What is IRS Form 8868Tax Extension 2024

What is IRS Form 8868?

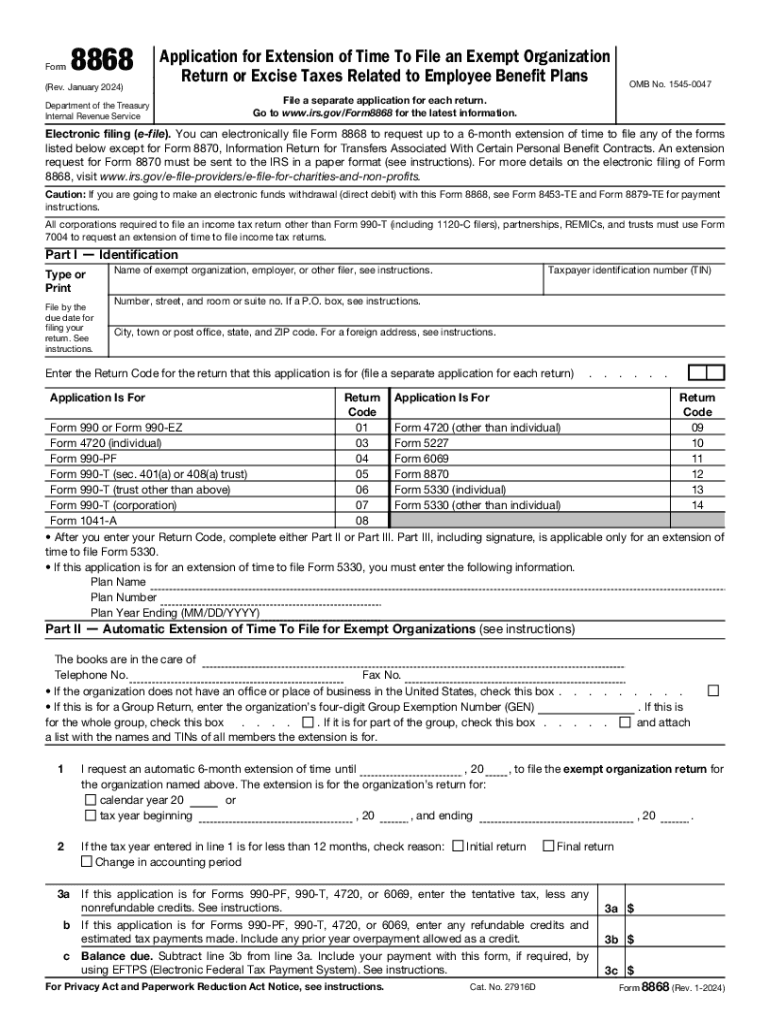

IRS Form 8868 is a tax extension form that allows organizations, such as non-profits and charities, to request an automatic extension of time to file their annual returns. This form is particularly relevant for entities that need additional time to prepare their tax documents accurately. By filing Form 8868, organizations can receive an extension of up to six months, providing them with the necessary time to ensure compliance with IRS regulations.

Steps to complete IRS Form 8868

Completing IRS Form 8868 involves several straightforward steps:

- Gather necessary information, including the organization's name, address, and Employer Identification Number (EIN).

- Indicate the type of return for which you are requesting an extension.

- Specify the period for which the extension is requested, ensuring it does not exceed six months.

- Sign and date the form, confirming the accuracy of the information provided.

Once completed, the form can be filed electronically or mailed to the appropriate IRS address.

Form Submission Methods

IRS Form 8868 can be submitted in multiple ways to accommodate different preferences. Organizations can file electronically through the IRS e-file system, which is often the quickest method. Alternatively, the form can be mailed to the IRS, ensuring it is sent to the correct address based on the organization's location. It is essential to check the latest IRS guidelines for any changes in submission procedures.

Filing Deadlines / Important Dates

Understanding the deadlines associated with IRS Form 8868 is crucial for compliance. The form must be filed by the original due date of the organization’s return. For most organizations, this means submitting Form 8868 by the 15th day of the fifth month after the end of their tax year. If the deadline is missed, organizations may face penalties, making timely submission essential.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 8868. It is important to refer to the IRS instructions for the form, which detail eligibility criteria, required information, and any potential penalties for late filing. Adhering to these guidelines helps ensure that organizations remain in good standing and avoid unnecessary complications with the IRS.

Eligibility Criteria

To be eligible to file IRS Form 8868, an organization must be recognized as a tax-exempt entity under the Internal Revenue Code. This includes non-profits, charitable organizations, and certain other entities. It is important to confirm that the organization meets these criteria before submitting the form to avoid any issues with the IRS.

Penalties for Non-Compliance

Failing to file IRS Form 8868 or submitting it late can result in penalties. The IRS may impose a failure-to-file penalty, which can accumulate daily until the form is filed. Additionally, organizations may face complications with their tax-exempt status if they do not comply with filing requirements. Understanding these potential penalties underscores the importance of timely and accurate filing.

Quick guide on how to complete what is irs form 8868tax extension

Easily Prepare What Is IRS Form 8868Tax Extension on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can find the needed template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle What Is IRS Form 8868Tax Extension seamlessly on any platform with airSlate SignNow's Android or iOS apps, and streamline any document-related task today.

Edit and eSign What Is IRS Form 8868Tax Extension Effortlessly

- Find What Is IRS Form 8868Tax Extension and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that task by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose how you want to send your form, whether via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and eSign What Is IRS Form 8868Tax Extension to ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what is irs form 8868tax extension

Create this form in 5 minutes!

How to create an eSignature for the what is irs form 8868tax extension

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8868 and why is it important?

Form 8868 is a request for an automatic extension of time to file certain tax forms for non-profits and other organizations. Understanding how to file Form 8868 electronically is essential as it ensures that you can avoid penalties for late filings and maintain compliance with IRS regulations.

-

How can airSlate SignNow help me file Form 8868 electronically?

airSlate SignNow provides a streamlined process to file Form 8868 electronically, making it easy for you to complete and submit your documents. Our user-friendly interface guides you through the necessary steps, ensuring that you know exactly how to file Form 8868 electronically, efficiently and accurately.

-

Is there a cost associated with filing Form 8868 electronically using airSlate SignNow?

Yes, airSlate SignNow offers competitive pricing for electronic document filing, including Form 8868. Our plans are designed to be cost-effective, providing excellent value for organizations seeking an efficient way to understand how to file Form 8868 electronically.

-

What features does airSlate SignNow offer for eSigning forms like Form 8868?

With airSlate SignNow, you gain access to various features such as customizable templates, secure cloud storage, and real-time tracking of document status. These capabilities make it easy to manage the entire process of how to file Form 8868 electronically with confidence and ease.

-

Can I integrate airSlate SignNow with other software for filing Form 8868?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, allowing you to easily manage your documents. This integration simplifies the process of understanding how to file Form 8868 electronically alongside your other financial tasks.

-

How secure is the process of filing Form 8868 electronically with airSlate SignNow?

Security is a top priority at airSlate SignNow. When you file Form 8868 electronically through our platform, you benefit from industry-standard encryption and secure access controls to keep your sensitive information safe throughout the filing process.

-

What support is available if I need help filing Form 8868 electronically?

airSlate SignNow offers dedicated customer support to assist you in learning how to file Form 8868 electronically. Our knowledgeable team is available to guide you through any challenges you may face, ensuring a smooth filing experience.

Get more for What Is IRS Form 8868Tax Extension

- Florida divorce formsfiling for divorce in floridaus

- Filing fee 765 form

- How to form a south dakota corporation rocket lawyer

- Organized pursuant to the laws of the state of south dakota hereinafter quotcorporationquot form

- Sdcl 47 1a 120 129 amp 202 form

- Name officers of the corporation form

- A south dakota corporation form

- Free llc operating agreement templates pdfwordeforms

Find out other What Is IRS Form 8868Tax Extension

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later