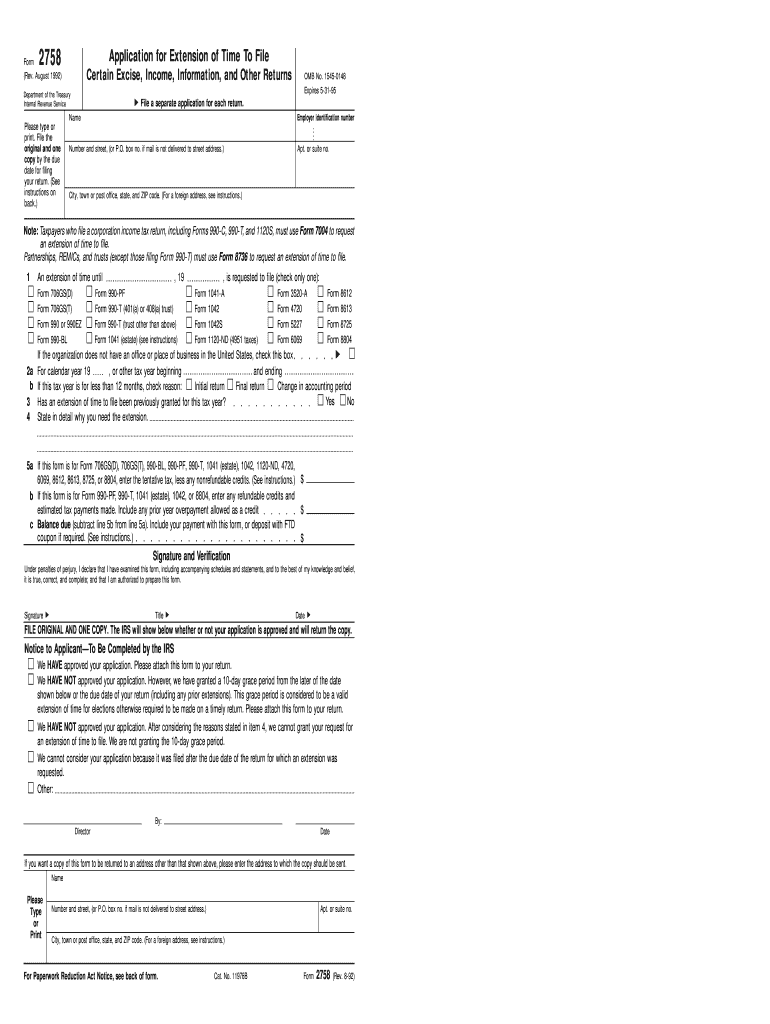

Irs Form 2758 1992

What is the Irs Form 2758

The Irs Form 2758 is a tax form used by taxpayers to request an extension of time to file certain tax returns. This form is particularly relevant for those who may need additional time to prepare their tax documents accurately. By submitting Form 2758, taxpayers can avoid late filing penalties while ensuring they meet their tax obligations. It is essential to understand the specific circumstances under which this form can be utilized, as it applies to various types of tax returns.

How to use the Irs Form 2758

Using the Irs Form 2758 involves several steps to ensure proper completion and submission. First, gather all necessary information, including your tax identification number and details about the tax return for which you are requesting an extension. Next, fill out the form accurately, providing all required information. After completing the form, review it for any errors before submitting it to the IRS. It is advisable to keep a copy of the submitted form for your records, as this can be helpful for future reference.

Steps to complete the Irs Form 2758

Completing the Irs Form 2758 requires careful attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the form from the IRS website or other official sources.

- Fill in your name, address, and taxpayer identification number in the appropriate fields.

- Indicate the type of return for which you are requesting an extension.

- Specify the tax year associated with the extension request.

- Sign and date the form to certify that the information provided is accurate.

Once completed, submit the form according to the instructions provided, either electronically or via mail.

Legal use of the Irs Form 2758

The legal use of the Irs Form 2758 is governed by IRS regulations, which stipulate that the form must be used correctly to request an extension. It is crucial to ensure that the request is made before the original filing deadline to avoid penalties. The form serves as a formal request for additional time, and its acceptance by the IRS provides legal protection against late filing penalties. Understanding the legal implications of using this form can help taxpayers navigate their responsibilities effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Form 2758 are critical to ensure compliance with IRS regulations. Generally, the form must be submitted before the original due date of the tax return for which an extension is being requested. It is important to note that while the form grants an extension for filing, it does not extend the time to pay any taxes owed. Taxpayers should be aware of these deadlines to avoid unnecessary penalties and interest on unpaid taxes.

Who Issues the Form

The Irs Form 2758 is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement of tax laws. The IRS provides this form to assist taxpayers in managing their filing obligations and ensuring compliance with tax regulations. Understanding that the IRS is the issuing authority can help taxpayers recognize the importance of using the form correctly and adhering to submission guidelines.

Quick guide on how to complete irs form 2758 1992

Complete Irs Form 2758 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Handle Irs Form 2758 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and eSign Irs Form 2758 with ease

- Obtain Irs Form 2758 and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the information and click the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 2758 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 2758 1992

Create this form in 5 minutes!

How to create an eSignature for the irs form 2758 1992

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is IRS Form 2758?

IRS Form 2758 is a document used to request an extension of time to file an estate tax return. Understanding how to complete the IRS Form 2758 is essential for managing estate tax obligations efficiently. Using an eSignature solution can streamline the process of filing this form.

-

How can airSlate SignNow help with IRS Form 2758?

airSlate SignNow offers an easy-to-use platform that allows users to fill out and eSign IRS Form 2758 seamlessly. The platform ensures that your documents are secure and compliant with IRS regulations, making tax season less stressful. Using airSlate SignNow, you can complete and send your IRS Form 2758 quickly.

-

Is there a cost associated with using airSlate SignNow for IRS Form 2758?

Yes, airSlate SignNow offers various subscription plans to suit different business needs, making it a cost-effective solution for handling IRS Form 2758. Pricing is based on the features and level of use, allowing you to choose the right plan for your requirements. There is also a free trial available to explore the platform.

-

What features does airSlate SignNow provide for completing IRS Form 2758?

airSlate SignNow provides a range of features including customizable templates, document tracking, and secure cloud storage that can assist in completing IRS Form 2758. The platform’s intuitive interface simplifies the completion and eSigning process. You can also collaborate with team members in real-time, ensuring accuracy.

-

Can I integrate airSlate SignNow with other tools for IRS Form 2758?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Workspace, Salesforce, and more to facilitate the management of IRS Form 2758. These integrations enhance workflow efficiency and allow for easy document sharing. This means you can access your forms directly from the tools you already use.

-

What are the benefits of eSigning IRS Form 2758 with airSlate SignNow?

Using airSlate SignNow to eSign IRS Form 2758 offers numerous benefits, including faster turnaround times and enhanced security. You can track the status of your document in real-time, ensuring that nothing falls through the cracks. This reduces the risk of errors and improves compliance with IRS requirements.

-

How secure is the process of signing IRS Form 2758 with airSlate SignNow?

airSlate SignNow prioritizes security by implementing advanced encryption and security protocols to protect your data when signing IRS Form 2758. The platform is compliant with industry standards, ensuring that your sensitive information remains confidential. You can confidently use airSlate SignNow for all your document signing needs.

Get more for Irs Form 2758

- Quitclaim deed from individual to husband and wife florida form

- Warranty deed from individual to husband and wife florida form

- Enhanced life estate deed florida form

- Quitclaim deed from corporation to husband and wife florida form

- Warranty deed grantor 497302666 form

- Enhanced life estate or lady bird deed husband and wife to two individuals florida form

- Marital trust form

- Quitclaim deed from corporation to individual florida form

Find out other Irs Form 2758

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself