Form 14653 2014

What is the Form 14653

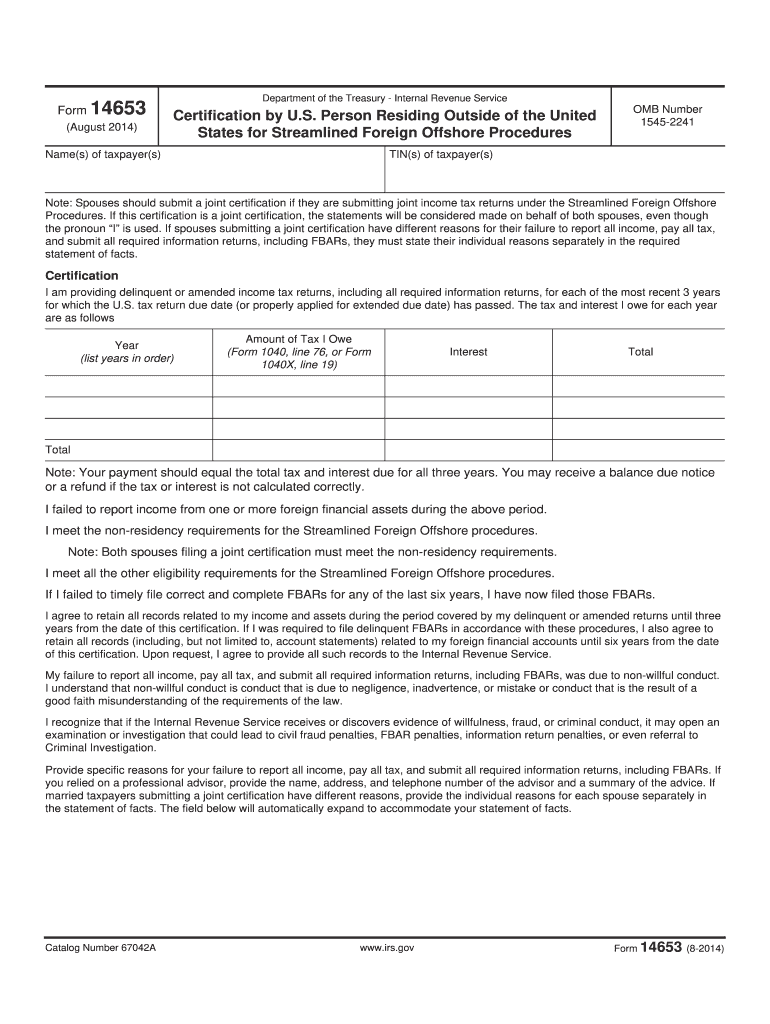

The Form 14653, also known as the "Application for Relief Under the Streamlined Procedures," is a crucial document for taxpayers who have failed to report foreign financial assets. This form is primarily used by individuals who qualify for the IRS's streamlined compliance procedures, allowing them to rectify their tax filings without facing penalties. The form is designed to simplify the process for U.S. citizens and residents who may have unintentionally overlooked their foreign income and asset reporting obligations.

How to use the Form 14653

Using Form 14653 involves several key steps. First, individuals must determine their eligibility for the streamlined procedures. Once eligibility is confirmed, the form must be completed accurately, detailing the taxpayer's foreign financial accounts and any income associated with those accounts. After filling out the form, it should be submitted along with the required tax returns and any additional documentation that supports the claim for relief. It is essential to ensure that all information is correct and complete to avoid delays in processing.

Steps to complete the Form 14653

Completing Form 14653 requires careful attention to detail. The following steps outline the process:

- Gather necessary information about foreign financial accounts, including account numbers and balances.

- Review eligibility criteria for the streamlined procedures to ensure compliance.

- Complete the form, providing accurate details about foreign income and taxes paid.

- Attach any supporting documents, such as prior tax returns or proof of foreign taxes paid.

- Review the completed form for accuracy before submission.

- Submit the form along with any required tax returns to the appropriate IRS address.

Legal use of the Form 14653

The legal use of Form 14653 is governed by IRS regulations regarding foreign asset reporting. When completed correctly, the form provides taxpayers with a pathway to rectify past non-compliance without incurring penalties. It is essential to adhere to the guidelines set forth by the IRS, as improper use of the form can lead to complications or denial of relief. The form serves as a declaration of the taxpayer's intent to comply with U.S. tax laws and is a critical step in the process of coming into compliance.

Filing Deadlines / Important Dates

Filing deadlines for Form 14653 align with the IRS's tax return deadlines. Generally, taxpayers must submit the form along with their tax returns by the annual tax filing deadline, which is typically April fifteenth. However, if additional time is needed, taxpayers may file for an extension, allowing them until October fifteenth to submit their returns and the form. It is crucial to stay informed about any changes to deadlines or procedures announced by the IRS to ensure timely compliance.

Required Documents

When submitting Form 14653, certain documents are required to support the application for relief. These documents may include:

- Copies of prior tax returns for the years in question.

- Documentation of foreign financial accounts, such as bank statements.

- Proof of foreign taxes paid, if applicable.

- Any correspondence with the IRS regarding past filings.

Having these documents ready can facilitate a smoother submission process and enhance the chances of approval.

Quick guide on how to complete form 14653 2014

Effortlessly Prepare Form 14653 on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form 14653 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign Form 14653 with Ease

- Obtain Form 14653 and select Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Form 14653 and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14653 2014

Create this form in 5 minutes!

How to create an eSignature for the form 14653 2014

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 14653 and how is it used?

Form 14653 is an IRS document used for the Voluntary Disclosure Program, allowing taxpayers to report previously undisclosed offshore accounts. By utilizing Form 14653, individuals can resolve their tax obligations while reducing exposure to penalties. This form is crucial for those seeking to comply with U.S. tax regulations effectively.

-

How does airSlate SignNow simplify the signing process for Form 14653?

airSlate SignNow streamlines the eSigning process for Form 14653 by offering an intuitive interface that allows users to sign documents electronically with ease. Users can upload their Form 14653, add necessary signatures, and send it to recipients quickly. This efficiency not only saves time but also ensures that all documents are securely signed and stored.

-

What pricing plans does airSlate SignNow offer for using Form 14653?

airSlate SignNow provides flexible pricing plans that cater to various business needs when preparing documents like Form 14653. Users can choose from monthly or annual subscription options that offer different features tailored to specific requirements. This affordability makes it an ideal choice for businesses of all sizes.

-

Can I integrate airSlate SignNow with other applications for Form 14653 processing?

Yes, airSlate SignNow seamlessly integrates with numerous applications to enhance the workflow surrounding Form 14653. With integrations available for popular tools like CRM systems and cloud storage, users can manage their documents more efficiently. This interoperability ensures that you can handle Form 14653 within your existing systems.

-

What are the key features of airSlate SignNow that benefit users of Form 14653?

Key features of airSlate SignNow that benefit users preparing Form 14653 include customizable templates, reusable signing workflows, and secure document sharing. These tools not only simplify the eSignature gathering process but also maintain compliance with regulatory requirements. Users can complete paperwork faster while ensuring accuracy and security.

-

Is airSlate SignNow secure for handling sensitive documents like Form 14653?

Absolutely, airSlate SignNow prioritizes security, making it a reliable platform for handling sensitive documents such as Form 14653. The service employs industry-standard encryption and complies with relevant regulations to protect your data. Users can have peace of mind knowing that their information is secure throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for submitting Form 14653?

Using airSlate SignNow for submitting Form 14653 offers several benefits, including a faster submission process, improved tracking of document status, and reduced paperwork hassle. The platform allows you to handle all signing and submission requirements digitally, which increases operational efficiency. This can be especially advantageous during tax season when timely submissions are crucial.

Get more for Form 14653

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497306866 form

- Indiana codes form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497306868 form

- Application for review by full board for workers compensation indiana form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497306870 form

- Indiana landlord in form

- Indiana landlord tenant form

- Indiana landlord tenant in form

Find out other Form 14653

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form