Form 8868 Rev January Application for Automatic Extension of Time to File an Exempt Organization Return 2022

What is IRS Form 8868?

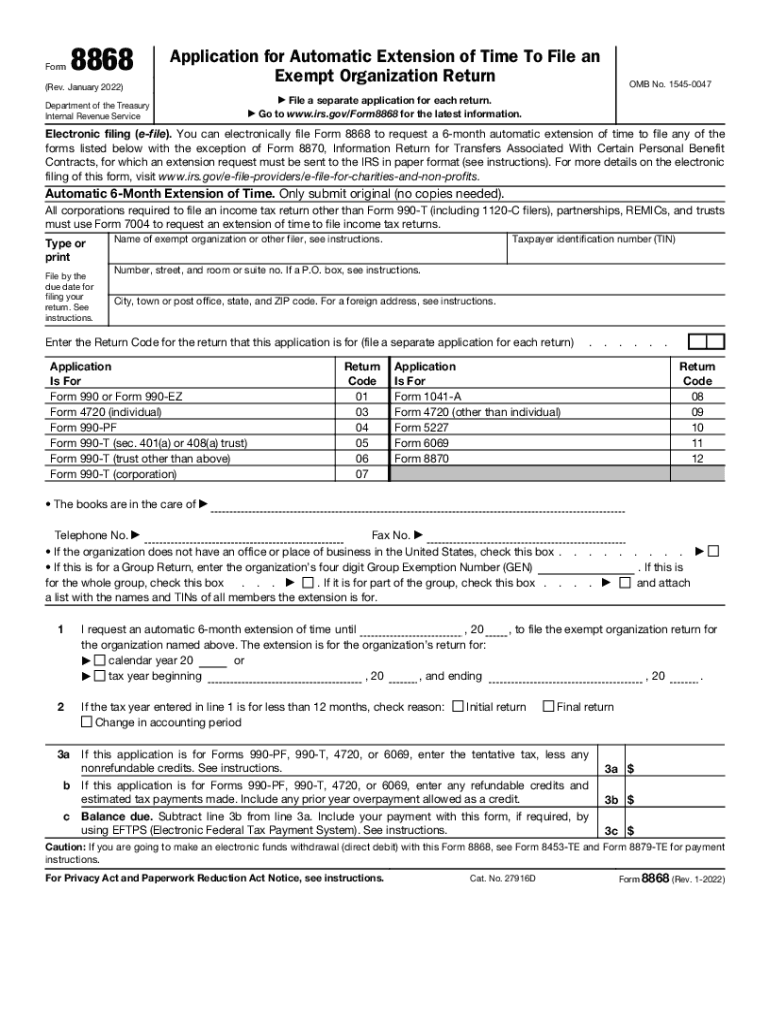

IRS Form 8868, officially known as the Application for Automatic Extension of Time To File an Exempt Organization Return, allows tax-exempt organizations to request an extension for filing their annual returns. This form is particularly relevant for organizations that need additional time to prepare their Form 990, 990-EZ, or 990-PF. By filing Form 8868, organizations can receive an automatic six-month extension, ensuring they meet their reporting obligations without incurring penalties.

Steps to Complete IRS Form 8868

Completing IRS Form 8868 involves several clear steps:

- Begin by filling out the organization’s name, address, and Employer Identification Number (EIN) at the top of the form.

- Indicate the type of return for which you are requesting an extension, such as Form 990, 990-EZ, or 990-PF.

- Specify the tax year for which the extension is being requested.

- Sign and date the form, ensuring that the authorized individual from the organization completes this section.

- Submit the completed form electronically or by mail, following the IRS guidelines for submission.

Filing Deadlines for IRS Form 8868

It is crucial to adhere to specific deadlines when filing Form 8868. Generally, the form should be submitted by the original due date of the organization’s return. For most organizations, this is the fifteenth day of the fifth month after the end of their tax year. For example, if the tax year ends on December 31, the form must be filed by May 15. Failure to file by this deadline may result in penalties.

Legal Use of IRS Form 8868

IRS Form 8868 is legally binding when completed and submitted according to IRS regulations. The form serves as a formal request for an extension, and organizations must ensure that they comply with all applicable laws and regulations regarding tax-exempt status. Using a reliable electronic filing platform can enhance compliance and provide a secure method of submission, ensuring that the form is processed efficiently.

IRS Guidelines for Form 8868

The IRS provides specific guidelines for completing and submitting Form 8868. Organizations must follow these instructions carefully to ensure their extension request is valid. Key points include:

- Ensure accurate information is provided, including the correct EIN and tax year.

- Submit the form electronically for faster processing.

- Maintain a copy of the submitted form for organizational records.

Penalties for Non-Compliance

Organizations that fail to file Form 8868 by the deadline may face penalties. The IRS imposes a penalty for failure to file a return on time, which can accumulate if the return is not submitted even after the extension. It is essential for organizations to understand these potential consequences and take proactive steps to ensure compliance with filing requirements.

Quick guide on how to complete form 8868 rev january 2022 application for automatic extension of time to file an exempt organization return

Complete Form 8868 Rev January Application For Automatic Extension Of Time To File An Exempt Organization Return effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form 8868 Rev January Application For Automatic Extension Of Time To File An Exempt Organization Return on any device using airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The simplest way to modify and electronically sign Form 8868 Rev January Application For Automatic Extension Of Time To File An Exempt Organization Return without any hassle

- Locate Form 8868 Rev January Application For Automatic Extension Of Time To File An Exempt Organization Return and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize critical sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to preserve your modifications.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 8868 Rev January Application For Automatic Extension Of Time To File An Exempt Organization Return to ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8868 rev january 2022 application for automatic extension of time to file an exempt organization return

Create this form in 5 minutes!

How to create an eSignature for the form 8868 rev january 2022 application for automatic extension of time to file an exempt organization return

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to create an e-signature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

How to create an e-signature for a PDF file on Android OS

People also ask

-

What is IRS Form 8868 electronic filing?

IRS Form 8868 electronic filing allows organizations to apply for an automatic extension of time to file an Exempt Organization Return. It ensures that you can submit your application quickly and securely using a digital platform. This process simplifies your tax obligations while staying compliant with IRS regulations.

-

How does airSlate SignNow facilitate IRS Form 8868 electronic filing?

airSlate SignNow provides a streamlined platform for IRS Form 8868 electronic filing, allowing users to complete, sign, and submit their forms effortlessly. The intuitive interface and eSigning capabilities help you finalize your documents quickly. Plus, the platform ensures that your sensitive information is securely handled throughout the filing process.

-

What are the costs associated with using airSlate SignNow for IRS Form 8868 electronic filing?

Prices for airSlate SignNow are competitive and are designed to fit various budgets. While some features are available for free, businesses investing in advanced plans benefit from enhanced functionalities, including IRS Form 8868 electronic filing. You can select a plan that suits your needs without breaking the bank.

-

Is IRS Form 8868 electronic filing through airSlate SignNow safe and secure?

Yes, IRS Form 8868 electronic filing through airSlate SignNow is both safe and secure. The platform employs advanced encryption and security measures to protect your data during the filing process. Trust is essential when dealing with sensitive tax documents, and airSlate SignNow prioritizes the security of your information.

-

Can I store and access previous IRS Form 8868 filings with airSlate SignNow?

Absolutely! airSlate SignNow allows you to store and access all your previous IRS Form 8868 filings in a secure cloud environment. This feature makes it easy to reference past submissions and manage your tax-related documents efficiently. You won’t have to worry about losing important records.

-

What integrations does airSlate SignNow offer for easier IRS Form 8868 electronic filing?

airSlate SignNow integrates with various applications and platforms to ensure a seamless experience when filing your IRS Form 8868 electronically. Whether you’re using accounting software or collaborative tools, these integrations help streamline your workflow. Enjoy efficiency and convenience at your fingertips!

-

Can I collaborate with my team on IRS Form 8868 electronic filing using airSlate SignNow?

Yes, airSlate SignNow supports team collaboration for IRS Form 8868 electronic filing. You can invite team members to review, edit, and sign documents collaboratively. This feature fosters teamwork and ensures that everyone involved has access to the necessary documents, leading to a more organized filing process.

Get more for Form 8868 Rev January Application For Automatic Extension Of Time To File An Exempt Organization Return

- Cancel judgment 497313612 form

- Mississippi no fault divorce form

- Agreed order granting additional time to complete discovery in circuit court with third parties mississippi form

- Agreed order court form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497313616 form

- Mississippi lien form

- Mississippi authority form

- Conservatorship 497313619 form

Find out other Form 8868 Rev January Application For Automatic Extension Of Time To File An Exempt Organization Return

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form