Fax 433 2017

What is the Fax 433

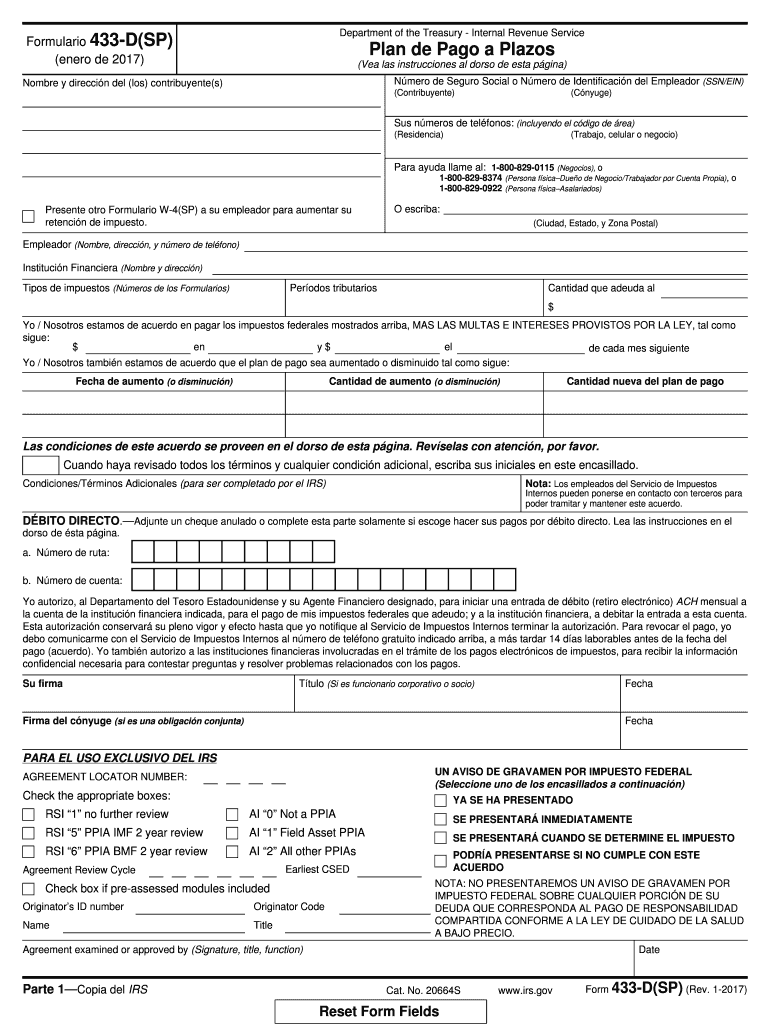

The Fax 433 refers to the IRS Form 433-D, which is used to establish a direct debit installment agreement with the Internal Revenue Service. This form is crucial for taxpayers who owe taxes and wish to set up a payment plan that allows them to pay their tax debt in manageable monthly installments. The form requires detailed financial information to assess the taxpayer's ability to pay and to determine an appropriate payment amount.

Steps to Complete the Fax 433

Completing the Fax 433 involves several key steps to ensure accuracy and compliance with IRS requirements. Here is a concise guide:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the personal information section, including your name, address, and Social Security number.

- Provide details about your tax liability, including the total amount owed and any previous payments made.

- Detail your monthly income and expenses to demonstrate your financial situation.

- Sign and date the form to validate your agreement with the IRS.

Legal Use of the Fax 433

The legal use of the Fax 433 is governed by IRS regulations, which stipulate that the form must be filled out accurately and submitted in a timely manner. This form serves as a binding agreement between the taxpayer and the IRS, allowing for the establishment of a payment plan. Failure to comply with the terms outlined in the form may result in penalties or the revocation of the agreement.

IRS Guidelines

IRS guidelines for the Fax 433 emphasize the importance of providing truthful and complete information. Taxpayers must ensure that the financial information submitted is current and accurately reflects their financial situation. The IRS may request additional documentation to support the information provided on the form. It is essential to follow these guidelines to avoid delays in processing and to ensure the acceptance of the installment agreement.

Form Submission Methods

The Fax 433 can be submitted to the IRS through various methods. Taxpayers can choose to fax the completed form directly to the IRS using the designated fax number for Form 433-D. Alternatively, the form can be mailed to the appropriate IRS address, depending on the taxpayer's location. It is crucial to retain a copy of the submitted form for personal records and to confirm the submission method used.

Required Documents

When completing the Fax 433, certain documents are required to support the information provided. These documents typically include:

- Proof of income, such as pay stubs or bank statements.

- Documentation of monthly expenses, including bills and receipts.

- Any previous IRS correspondence related to the tax liability.

Having these documents ready will facilitate a smoother application process and help ensure compliance with IRS requirements.

Quick guide on how to complete fax 433

Effortlessly prepare Fax 433 on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any hassles. Manage Fax 433 on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Fax 433 with ease

- Find Fax 433 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or mistakes that necessitate printing out new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Fax 433 to ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fax 433

Create this form in 5 minutes!

How to create an eSignature for the fax 433

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the IRS DSP and how does it relate to airSlate SignNow?

The IRS DSP, or IRS Digital Signature Program, is a method that organizations can use to sign and secure their documents electronically. airSlate SignNow seamlessly integrates with the IRS DSP, allowing businesses to eSign documents while ensuring compliance with IRS standards. This integration enhances the document signing experience by offering reliable and legally binding electronic signatures.

-

What features does airSlate SignNow offer for IRS DSP compliance?

airSlate SignNow provides a range of features that ensure compliance with IRS DSP requirements, including secure transmission of documents, audit trails, and tamper-evident signatures. These features help businesses maintain the integrity of their electronic signatures while complying with IRS regulations. The user-friendly interface also makes it easy to manage and track signed documents.

-

How much does airSlate SignNow cost, and does it support IRS DSP?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes, with options for monthly and annual subscriptions. Each plan includes features that support IRS DSP compliance, ensuring that your document signing needs are effectively met. For detailed pricing, visit our pricing page or contact our sales team.

-

Can I integrate airSlate SignNow with other tools for IRS DSP purposes?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, enhancing your workflow for IRS DSP compliance. Integrations with CRMs, document management systems, and cloud storage services allow for centralized document handling and signing. This flexibility makes it easier to manage your organizational needs while adhering to IRS requirements.

-

What are the benefits of using airSlate SignNow for IRS DSP documentation?

Using airSlate SignNow for IRS DSP documentation streamlines the signing process, reduces paper waste, and improves efficiency. With its user-friendly platform, businesses can quickly send, sign, and manage documents without any hassle. Additionally, the security features ensure that your sensitive data is protected while remaining compliant with IRS standards.

-

Is airSlate SignNow user-friendly for non-technical users dealing with IRS DSP?

Absolutely! airSlate SignNow is designed with a user-friendly interface that caters to users of all technical levels, including those unfamiliar with IRS DSP. The straightforward navigation and intuitive controls make it easy for anyone to create, send, and sign documents. Moreover, we offer dedicated customer support to assist users in maximizing their experience.

-

How does airSlate SignNow ensure document security for IRS DSP?

airSlate SignNow employs advanced security measures, including encryption, secure cloud storage, and multi-factor authentication, to safeguard documents for IRS DSP compliance. These measures protect your sensitive information during the signing process and ensure that signatures are legally binding and tamper-proof. Trust in airSlate SignNow to keep your documents secure.

Get more for Fax 433

- Recyclables handling and recovery facility annual report form

- Application for efda certification by examination commonwealth of portal state pa form

- Georgia school boards association risk management fund claims form

- Ontario form 16

- Pc 3 form

- Compulsive exercise test pdf form

- Tembo sacco form

- Contractor change request form

Find out other Fax 433

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation