Form 14653 2016

What is the Form 14653

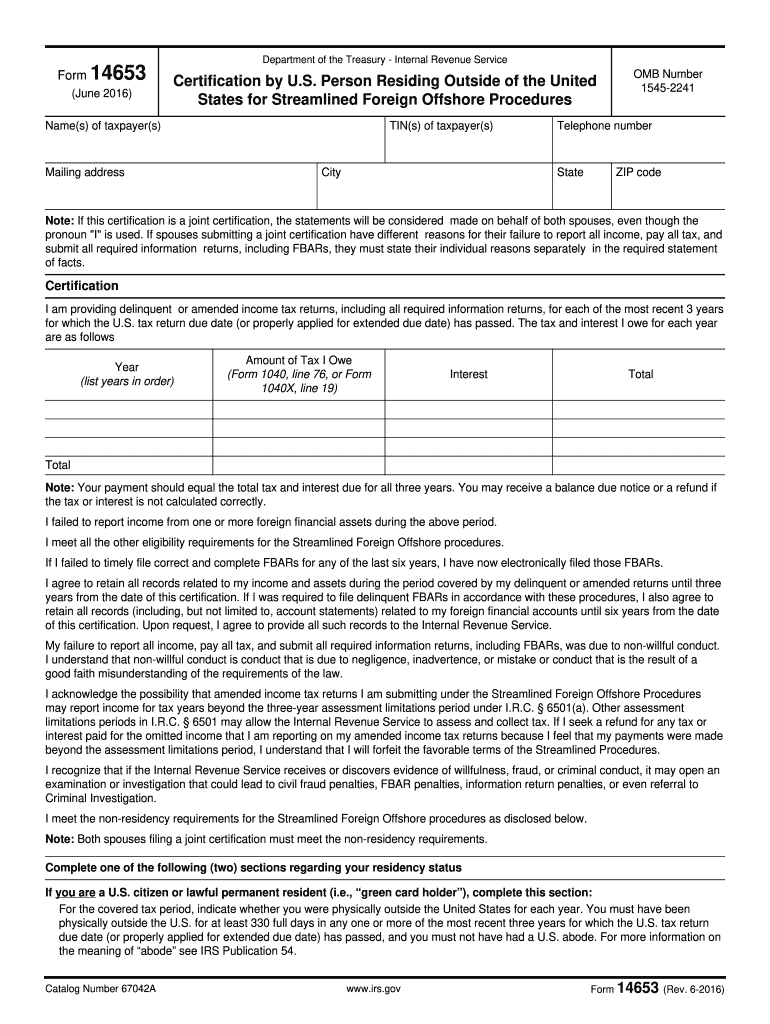

The Form 14653 is a document used by taxpayers in the United States to request relief from penalties associated with the failure to file or pay taxes. This form is particularly relevant for individuals who may have reasonable cause for their noncompliance. By submitting this form, taxpayers can explain their circumstances and seek a waiver of penalties imposed by the Internal Revenue Service (IRS).

How to use the Form 14653

Using the Form 14653 involves a straightforward process. Taxpayers must first complete the form by providing personal information, including their name, address, and Social Security number. They should then detail the reasons for their failure to comply with tax obligations. It is essential to provide thorough explanations and any supporting documentation that may strengthen the case for penalty relief.

Steps to complete the Form 14653

Completing the Form 14653 requires careful attention to detail. Follow these steps:

- Gather necessary personal information, including tax identification numbers.

- Clearly state the reasons for the penalty relief request in the designated sections.

- Attach any relevant documents that provide evidence of reasonable cause.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 14653

The legal use of the Form 14653 is governed by IRS guidelines. Taxpayers must ensure that the information provided is truthful and accurate. Misrepresentation or fraudulent claims can lead to further penalties. The form is designed to protect taxpayers who have legitimate reasons for their tax issues, and it is crucial to adhere to all legal requirements when submitting it.

Filing Deadlines / Important Dates

Filing deadlines for the Form 14653 can vary based on individual circumstances. Typically, it should be submitted as soon as a taxpayer becomes aware of penalties. It is advisable to file the form along with the tax return or as soon as possible after receiving a penalty notice from the IRS. Keeping track of these deadlines is essential to ensure that the request for penalty relief is considered timely.

Required Documents

When submitting the Form 14653, taxpayers should include specific documents that support their request for penalty relief. These may include:

- Proof of timely tax payments, if applicable.

- Documentation of circumstances that led to the failure to comply, such as medical records or financial statements.

- Any correspondence with the IRS regarding the penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 14653 can be submitted through various methods. Taxpayers may choose to file it online, if available, or mail it directly to the appropriate IRS address. In some cases, individuals may also have the option to submit the form in person at designated IRS offices. It is important to check the IRS website for the most current submission methods and guidelines.

Quick guide on how to complete form 14653 2016

Effortlessly Prepare Form 14653 on Any Device

Digital document management has become increasingly favored among businesses and individuals alike. It serves as a perfect eco-friendly substitute for conventional printed and signed materials, enabling you to find the right template and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents rapidly without interruptions. Handle Form 14653 on any platform using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

Easy Methods to Edit and eSign Form 14653 with Minimal Effort

- Find Form 14653 and select Get Form to begin.

- Use the tools available to fill out your document.

- Highlight important sections of your documents or black out sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invite link, or download it directly to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 14653 and guarantee excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14653 2016

Create this form in 5 minutes!

How to create an eSignature for the form 14653 2016

How to generate an eSignature for your Form 14653 2016 online

How to generate an eSignature for the Form 14653 2016 in Chrome

How to generate an electronic signature for putting it on the Form 14653 2016 in Gmail

How to create an eSignature for the Form 14653 2016 straight from your smartphone

How to make an eSignature for the Form 14653 2016 on iOS

How to make an electronic signature for the Form 14653 2016 on Android OS

People also ask

-

What is Form 14653 and why is it important?

Form 14653 is a crucial IRS document used for the Streamlined Foreign Offshore Procedures. It helps taxpayers report their foreign income and claim any applicable tax benefits. By utilizing Form 14653, individuals can avoid penalties and ensure compliance with U.S. tax laws.

-

How can airSlate SignNow help with submitting Form 14653?

airSlate SignNow simplifies the process of preparing and submitting Form 14653 by allowing users to electronically sign documents securely. With our easy-to-use interface, you can fill out the form and send it directly to the IRS, ensuring that your submission is both efficient and compliant.

-

Is there a cost associated with using airSlate SignNow for Form 14653?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, including a plan suitable for handling Form 14653 submissions. Our cost-effective solution allows businesses to manage their document signing efficiently while ensuring compliance with IRS requirements.

-

What features does airSlate SignNow provide for Form 14653 processing?

airSlate SignNow provides features such as customizable templates, cloud storage, and secure eSignature capabilities for processing Form 14653. These tools make it easier for users to manage their tax documentation and ensure a seamless filing experience.

-

Can I integrate airSlate SignNow with other applications for Form 14653?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including popular tax software and document management systems. This allows you to streamline your workflow for Form 14653 and other documents, making the filing process more efficient.

-

What are the benefits of using airSlate SignNow for Form 14653 submissions?

Using airSlate SignNow for Form 14653 submissions offers numerous benefits, such as enhanced security, increased efficiency, and reduced paperwork. Our platform ensures that your documents are signed and sent securely, minimizing the risk of errors and delays.

-

How secure is my information when using airSlate SignNow for Form 14653?

Your information is highly secure when using airSlate SignNow for Form 14653. We utilize industry-standard encryption and adhere to strict compliance protocols to protect your sensitive data throughout the signing and submission process.

Get more for Form 14653

Find out other Form 14653

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple