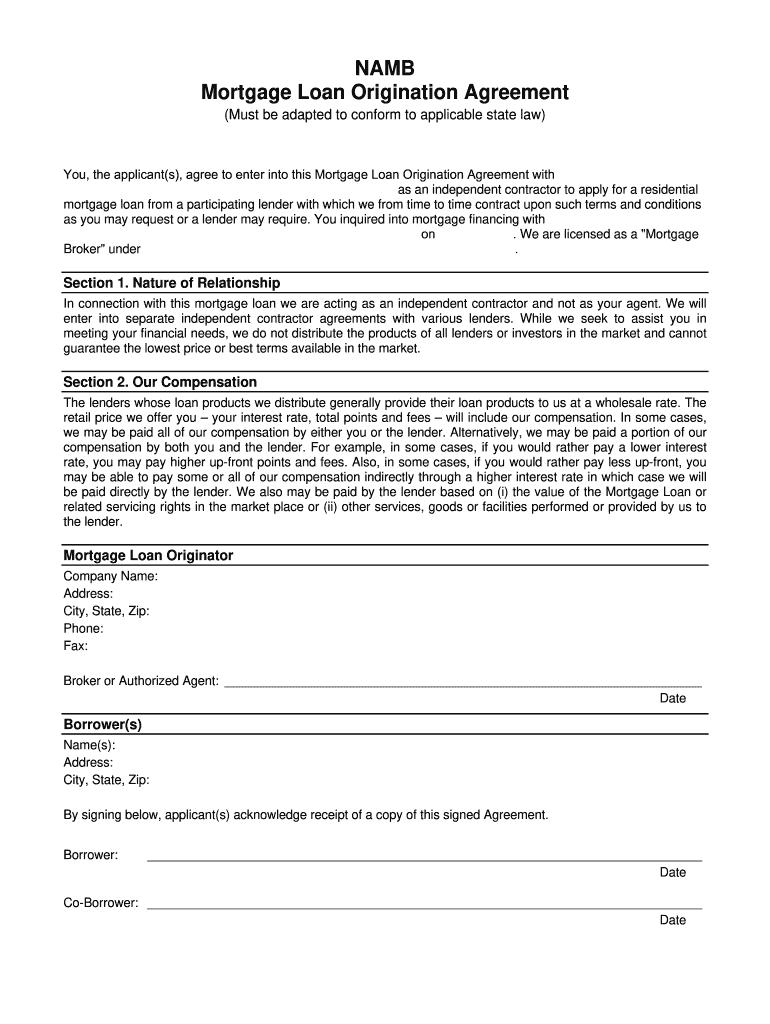

The mortgage loan origination agreement is a crucial document that outlines the terms and conditions between a borrower and a lender during the loan origination process. This agreement serves to formalize the relationship and expectations of both parties as they navigate the complexities of securing a mortgage. It typically includes details such as the loan amount, interest rate, repayment terms, and any fees associated with the loan. Understanding this agreement is essential for borrowers to ensure they are fully informed about their financial commitments.

Key Elements of the Mortgage Loan Origination Agreement

Several key elements are integral to the mortgage loan origination agreement. These include:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The cost of borrowing, expressed as a percentage.

- Repayment Terms: Details on how and when the loan will be repaid.

- Fees and Charges: Any additional costs associated with the loan, such as origination fees or closing costs.

- Conditions and Covenants: Specific requirements that the borrower must meet during the loan term.

These elements ensure that both parties have a clear understanding of their obligations and rights throughout the mortgage process.

Steps to Complete the Mortgage Loan Origination Agreement

Completing the mortgage loan origination agreement involves several important steps:

- Gather Required Information: Collect personal financial information, including income, debts, and credit history.

- Review Loan Options: Compare different loan products and terms offered by lenders.

- Fill Out the Agreement: Provide accurate information in the agreement, ensuring all sections are completed.

- Sign the Agreement: Both parties must sign to indicate their acceptance of the terms.

- Submit the Agreement: Send the completed agreement to the lender for processing.

Following these steps helps ensure a smooth and efficient loan origination process.

Legal Use of the Mortgage Loan Origination Agreement

The legal use of the mortgage loan origination agreement is governed by various laws and regulations that protect both borrowers and lenders. In the United States, the agreement must comply with federal and state laws, including the Truth in Lending Act and the Real Estate Settlement Procedures Act. These laws ensure transparency and fairness in lending practices. Additionally, the agreement must be signed by both parties to be considered legally binding, and the lender must provide a copy to the borrower for their records.

How to Obtain the Mortgage Loan Origination Agreement

Obtaining a mortgage loan origination agreement typically involves contacting a lender or mortgage broker. Borrowers can request the agreement directly from their chosen financial institution, which may provide it as part of the loan application process. Additionally, many lenders offer digital versions of the agreement that can be filled out online, making it easier for borrowers to complete the necessary documentation. It is important to review the agreement thoroughly before signing to ensure all terms are understood.

Examples of Using the Mortgage Loan Origination Agreement

There are various scenarios in which a mortgage loan origination agreement is utilized. For instance:

- A first-time homebuyer securing a fixed-rate mortgage may use this agreement to formalize their loan terms.

- An investor purchasing rental properties might rely on the agreement to outline financing for multiple properties.

- A homeowner refinancing their existing mortgage will need to complete a new origination agreement to reflect updated terms.

These examples illustrate the versatility of the mortgage loan origination agreement in different borrowing situations.

Quick guide on how to complete mortgage loan origination agreement 250722351

Complete Mortgage Loan Origination Agreement effortlessly on any device

Digital document management has gained traction with companies and individuals alike. It serves as a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your paperwork swiftly and without delay. Manage Mortgage Loan Origination Agreement on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and electronically sign Mortgage Loan Origination Agreement without difficulty

- Find Mortgage Loan Origination Agreement and select Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Mortgage Loan Origination Agreement and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage loan origination agreement 250722351

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is a mortgage loan origination agreement?

A mortgage loan origination agreement is a legal document that outlines the terms and responsibilities of the lender and borrower during the loan origination process. This agreement is crucial as it ensures that both parties understand their obligations and rights. airSlate SignNow provides an easy-to-use platform for creating and signing these agreements effortlessly.

-

How does airSlate SignNow streamline the mortgage loan origination agreement process?

airSlate SignNow simplifies the mortgage loan origination agreement process by allowing users to create, send, and eSign documents in a few clicks. With a user-friendly interface and robust features, businesses can manage agreements without the hassle of paperwork. This results in faster processing times and improved customer satisfaction.

-

Is there a cost associated with using airSlate SignNow for mortgage loan origination agreements?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan includes features that support the preparation and signing of mortgage loan origination agreements, ensuring that you get value for your investment. Check our pricing page for detailed information on features and costs.

-

What features does airSlate SignNow offer for handling mortgage loan origination agreements?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking of document status for mortgage loan origination agreements. Additionally, users can collaborate with team members and clients seamlessly on the platform. These tools help streamline the entire loan process.

-

Are there any integrations available with airSlate SignNow for mortgage loan origination agreements?

Yes, airSlate SignNow integrates with various applications including CRMs and document management systems to enhance the mortgage loan origination agreement process. This means you can easily sync your workflow with existing tools, improving efficiency for your team. Explore our integrations page for more details.

-

What are the benefits of using airSlate SignNow for mortgage loan origination agreements?

Using airSlate SignNow for mortgage loan origination agreements offers numerous benefits, such as reduced turnaround times and improved accuracy through automated workflows. The platform also enhances security with encrypted eSigning, ensuring that all parties' information is protected. Overall, it leads to a more efficient loan origination process.

-

Can I customize my mortgage loan origination agreement using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize mortgage loan origination agreements with specific terms and branding. This flexibility ensures that your agreements meet your unique needs and reflect your business's identity. Custom templates can save time and ensure consistency across all documents.

Get more for Mortgage Loan Origination Agreement

- Percentage shopping center lease agreement form

- Parking lease agreement form

- Breach contract 481378406 form

- Risk acknowledgement form

- Settlement agreement and release of claims pending litigation general form

- Assignment copyright agreement form

- Separation agreement sample form

- Property information check list residential

Find out other Mortgage Loan Origination Agreement

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will