Where to Fax Form 433 D 2005

What is the Where To Fax Form 433 D

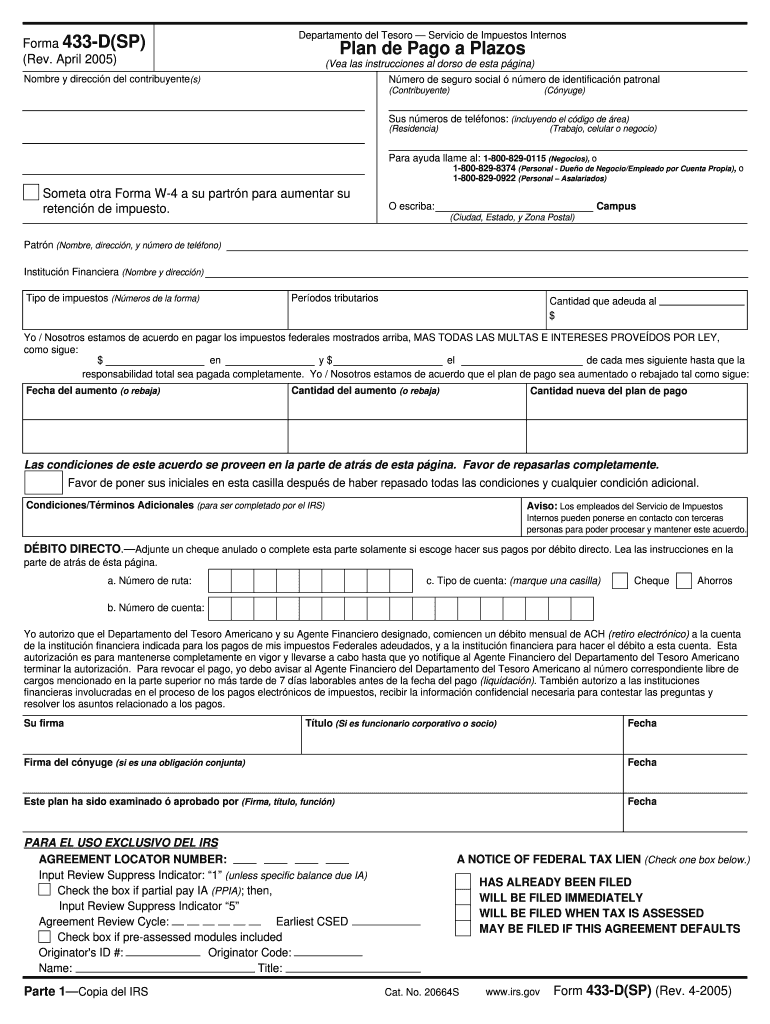

The Where To Fax Form 433 D is a form used by taxpayers to provide the Internal Revenue Service (IRS) with detailed financial information. This form is often utilized in the context of requesting a payment plan or an offer in compromise. It helps the IRS assess a taxpayer's ability to pay their tax liabilities by outlining their income, expenses, and assets.

How to use the Where To Fax Form 433 D

Using the Where To Fax Form 433 D involves several key steps. First, gather all necessary financial documentation, including income statements and expense records. Next, accurately fill out the form, ensuring that all information is complete and truthful. Once completed, the form should be faxed to the appropriate IRS office, as specified in the instructions accompanying the form. It is important to keep a copy of the fax confirmation for your records.

Steps to complete the Where To Fax Form 433 D

Completing the Where To Fax Form 433 D requires careful attention to detail. Follow these steps:

- Gather financial documents, such as pay stubs, bank statements, and bills.

- Fill out the personal information section accurately.

- Detail your income sources, including wages and any other earnings.

- List your monthly expenses, ensuring all necessary categories are covered.

- Provide information on assets, such as property and savings.

- Review the completed form for accuracy before submission.

Legal use of the Where To Fax Form 433 D

The Where To Fax Form 433 D is legally binding when filled out and submitted correctly. It is essential to ensure that all information provided is accurate and truthful, as false information can lead to penalties or legal repercussions. The form must be submitted to the IRS in accordance with their guidelines to be considered valid.

Form Submission Methods

The Where To Fax Form 433 D can be submitted to the IRS through various methods. The primary method is faxing the completed form to the designated IRS office. In some cases, taxpayers may also have the option to submit the form via mail or in person, depending on their specific circumstances. Always refer to the latest IRS guidelines for the most accurate submission methods.

Filing Deadlines / Important Dates

Filing deadlines for the Where To Fax Form 433 D can vary based on individual circumstances. It is crucial to submit the form as soon as possible if you are seeking relief from tax liabilities. Generally, it is advisable to check the IRS website or consult with a tax professional for specific deadlines related to your situation.

Quick guide on how to complete where to fax form 433 d 2005

Prepare Where To Fax Form 433 D effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Where To Fax Form 433 D on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to alter and eSign Where To Fax Form 433 D with ease

- Find Where To Fax Form 433 D and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced files, frustrating form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Edit and eSign Where To Fax Form 433 D and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct where to fax form 433 d 2005

Create this form in 5 minutes!

How to create an eSignature for the where to fax form 433 d 2005

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is Form 433 D and why do I need to fax it?

Form 433 D is used to establish a direct debit installment agreement with the IRS. Understanding where to fax Form 433 D is crucial for ensuring your application is processed efficiently. By faxing this form, you can manage your tax obligations effectively while avoiding delays.

-

Where to fax Form 433 D if I'm an individual taxpayer?

As an individual taxpayer, you should fax Form 433 D to the IRS office that corresponds with your local area. Make sure to confirm the right fax number based on your location to ensure the form signNowes the appropriate department. Doing so helps in quick processing of your request.

-

Can airSlate SignNow help me fax Form 433 D?

Absolutely! airSlate SignNow allows users to send and eSign documents quickly and securely, including Form 433 D. This service simplifies the process of understanding where to fax Form 433 D by integrating faxing features directly into the platform.

-

What features does airSlate SignNow offer for faxing documents?

airSlate SignNow provides an intuitive interface for faxing documents, including the ability to upload, edit, and sign forms digitally. This ensures that you can manage where to fax Form 433 D effectively while keeping all your documents organized in one place.

-

Is airSlate SignNow's faxing service cost-effective?

Yes, airSlate SignNow offers a cost-effective solution for businesses and individuals who need to send documents regularly. By providing a comprehensive package that includes faxing services, users can save both time and money when figuring out where to fax Form 433 D.

-

How long does it take for the IRS to process Form 433 D once faxed?

The processing time for Form 433 D can vary, but generally, the IRS processes faxed forms quicker than mailed ones. Knowing where to fax Form 433 D ensures that you reduce waiting times for your agreement to be set up. On average, you can expect a response within a few weeks.

-

Are there any integrations that support faxing with airSlate SignNow?

Yes, airSlate SignNow integrates with various applications, allowing you to streamline your document workflow. These integrations can simplify how and where to fax Form 433 D, enhancing your overall productivity and management of tax-related documents.

Get more for Where To Fax Form 433 D

- Connecticut documents form

- General durable power of attorney for property and finances or financial effective upon disability connecticut form

- Essential legal life documents for baby boomers connecticut form

- Connecticut general 497301262 form

- Revocation of general durable power of attorney connecticut form

- Essential legal life documents for newlyweds connecticut form

- Essential legal life documents for military personnel connecticut form

- Essential legal life documents for new parents connecticut form

Find out other Where To Fax Form 433 D

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form