Form 1041 a U S Information Return Trust Accumulation of Irs 2012

What is the Form 1041 A U S Information Return Trust Accumulation Of IRS

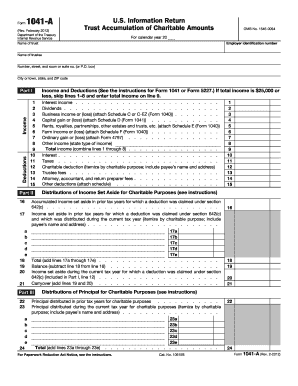

The Form 1041 A U S Information Return Trust Accumulation Of IRS is a tax form used by estates and trusts to report income, deductions, and credits. It is specifically designed for trusts that accumulate income rather than distribute it to beneficiaries. This form is essential for ensuring compliance with federal tax regulations, as it provides the IRS with detailed information about the trust's financial activities during the tax year. Understanding this form is crucial for fiduciaries managing trusts, as it helps in accurately reporting the trust's income and fulfilling tax obligations.

How to use the Form 1041 A U S Information Return Trust Accumulation Of IRS

Using the Form 1041 A U S Information Return Trust Accumulation Of IRS involves several steps. First, gather all necessary financial documents related to the trust, including income statements, expense records, and previous tax returns. Next, complete the form by accurately entering the trust's income, deductions, and any applicable credits. Ensure that all information is consistent with the trust's financial records. Once completed, the form must be filed with the IRS by the designated deadline, typically on the fifteenth day of the fourth month following the end of the trust's tax year. It is advisable to keep copies of the form and all supporting documents for your records.

Steps to complete the Form 1041 A U S Information Return Trust Accumulation Of IRS

Completing the Form 1041 A U S Information Return Trust Accumulation Of IRS involves a systematic approach:

- Gather all relevant financial information, including income from investments and any deductions.

- Fill out the identification section, including the name and taxpayer identification number of the trust.

- Report the total income received by the trust in the appropriate sections.

- Deduct any allowable expenses to arrive at the net income for the trust.

- Complete the tax calculation section to determine any taxes owed.

- Sign and date the form, ensuring that it is submitted by the deadline.

Legal use of the Form 1041 A U S Information Return Trust Accumulation Of IRS

The legal use of the Form 1041 A U S Information Return Trust Accumulation Of IRS is paramount for compliance with federal tax laws. This form serves as an official record of the trust's income and expenses, which is necessary for accurate tax reporting. Failure to file this form or inaccuracies can lead to penalties and interest on unpaid taxes. It is essential for fiduciaries to understand the legal implications of the information reported on this form, as it reflects the trust's financial health and adherence to tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 A U S Information Return Trust Accumulation Of IRS are critical for compliance. Generally, the form is due on the fifteenth day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year, this means the form is typically due on April fifteenth. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Fiduciaries should be aware of these dates to avoid late filing penalties and ensure timely submission.

Required Documents

To complete the Form 1041 A U S Information Return Trust Accumulation Of IRS, several documents are required:

- Financial statements detailing income and expenses of the trust.

- Previous tax returns for the trust, if applicable.

- Records of any distributions made to beneficiaries.

- Documentation supporting deductions claimed on the form.

Having these documents readily available will streamline the process of completing the form and ensure accuracy in reporting.

Quick guide on how to complete form 1041 a us information return trust accumulation of irs

Manage Form 1041 A U S Information Return Trust Accumulation Of Irs effortlessly across all devices

Online document administration has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Form 1041 A U S Information Return Trust Accumulation Of Irs on any device with airSlate SignNow's Android or iOS applications, and simplify any document-related procedures today.

How to alter and electronically sign Form 1041 A U S Information Return Trust Accumulation Of Irs with ease

- Locate Form 1041 A U S Information Return Trust Accumulation Of Irs and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for such tasks.

- Craft your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form 1041 A U S Information Return Trust Accumulation Of Irs to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 a us information return trust accumulation of irs

Create this form in 5 minutes!

How to create an eSignature for the form 1041 a us information return trust accumulation of irs

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is Form 1041 A U S Information Return Trust Accumulation Of IRS?

Form 1041 A U S Information Return Trust Accumulation Of IRS is used to report income, deductions, and credits for trusts that accumulate income rather than distribute it. It is essential for trustees to document the financial activities accurately to comply with IRS regulations. Ensuring correct filing helps avoid penalties and interest on late submissions.

-

How does airSlate SignNow facilitate the completion of Form 1041 A U S Information Return Trust Accumulation Of IRS?

airSlate SignNow provides tools that streamline document creation and eSigning, making it easier to complete Form 1041 A U S Information Return Trust Accumulation Of IRS. The platform offers templates and guided workflows to ensure all necessary sections are filled correctly. Additionally, you can securely store and access all completed forms anytime.

-

What are the pricing options for using airSlate SignNow for Form 1041 A U S Information Return Trust Accumulation Of IRS?

airSlate SignNow offers competitive pricing plans tailored to fit various business needs when managing documents such as Form 1041 A U S Information Return Trust Accumulation Of IRS. You can choose from individual plans or team packages that provide added features and functionalities. Pricing details are available on our website, and we also offer a free trial to explore the platform.

-

Can airSlate SignNow integrate with other software for managing Form 1041 A U S Information Return Trust Accumulation Of IRS?

Yes, airSlate SignNow supports integrations with popular software solutions that help you manage Form 1041 A U S Information Return Trust Accumulation Of IRS more efficiently. This includes accounting software and other document management tools that streamline your workflow. These integrations enhance collaboration and ensure all your financial documents are in sync.

-

What features does airSlate SignNow offer for eSigning Form 1041 A U S Information Return Trust Accumulation Of IRS?

With airSlate SignNow, you can easily eSign Form 1041 A U S Information Return Trust Accumulation Of IRS with a few clicks. The platform offers a secure and legally binding eSignature solution, ensuring your documents are signed quickly and efficiently. Features such as custom branding for your documents and advanced authentication options are also available.

-

Are my documents safe when using airSlate SignNow to manage Form 1041 A U S Information Return Trust Accumulation Of IRS?

Absolutely! airSlate SignNow prioritizes security and employs advanced encryption technologies to keep your documents safe, including Form 1041 A U S Information Return Trust Accumulation Of IRS. Our platform is compliant with industry standards, ensuring that your sensitive information remains protected during storage and transmission.

-

What support options are available for customers using airSlate SignNow for Form 1041 A U S Information Return Trust Accumulation Of IRS?

airSlate SignNow offers a variety of support options for our users managing Form 1041 A U S Information Return Trust Accumulation Of IRS. Our comprehensive knowledge base is available online, and you can also signNow out for assistance through email or chat support. We strive to resolve any inquiries promptly to ensure you have a seamless experience.

Get more for Form 1041 A U S Information Return Trust Accumulation Of Irs

- Warranty deed from two individuals to llc indiana 497306825 form

- Quitclaim deed business entity grantor by attorney in fact to individual grantee indiana form

- Business entity 497306827 form

- Indiana affidavit form 497306828

- Indiana lien in form

- Indiana husband wife 497306831 form

- Warranty deed from husband and wife to corporation indiana form

- Quitclaim deed from business entity through attorney in fact to two individuals or husband and wife indiana form

Find out other Form 1041 A U S Information Return Trust Accumulation Of Irs

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online