Form 433 DSP Rev 7 Installment Agreement Spanish Version 2020

What is the Form 433 DSP Rev 7 Installment Agreement Spanish Version

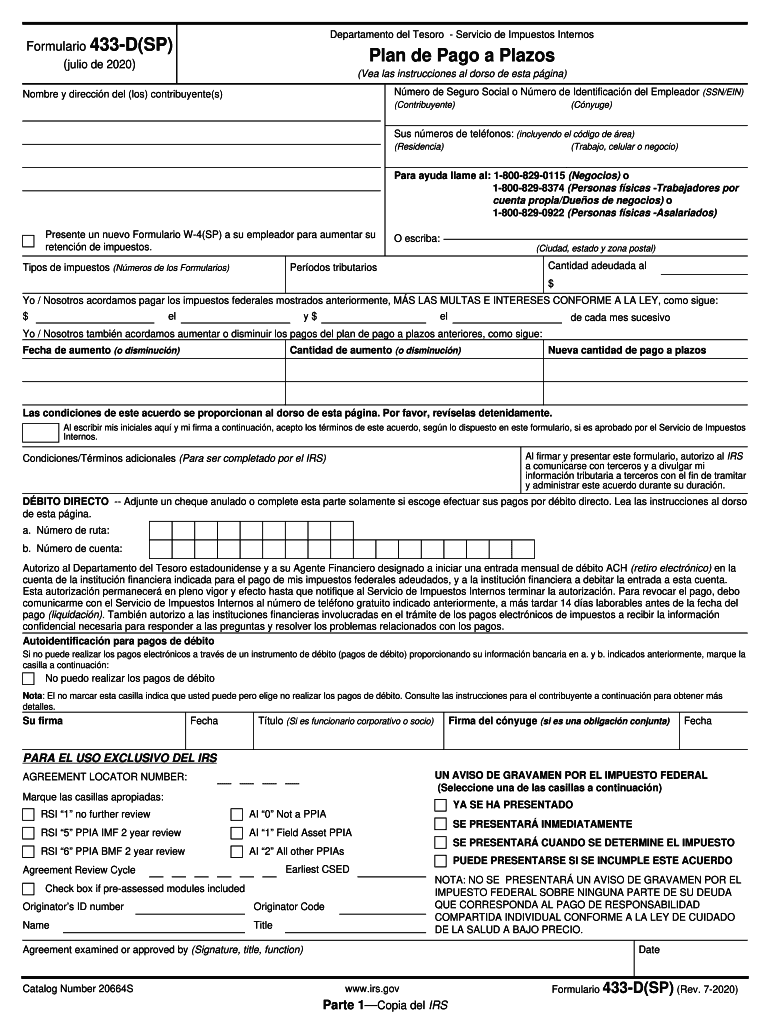

The Form 433 DSP Rev 7 is a document used by taxpayers to request an installment agreement with the IRS. This version is specifically designed for Spanish-speaking individuals, ensuring that they can understand and complete the form accurately. The form collects essential financial information, allowing the IRS to assess the taxpayer's ability to pay their tax liabilities over time. It is crucial for individuals who wish to manage their tax debts through structured payments.

How to use the Form 433 DSP Rev 7 Installment Agreement Spanish Version

To use the Form 433 DSP Rev 7, taxpayers must first download and print the form. After filling it out with accurate financial data, including income, expenses, and assets, it should be submitted to the IRS. This form can be used to propose a monthly payment plan that fits the taxpayer's financial situation. It is important to ensure that all information is complete and correct to avoid delays in processing the request.

Steps to complete the Form 433 DSP Rev 7 Installment Agreement Spanish Version

Completing the Form 433 DSP Rev 7 involves several key steps:

- Gather financial documents, including income statements and expense records.

- Fill out the form with detailed information about your financial situation.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate IRS address or fax number.

Each step is essential to ensure that the IRS has a clear understanding of your financial circumstances, which will aid in the approval of your installment agreement.

Legal use of the Form 433 DSP Rev 7 Installment Agreement Spanish Version

The Form 433 DSP Rev 7 is legally binding once submitted to the IRS. It serves as a formal request for an installment agreement, allowing taxpayers to pay their tax debts over time. Compliance with the information provided is crucial, as any discrepancies can lead to penalties or denial of the agreement. It is advisable to keep copies of all submitted documents for personal records.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 433 DSP Rev 7. Taxpayers are encouraged to follow these guidelines closely to ensure that their requests are processed efficiently. This includes understanding eligibility criteria, required documentation, and the importance of timely submissions. Adhering to IRS instructions can significantly improve the chances of obtaining an installment agreement.

Required Documents

When submitting the Form 433 DSP Rev 7, taxpayers must include various supporting documents to validate their financial information. This typically includes:

- Proof of income, such as pay stubs or bank statements.

- Documentation of monthly expenses, including bills and receipts.

- Information on assets, such as property deeds or vehicle titles.

Providing complete and accurate documentation is essential for the IRS to evaluate the request effectively.

Quick guide on how to complete form 433 dsp rev 7 2020 installment agreement spanish version

Effortlessly Prepare Form 433 DSP Rev 7 Installment Agreement Spanish Version on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form 433 DSP Rev 7 Installment Agreement Spanish Version on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The easiest way to edit and electronically sign Form 433 DSP Rev 7 Installment Agreement Spanish Version without hassle

- Obtain Form 433 DSP Rev 7 Installment Agreement Spanish Version and click on Get Form to commence.

- Use the tools we supply to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that reason.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tiresome form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 433 DSP Rev 7 Installment Agreement Spanish Version and guarantee excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 433 dsp rev 7 2020 installment agreement spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 433 dsp rev 7 2020 installment agreement spanish version

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the 433 d fax number used for in airSlate SignNow?

The 433 d fax number in airSlate SignNow allows users to send and receive faxes securely and efficiently. This feature integrates seamlessly with our eSigning platform, enabling businesses to manage documents without the hassle of traditional faxing.

-

How can I obtain the 433 d fax number for my account?

You can easily obtain your 433 d fax number by signing up for an airSlate SignNow account. After completing the registration process, your unique fax number will be assigned, allowing you to start sending and receiving faxes right away.

-

Is there an additional cost for using the 433 d fax number?

Using the 433 d fax number comes at no extra charge when you subscribe to one of our plans on airSlate SignNow. This makes it a cost-effective solution for businesses looking to streamline their document handling process without hidden fees.

-

What documents can I send using the 433 d fax number in airSlate SignNow?

You can send a variety of documents using the 433 d fax number, including contracts, agreements, and any other important paperwork. airSlate SignNow supports multiple file formats, ensuring that your documents are transmitted efficiently.

-

How does the 433 d fax number integrate with airSlate SignNow's eSignature features?

The 433 d fax number works well with airSlate SignNow's eSignature features, allowing you to send documents for signature via fax seamlessly. Recipients can eSign the documents and return them quickly, streamlining your workflow signNowly.

-

Can I track faxes sent to and from the 433 d fax number?

Yes, airSlate SignNow provides tracking and logging features for all faxes sent to and from the 433 d fax number. This allows you to maintain a clear record of your documents and monitor their status at any time.

-

Is the 433 d fax number secure for sensitive documents?

Absolutely! The 433 d fax number utilizes advanced security measures to protect your sensitive documents during transmission. Encryption and compliance with industry standards ensure that your data remains confidential.

Get more for Form 433 DSP Rev 7 Installment Agreement Spanish Version

- Site work contract for contractor wisconsin form

- Siding contract for contractor wisconsin form

- Refrigeration contract for contractor wisconsin form

- Drainage contract for contractor wisconsin form

- Foundation contract for contractor wisconsin form

- Plumbing contract for contractor wisconsin form

- Brick mason contract for contractor wisconsin form

- Wisconsin contractor 497430440 form

Find out other Form 433 DSP Rev 7 Installment Agreement Spanish Version

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT