Form 109 2007

What is the Form 109?

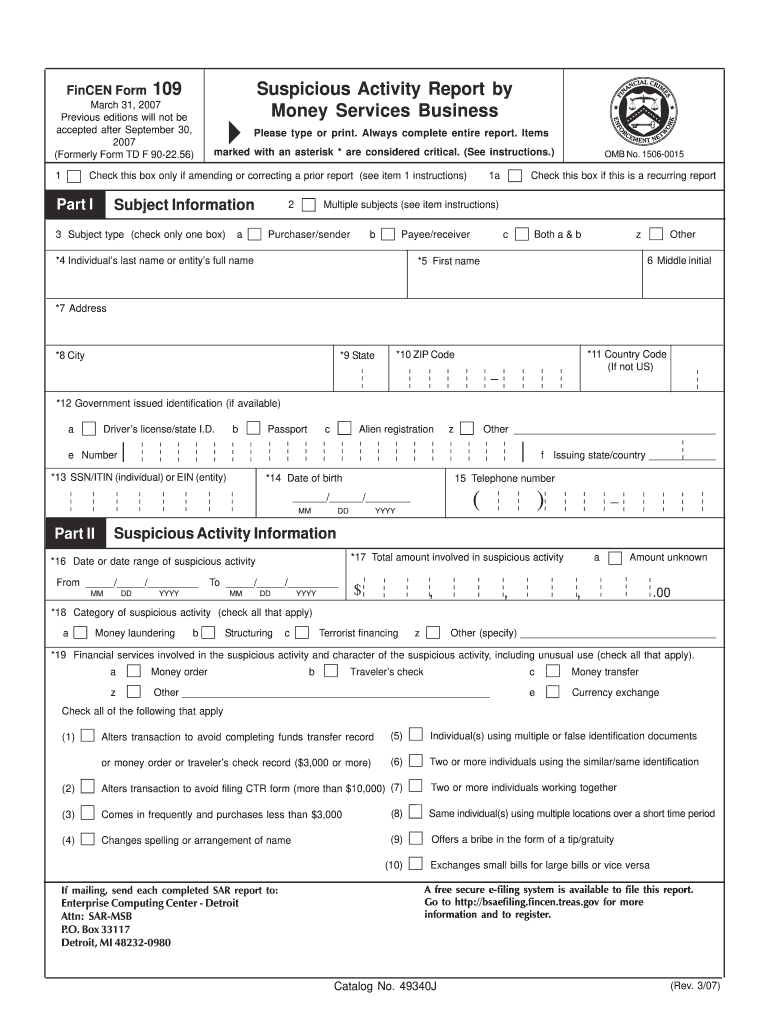

The Form 109 is a tax document used in the United States, primarily for reporting various types of income. It serves as an essential tool for both individuals and businesses to ensure compliance with federal tax regulations. This form is typically issued by employers, financial institutions, or other entities that have paid income to a taxpayer. The information provided on the Form 109 helps the Internal Revenue Service (IRS) track income and ensure that taxpayers report their earnings accurately.

How to use the Form 109

Using the Form 109 involves several key steps. First, taxpayers should gather all relevant income information, including amounts reported on the form. Next, they need to accurately enter this information into their tax return. It is crucial to ensure that the details match those provided on the Form 109 to avoid discrepancies that could trigger an audit. Additionally, taxpayers should keep a copy of the form for their records, as it may be required for future reference or in case of an IRS inquiry.

Steps to complete the Form 109

Completing the Form 109 requires careful attention to detail. Here are the steps to follow:

- Obtain the Form 109 from the issuer, which could be your employer or financial institution.

- Review the form for accuracy, ensuring all reported income amounts are correct.

- Fill in your personal information, including your name, address, and Social Security number.

- Enter the income amounts as specified on the form, ensuring they align with your financial records.

- Double-check all entries for accuracy before submitting the form.

Legal use of the Form 109

The legal use of the Form 109 is governed by IRS regulations. This form must be completed accurately and submitted on time to avoid penalties. It is essential for taxpayers to understand that the information reported on the Form 109 is used by the IRS to verify income and ensure that all taxes owed are paid. Failure to use the form correctly can lead to legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 109 can vary depending on the specific type of income reported. Generally, the form must be provided to recipients by January thirty-first of the year following the tax year. Additionally, the IRS requires that the form be filed electronically or mailed by the end of February. It is important for taxpayers to be aware of these deadlines to ensure compliance and avoid potential penalties.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Form 109. Taxpayers should familiarize themselves with these guidelines to ensure they meet all requirements. This includes understanding what types of income must be reported, how to handle discrepancies, and the proper methods for submitting the form. Adhering to IRS guidelines helps ensure that taxpayers avoid issues with their tax filings.

Quick guide on how to complete form 109 2007

Effortlessly prepare Form 109 on any device

The management of online documents has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute to traditional printed and signed documents, as you can access the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Handle Form 109 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form 109 with ease

- Locate Form 109 and click Get Form to begin.

- Employ the tools we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal authority as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Modify and electronically sign Form 109 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 109 2007

Create this form in 5 minutes!

How to create an eSignature for the form 109 2007

How to generate an eSignature for your PDF file in the online mode

How to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is Form 109 and how can I use it with airSlate SignNow?

Form 109 refers to the IRS tax form used for reporting certain types of income. With airSlate SignNow, you can easily create, send, and electronically sign Form 109, streamlining your tax documentation process. Our platform allows you to manage your forms efficiently, ensuring compliance and accuracy.

-

What features does airSlate SignNow offer for handling Form 109?

airSlate SignNow provides features like document templates, automatic reminders, and secure storage to manage your Form 109 efficiently. You can customize your forms to meet your specific needs and share them effortlessly with clients or employees. This helps you reduce administrative workload while ensuring that your documents are signed swiftly.

-

Is there a cost associated with using airSlate SignNow for Form 109?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. You can choose the plan that best suits your usage of Form 109, whether you are an individual freelancer or a large organization needing bulk signing capabilities. Our competitive pricing ensures that you receive excellent value for managing your documents.

-

Can I integrate airSlate SignNow with other software for processing Form 109?

Absolutely! airSlate SignNow is designed to integrate seamlessly with a variety of software applications, allowing you to automate your workflow for Form 109. This means you can connect with popular tools like CRMs, accounting software, and storage solutions to ensure a smooth document management experience.

-

What are the benefits of using airSlate SignNow for Form 109?

By using airSlate SignNow for Form 109, you gain benefits like faster processing times, enhanced security for your documents, and improved team collaboration. The platform simplifies the signing process, allowing you to focus on other important aspects of your business. Additionally, it helps you maintain compliance with legal requirements for document handling.

-

How secure is my information when using airSlate SignNow for Form 109?

airSlate SignNow prioritizes your security with industry-standard encryption and compliance with regulations. When working with Form 109, you can be assured that your sensitive information is protected. We implement rigorous security measures to safeguard your documents throughout the signing process.

-

What types of businesses benefit from using airSlate SignNow for Form 109?

Businesses of all sizes can benefit from using airSlate SignNow for Form 109, including freelancers, small businesses, and large corporations. Our platform is adaptable to various industries, making it ideal for anyone needing a reliable solution for electronic signatures and document management. It's particularly useful for accounting firms and financial services in managing client tax documents.

Get more for Form 109

Find out other Form 109

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later