8868 Form 2012

What is the 8868 Form

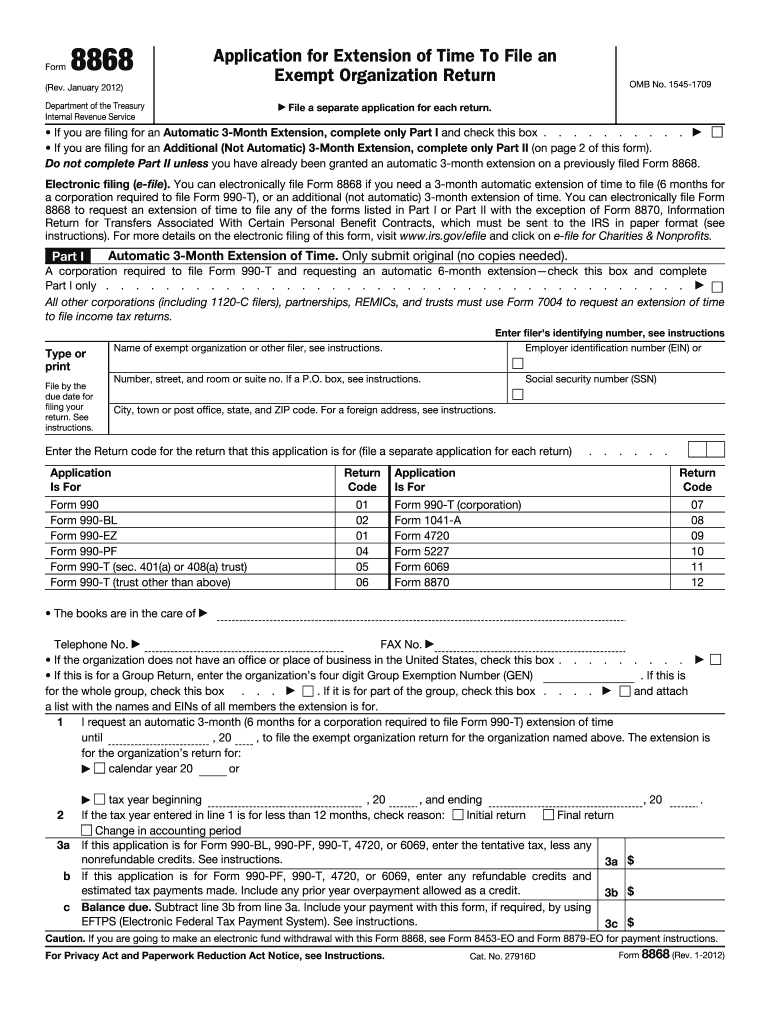

The 8868 Form, officially known as the Application for Extension of Time To File an Exempt Organization Return, is a crucial document for tax-exempt organizations in the United States. This form allows organizations to request an extension for filing their annual returns, such as Form 990, Form 990-EZ, or Form 990-PF. By submitting the 8868 Form, organizations can gain additional time to prepare their returns without incurring penalties for late filing. It is important for organizations to understand the requirements and implications of this form to maintain their tax-exempt status.

How to use the 8868 Form

Using the 8868 Form involves a straightforward process. Organizations must complete the form by providing essential information, including their name, address, and Employer Identification Number (EIN). The form can be filed electronically or via mail. Organizations should ensure that they submit the form before the original due date of their return to avoid penalties. Additionally, it's crucial to check that all information is accurate and complete to facilitate a smooth extension process.

Steps to complete the 8868 Form

Completing the 8868 Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your organization's name, address, and EIN.

- Indicate the type of return for which you are requesting an extension.

- Specify the length of the extension you are seeking, which can be up to six months.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail to the appropriate IRS address.

Legal use of the 8868 Form

The legal use of the 8868 Form ensures that organizations comply with IRS regulations regarding tax-exempt status. By properly filing this form, organizations can avoid penalties associated with late filing of their annual returns. It is essential to adhere to the guidelines set forth by the IRS, including submitting the form on time and accurately reporting the required information. Failure to comply can jeopardize an organization’s tax-exempt status, making it critical to understand the legal implications of using the 8868 Form.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the 8868 Form is vital for organizations seeking an extension. The form must be submitted by the original due date of the return for which the extension is requested. Typically, this is the fifteenth day of the fifth month after the end of the organization’s fiscal year. Organizations should keep track of these dates to ensure they file the 8868 Form on time and avoid any potential penalties.

Required Documents

When completing the 8868 Form, organizations should prepare certain documents to ensure a smooth filing process. Key documents include:

- The organization’s EIN and contact information.

- Details about the specific return for which an extension is requested.

- Any previous correspondence with the IRS regarding the organization’s tax-exempt status.

Having these documents ready will help facilitate the accurate completion of the form and support the organization’s request for an extension.

Quick guide on how to complete 2012 8868 form

Effortlessly Prepare 8868 Form on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to search for the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage 8868 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign 8868 Form with Ease

- Locate 8868 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign 8868 Form while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 8868 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 8868 form

The way to create an eSignature for your PDF in the online mode

The way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is the 8868 Form and why is it important?

The 8868 Form is an application for an automatic extension of time to file an exempt organization return. It is important because it allows organizations to extend their filing deadline, ensuring compliance with IRS regulations and avoiding penalties.

-

How can airSlate SignNow help me with the 8868 Form?

airSlate SignNow can simplify the process of completing and submitting the 8868 Form. With features like eSigning, document sharing, and secure storage, businesses can efficiently manage their filing needs and ensure timely submissions.

-

What features does airSlate SignNow offer for managing the 8868 Form?

airSlate SignNow offers features such as customizable templates for the 8868 Form, collaboration tools for team members, and automated reminders for deadlines. These capabilities help streamline the preparation and submission process.

-

Is there a cost associated with using airSlate SignNow for the 8868 Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, which include features for managing documents like the 8868 Form. Investing in this solution can result in savings through reduced administrative costs and improved compliance.

-

Can I integrate airSlate SignNow with other applications for the 8868 Form?

Absolutely! airSlate SignNow integrates with various applications, allowing you to streamline your workflow when handling the 8868 Form. These integrations enhance productivity by connecting your existing tools with our eSigning capabilities.

-

How secure is the information submitted through the 8868 Form in airSlate SignNow?

Security is a top priority at airSlate SignNow. When submitting the 8868 Form, all data is encrypted, ensuring the protection of sensitive information. Our platform complies with industry-standard security protocols to provide peace of mind.

-

Can I track the status of my 8868 Form after submission?

Yes, airSlate SignNow allows you to track the status of your 8868 Form submission in real-time. This feature helps you stay informed and ensures that you know when your form has been received and processed.

Get more for 8868 Form

- Assignment of mortgage by individual mortgage holder iowa form

- Assignment of mortgage by corporate mortgage holder iowa form

- Unconditional waiver lien form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property iowa form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497305002 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property iowa form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential iowa form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property iowa form

Find out other 8868 Form

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online