Form 433 D Sp Rev 7 Installment Agreement Spanish Version 2024-2026

What is the Form 433 D espanol?

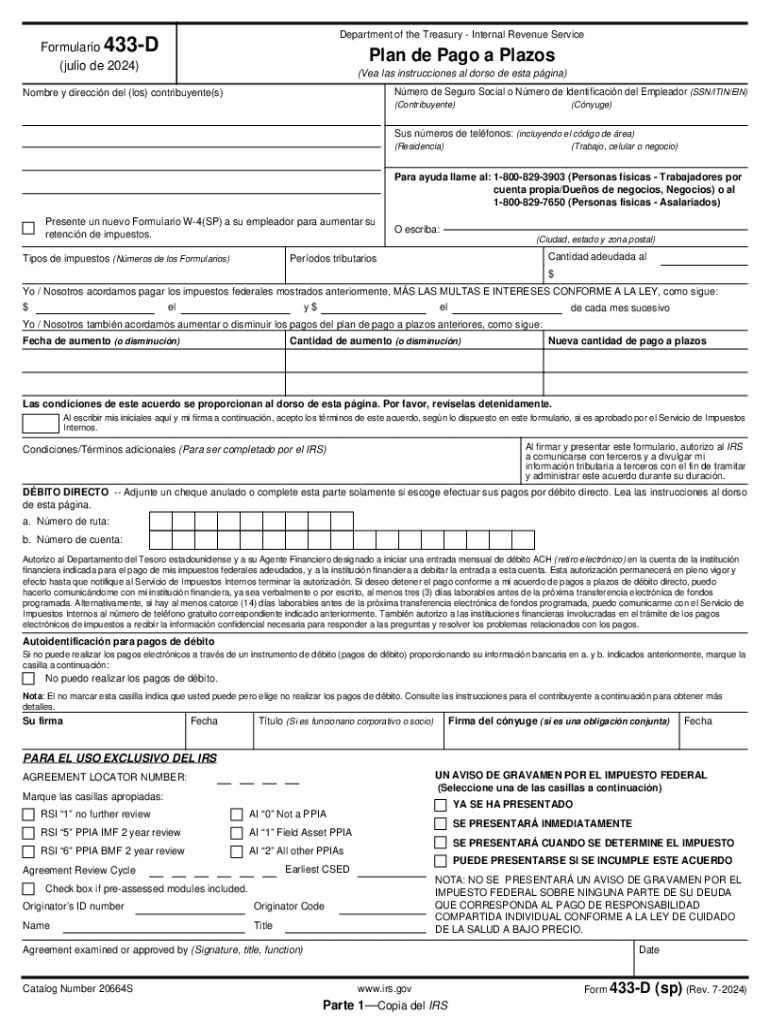

The Form 433 D espanol, also known as the IRS Form 433 D, is a crucial document used by taxpayers in the United States to request an installment agreement with the IRS. This form is specifically designed for Spanish-speaking individuals who are seeking to manage their tax liabilities through a structured payment plan. By submitting this form, taxpayers can propose a payment schedule that aligns with their financial capabilities, allowing them to pay off their tax debts over time.

How to use the Form 433 D espanol

Using the Form 433 D espanol involves several steps. First, gather all necessary financial information, including income, expenses, and assets. This data is essential for accurately completing the form. Next, fill out the form by providing your personal details, financial situation, and the proposed monthly payment amount. Once completed, review the form for accuracy. Finally, submit the form to the IRS using the appropriate submission method, which can include mailing or faxing the document.

Steps to complete the Form 433 D espanol

Completing the Form 433 D espanol requires careful attention to detail. Follow these steps:

- Gather financial documents, including pay stubs, bank statements, and expense records.

- Fill out your personal information, including your name, address, and Social Security number.

- Detail your income sources, including wages, self-employment income, and any other earnings.

- List your monthly expenses, such as housing costs, utilities, and transportation.

- Provide information on your assets, including bank accounts, real estate, and vehicles.

- Propose a reasonable monthly payment amount based on your financial situation.

- Review the form for completeness and accuracy before submission.

Key elements of the Form 433 D espanol

The Form 433 D espanol includes several key elements that are essential for the IRS to evaluate your request for an installment agreement. These elements consist of:

- Personal Information: Your name, address, and taxpayer identification number.

- Financial Information: Detailed breakdown of income, expenses, and assets.

- Proposed Payment Plan: The amount you wish to pay monthly and the duration of the payment plan.

- Signature: Your signature is required to validate the information provided.

Form Submission Methods

The Form 433 D espanol can be submitted to the IRS through various methods. Taxpayers can choose to mail the completed form to the designated IRS address or fax it to the IRS fax number for Form 433 D. It is important to ensure that the form is sent to the correct address to avoid delays in processing. Keeping a copy of the submitted form for your records is also advisable.

Eligibility Criteria

To be eligible to use the Form 433 D espanol, taxpayers must meet certain criteria. These include having a tax liability that they are unable to pay in full and demonstrating a financial need for an installment agreement. The IRS will review your financial information to determine if your proposed payment plan is reasonable and feasible based on your income and expenses.

Handy tips for filling out Form 433 D sp Rev 7 Installment Agreement Spanish Version online

Quick steps to complete and e-sign Form 433 D sp Rev 7 Installment Agreement Spanish Version online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant service for optimum efficiency. Use signNow to electronically sign and share Form 433 D sp Rev 7 Installment Agreement Spanish Version for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 433 d sp rev 7 installment agreement spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 433 d sp rev 7 installment agreement spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 433 d espanol and how is it used?

The form 433 d espanol is a Spanish version of the IRS Form 433-D, which is used for installment agreements. It allows individuals to request a payment plan for their tax liabilities. By using airSlate SignNow, you can easily fill out and eSign this form, streamlining the process.

-

How can airSlate SignNow help with the form 433 d espanol?

airSlate SignNow simplifies the process of completing the form 433 d espanol by providing an intuitive interface for filling out and signing documents. You can quickly upload your form, add necessary information, and eSign it securely. This saves time and reduces the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for the form 433 d espanol?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that enhance document management, including the ability to handle the form 433 d espanol efficiently. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the form 433 d espanol?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the form 433 d espanol. These features ensure that your documents are completed accurately and efficiently. Additionally, you can collaborate with others in real-time, making the process seamless.

-

Can I integrate airSlate SignNow with other applications for the form 433 d espanol?

Yes, airSlate SignNow offers integrations with various applications, allowing you to manage the form 433 d espanol alongside your existing workflows. This includes CRM systems, cloud storage services, and more. Integrating these tools enhances productivity and ensures that your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the form 433 d espanol?

Using airSlate SignNow for the form 433 d espanol provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows you to complete and sign documents from anywhere, making it convenient for users. Additionally, it helps ensure compliance with IRS requirements.

-

Is airSlate SignNow secure for handling the form 433 d espanol?

Absolutely, airSlate SignNow prioritizes security and compliance when handling the form 433 d espanol. The platform uses advanced encryption and secure storage to protect your sensitive information. You can trust that your documents are safe while using our eSigning services.

Get more for Form 433 D sp Rev 7 Installment Agreement Spanish Version

- Quit claim deed 2740645 form

- Speed problems worksheet with answers pdf form

- M30 form 309790

- Emis form

- Tama endorsement application form

- Form 188

- Da form 67 10 3 mar 641a4d019b82589970f7742fmainda form 67 10 3 strategic grade plate o6 officer evaluation report pdf

- Motion and qualified domestic relations order pinal county clerk form

Find out other Form 433 D sp Rev 7 Installment Agreement Spanish Version

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document