Form 14653 2015

What is the Form 14653

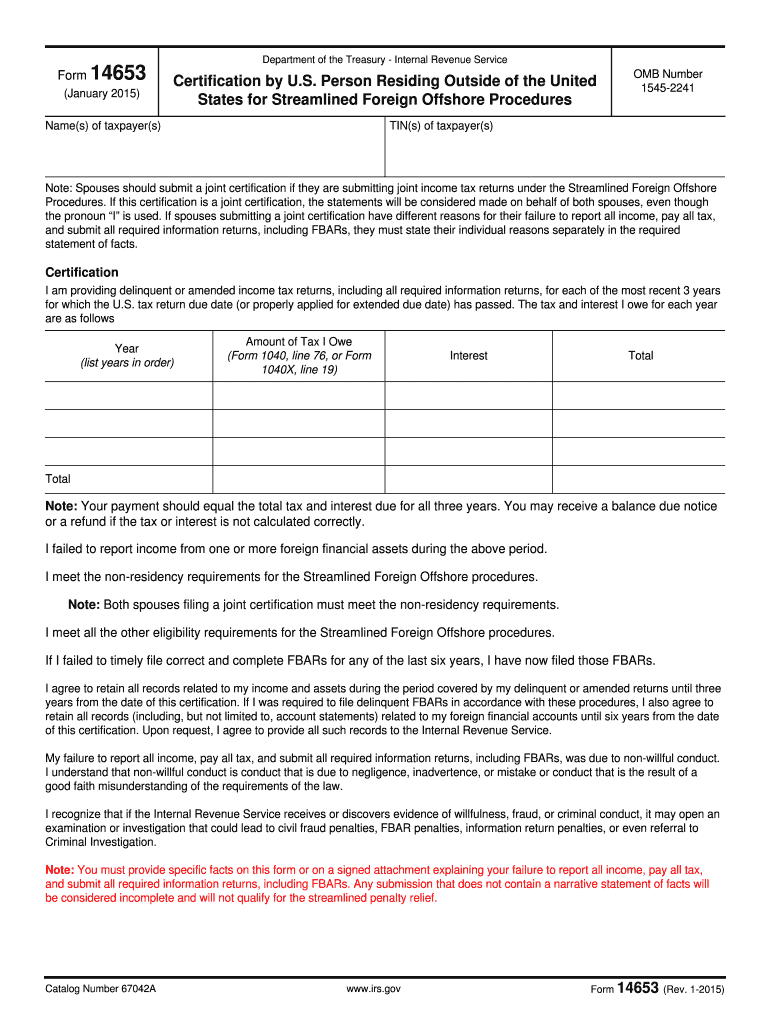

The Form 14653, also known as the "Application for Relief Under the Streamlined Procedures," is a document used by U.S. taxpayers who have failed to report foreign financial assets. This form allows individuals to apply for relief from penalties associated with non-compliance in reporting these assets. It is primarily utilized by those who qualify for the IRS's streamlined filing compliance procedures, which aim to encourage taxpayers to come into compliance without facing severe penalties.

How to use the Form 14653

To effectively use the Form 14653, taxpayers must first determine their eligibility for the streamlined procedures. Once confirmed, they should complete the form by providing accurate information regarding their foreign financial assets and any previous non-compliance. After filling out the form, it should be submitted along with the required tax returns and any other supporting documentation to the appropriate IRS office. It is crucial to ensure that all information is complete and accurate to avoid delays in processing.

Steps to complete the Form 14653

Completing the Form 14653 involves several key steps:

- Gather necessary documentation, including details of foreign financial accounts and assets.

- Review the eligibility criteria for the streamlined procedures to ensure compliance.

- Fill out the form accurately, providing all requested information regarding your financial history.

- Attach any required supporting documents, such as tax returns and proof of foreign accounts.

- Submit the completed form and accompanying documents to the IRS by the specified deadline.

Legal use of the Form 14653

The legal use of the Form 14653 is governed by IRS regulations that outline the streamlined filing compliance procedures. Taxpayers must adhere to these guidelines to ensure that their application is valid and that they receive the intended relief from penalties. Proper completion and submission of the form demonstrate a good faith effort to comply with U.S. tax laws regarding foreign assets.

Filing Deadlines / Important Dates

Filing deadlines for the Form 14653 can vary based on individual circumstances. Generally, taxpayers should submit the form along with their tax returns by the annual tax filing deadline, which is typically April 15. However, if an extension is filed, the deadline may be extended to October 15. It is important to stay informed about any changes in deadlines that the IRS may announce, particularly in response to unforeseen circumstances.

Required Documents

When submitting the Form 14653, taxpayers must include several key documents to support their application. These typically include:

- Completed Form 14653.

- Copies of tax returns for the previous three years.

- Documentation of foreign financial accounts, such as bank statements or account statements.

- Any correspondence with the IRS regarding prior non-compliance.

Who Issues the Form

The Form 14653 is issued by the Internal Revenue Service (IRS), which is the U.S. government agency responsible for tax collection and enforcement. The IRS provides guidelines and resources to assist taxpayers in understanding the streamlined procedures and the proper use of the form. Taxpayers can access the form directly from the IRS website or through tax professionals who assist with compliance matters.

Quick guide on how to complete form 14653 2015

Complete Form 14653 seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to easily find the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without interruptions. Manage Form 14653 on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

Steps to edit and eSign Form 14653 effortlessly

- Locate Form 14653 and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Mark important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 14653 and guarantee seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14653 2015

Create this form in 5 minutes!

How to create an eSignature for the form 14653 2015

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is Form 14653 and how does it work with airSlate SignNow?

Form 14653 is a crucial document in the IRS process for claiming certain tax benefits. With airSlate SignNow, you can easily create, send, and eSign Form 14653, streamlining your documentation process. Our platform ensures that you can manage these forms efficiently, saving time for your business.

-

Is airSlate SignNow a cost-effective solution for managing Form 14653?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 14653 and other documents. Our pricing plans are designed to cater to businesses of all sizes, ensuring that you get the best value for your money. With affordable plans, you can easily integrate electronic signing without breaking the bank.

-

What features does airSlate SignNow provide for Form 14653 signers?

AirSlate SignNow provides robust features for Form 14653 signers, including easy eSigning, document tracking, and collaborative workspaces. Our intuitive interface makes it simple for users to navigate the signing process, ensuring that Form 14653 is completed quickly and accurately. Additionally, you can access templates for faster document preparation.

-

Can I integrate airSlate SignNow with other tools for managing Form 14653?

Absolutely! airSlate SignNow offers seamless integrations with a variety of software tools, enabling you to manage Form 14653 alongside your other business applications. This integration allows for automatic syncing of data and documents, improving workflow efficiency and reducing errors.

-

What are the benefits of using airSlate SignNow for Form 14653?

Using airSlate SignNow for Form 14653 provides numerous benefits, including enhanced security, compliance, and convenience. Our platform ensures that your documents are encrypted and securely stored, so you can trust that sensitive information is protected. Moreover, the ease of use enables quick turnaround times, facilitating faster business operations.

-

Is it easy to set up and send Form 14653 using airSlate SignNow?

Yes, setting up and sending Form 14653 with airSlate SignNow is straightforward. Users can quickly upload their document, specify signer roles, and send it for eSignature in just a few clicks. Our user-friendly platform is designed for maximum efficiency, allowing you to focus on your core business activities.

-

What industries can benefit from using airSlate SignNow for Form 14653?

Various industries can benefit from using airSlate SignNow for Form 14653, including finance, healthcare, and legal sectors. Any organization that needs to manage tax documents or require signed agreements can leverage our platform's capabilities. By facilitating the signing process, businesses can ensure compliance and reduce delays in operations.

Get more for Form 14653

Find out other Form 14653

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed