Fincen Form Print 2011-2026

What is the FinCEN Form SAR?

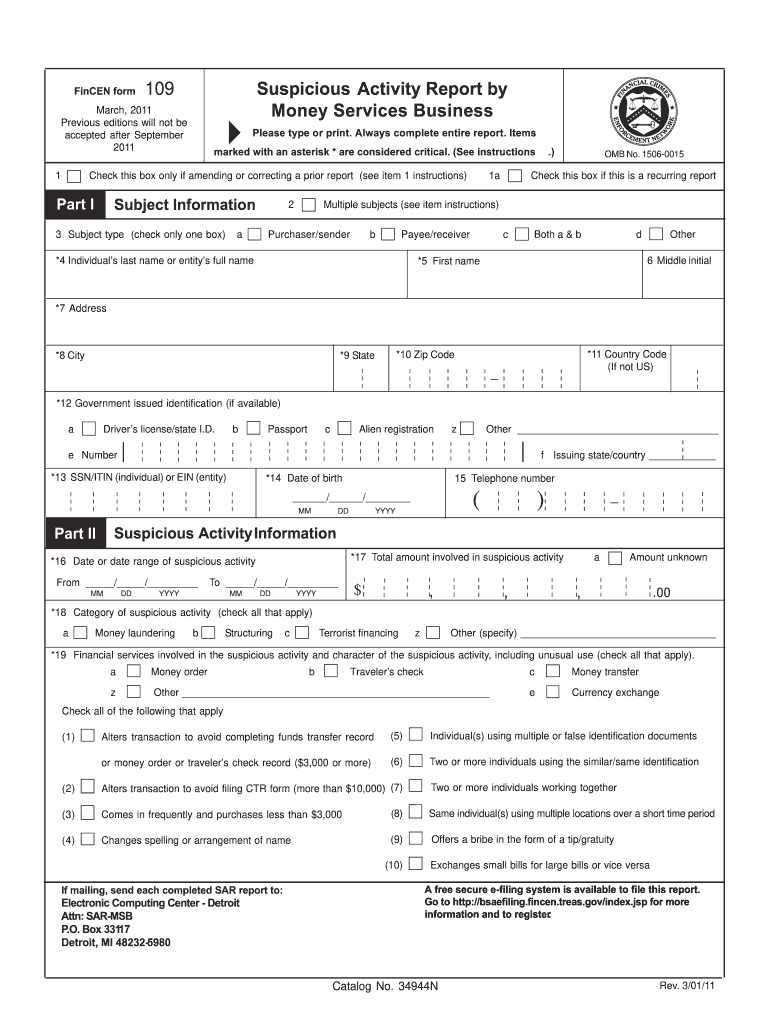

The FinCEN Form SAR (Suspicious Activity Report) is a crucial document used by financial institutions in the United States to report suspicious activities that may indicate money laundering, fraud, or other financial crimes. This form is mandated by the Financial Crimes Enforcement Network (FinCEN) under the Bank Secrecy Act. It enables institutions to communicate their concerns about potentially illegal activities to the federal government, helping to combat financial crime and protect the integrity of the financial system.

Steps to Complete the FinCEN Form SAR

Completing the FinCEN Form SAR involves several important steps to ensure accuracy and compliance. First, gather all relevant information regarding the suspicious activity, including dates, amounts, and involved parties. Next, fill out the form with precise details, ensuring that all required fields are completed. Pay attention to the narrative section, where you should clearly describe the nature of the suspicious activity. Once the form is filled out, review it for any errors or omissions before submission. Finally, submit the form electronically through the FinCEN's BSA E-Filing System, ensuring you retain a copy for your records.

Legal Use of the FinCEN Form SAR

The FinCEN Form SAR must be used in accordance with federal regulations. Financial institutions are required to file this form when they detect suspicious transactions that may involve illegal activities. It is essential to understand that filing a SAR does not imply that a crime has occurred; rather, it indicates that the institution has identified activities that warrant further investigation. Legal protections are in place for institutions that file SARs in good faith, shielding them from liability for disclosing information about the reported activities.

Form Submission Methods

The FinCEN Form SAR can be submitted electronically through the BSA E-Filing System, which is the preferred method. This system allows for secure and efficient filing, ensuring that reports are received promptly by FinCEN. In certain circumstances, if electronic filing is not feasible, institutions may be able to submit paper forms, although electronic submission is strongly encouraged to facilitate quicker processing and reduce the risk of errors.

Key Elements of the FinCEN Form SAR

Understanding the key elements of the FinCEN Form SAR is vital for accurate completion. The form requires detailed information about the reporting institution, the subject of the report, and the suspicious activity itself. Key sections include the identification of the subject, the type of suspicious activity, the amount involved, and a detailed narrative explaining the reasons for suspicion. Additionally, the form may require information on any relevant attachments, such as transaction records or supporting documentation.

Examples of Using the FinCEN Form SAR

There are various scenarios in which the FinCEN Form SAR may be utilized. For instance, a bank may file a SAR if it notices unusual patterns of cash deposits that do not align with a customer's typical banking behavior. Similarly, a money services business might report a transaction involving a large sum of money sent to a high-risk jurisdiction without a clear business purpose. These examples illustrate the importance of vigilance in detecting and reporting suspicious activities to help prevent financial crime.

Quick guide on how to complete 109 form pdf 2011 2019

Discover the most efficient method to complete and sign your Fincen Form Print

Are you still spending time on preparing your official documents on paper instead of doing so online? airSlate SignNow provides a superior approach to finalize and sign your Fincen Form Print and associated forms for public services. Our intelligent eSignature tool equips you with everything required to manage paperwork swiftly and in compliance with official standards - robust PDF editing, organization, safeguarding, signing, and sharing features all available within an intuitive interface.

Only a few steps are needed to complete and sign your Fincen Form Print:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you must input in your Fincen Form Print.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly signNow or Remove areas that are no longer relevant.

- Click on Sign to create a legally binding eSignature using your preferred method.

- Add the Date next to your signature and conclude your work with the Done button.

Store your completed Fincen Form Print in the Documents folder in your profile, download it, or export it to your preferred cloud storage. Our service also provides versatile form sharing options. There’s no need to print out your forms when you need to submit them to the proper public office - do it via email, fax, or by requesting a USPS "snail mail" delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct 109 form pdf 2011 2019

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

What is the best way to fill out a PDF form?

If you are a user of Mac, iPhone or iPad, your tasks will be quickly and easily solved with the help of PDF Expert. Thanks to a simple and intuitive design, you don't have to dig into settings and endless options. PDF Expert also allows you to view, edit, reduce, merge, extract, annotate important parts of documents in a click. You have a special opportunity to try it on your Mac for free!

Create this form in 5 minutes!

How to create an eSignature for the 109 form pdf 2011 2019

How to make an eSignature for your 109 Form Pdf 2011 2019 in the online mode

How to create an electronic signature for your 109 Form Pdf 2011 2019 in Google Chrome

How to make an eSignature for putting it on the 109 Form Pdf 2011 2019 in Gmail

How to make an electronic signature for the 109 Form Pdf 2011 2019 straight from your smart phone

How to make an electronic signature for the 109 Form Pdf 2011 2019 on iOS devices

How to generate an eSignature for the 109 Form Pdf 2011 2019 on Android

People also ask

-

What is the Fincen Form Print and how can I use it?

The Fincen Form Print is a crucial document for businesses to report suspicious activities to the Financial Crimes Enforcement Network (FinCEN). With airSlate SignNow, you can easily create, fill out, and print the Fincen Form, ensuring compliance with legal requirements. Our platform simplifies the process, allowing you to manage your documents efficiently.

-

Is there a cost associated with printing the Fincen Form using airSlate SignNow?

Yes, while you can access the Fincen Form Print feature through airSlate SignNow, there may be associated costs depending on your subscription plan. We offer various pricing options that cater to different business needs, ensuring you get the best value for your money while using our eSigning and document management solutions.

-

Can I electronically sign the Fincen Form Print with airSlate SignNow?

Absolutely! airSlate SignNow allows you to electronically sign the Fincen Form Print securely and legally. Our platform ensures that your signatures are compliant with eSignature laws, making it easy to finalize your documents without the need for printing and scanning.

-

What features does airSlate SignNow offer for Fincen Form Print?

airSlate SignNow provides a range of features for Fincen Form Print, including customizable templates, secure cloud storage, and easy sharing options. You can also track document status and receive notifications when your form has been signed, enhancing your workflow and document management.

-

How does airSlate SignNow ensure the security of the Fincen Form Print?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption methods to protect your Fincen Form Print and all documents, ensuring that your sensitive information remains confidential and secure during transmission and storage.

-

Can I integrate airSlate SignNow with other software for Fincen Form Print?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage the Fincen Form Print. Whether you use CRM systems or document management tools, our integrations help streamline your processes and improve productivity.

-

What are the benefits of using airSlate SignNow for Fincen Form Print?

Using airSlate SignNow for your Fincen Form Print offers numerous benefits, including increased efficiency, reduced paper waste, and faster turnaround times. Our user-friendly platform simplifies the entire process, allowing your team to focus on what matters most while ensuring compliance with regulatory requirements.

Get more for Fincen Form Print

Find out other Fincen Form Print

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form