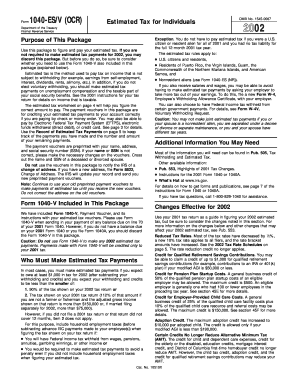

1040 Esv 2002

What is the 1040 Esv

The 1040 Esv is a specific version of the IRS Form 1040 designed for electronic submission. It is primarily used by individuals to report their annual income and calculate their tax liability. This form allows taxpayers to detail various income sources, claim deductions, and apply for credits. The Esv version streamlines the process for electronic filing, ensuring compliance with IRS regulations while enhancing efficiency and accuracy in tax reporting.

How to use the 1040 Esv

Using the 1040 Esv involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, access the form through a reliable electronic filing platform. Fill out the required sections, including personal information, income details, and deductions. After completing the form, review it for accuracy before submitting it electronically. This method not only saves time but also reduces the likelihood of errors that can occur with paper submissions.

Steps to complete the 1040 Esv

Completing the 1040 Esv requires careful attention to detail. Follow these steps:

- Gather all relevant documents, such as income statements and previous tax returns.

- Access the 1040 Esv form through an electronic filing service.

- Enter personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring accuracy in amounts reported.

- Claim eligible deductions and credits to reduce your taxable income.

- Review the completed form for any errors or omissions.

- Submit the form electronically and save a copy for your records.

Legal use of the 1040 Esv

The 1040 Esv is legally recognized for tax reporting purposes in the United States. To ensure its legal validity, it must be completed in accordance with IRS guidelines. This includes providing accurate information and adhering to deadlines for submission. Electronic signatures on the form are also legally binding, provided that the eSignature complies with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant legislation. Using a compliant eSigning platform enhances the legal standing of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 Esv are crucial for compliance with IRS regulations. Typically, the deadline for submitting your federal income tax return is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed about any changes to these deadlines, as well as any extensions that may be available. Marking these dates on your calendar can help ensure timely filing and avoid penalties.

Required Documents

To complete the 1040 Esv accurately, several documents are required. These include:

- W-2 forms from employers detailing wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Records of other income, such as interest or dividends.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

- Previous year's tax return for reference.

Quick guide on how to complete 1040 esv

Effortlessly Prepare 1040 Esv on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and efficiently. Handle 1040 Esv on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

Seamlessly Edit and eSign 1040 Esv with Ease

- Access 1040 Esv and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your device of choice. Modify and eSign 1040 Esv and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040 esv

Create this form in 5 minutes!

How to create an eSignature for the 1040 esv

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the form 1040 es ocr?

The form 1040 es ocr is an official tax form used for estimated tax payments by individuals. It allows taxpayers to calculate and submit their estimated tax for the year. Utilizing tools like airSlate SignNow can simplify the e-signing process for these documents.

-

How does airSlate SignNow help with the form 1040 es ocr?

airSlate SignNow streamlines the process of completing and signing your form 1040 es ocr. With our easy-to-use platform, you can effortlessly fill out, review, and eSign your tax forms, saving you time and reducing errors. Our electronic signature solution ensures compliance and security.

-

Is there a free trial for using airSlate SignNow for form 1040 es ocr?

Yes, airSlate SignNow offers a free trial that allows you to explore our features for eSigning and managing documents like the form 1040 es ocr. During the trial, you can experience our platform's ease of use without any financial commitment. This is a great way to see how our solution meets your needs.

-

What are the pricing plans for airSlate SignNow when using it for form 1040 es ocr?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Depending on whether you are an individual or a larger organization, you can choose a plan that fits your budget and requirements for managing form 1040 es ocr. Visit our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other tax preparation software for the form 1040 es ocr?

Absolutely! airSlate SignNow can be integrated with various tax preparation software. This feature ensures that you can manage your form 1040 es ocr seamlessly alongside your existing tools for efficient tax preparation and filing.

-

What are the security features of airSlate SignNow for handling form 1040 es ocr?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption technologies to ensure that your form 1040 es ocr documents are protected. Additionally, we comply with industry-standard security practices to safeguard sensitive information.

-

How user-friendly is the airSlate SignNow interface for completing the form 1040 es ocr?

The airSlate SignNow interface is designed to be highly user-friendly, making it easy for anyone to complete the form 1040 es ocr. Our intuitive design helps users navigate through the document with little to no learning curve, ensuring a smooth eSigning experience.

Get more for 1040 Esv

- Quitclaim deed from husband and wife to two individuals kansas form

- Quitclaim deed trust 2 co trustees to llc kansas form

- Kansas lien 497307390 form

- Kansas deed form

- Kansas renunciation and disclaimer of joint tenant or tenancy interest kansas form

- Ks affidavit form

- Quitclaim deed by two individuals to husband and wife kansas form

- Warranty deed from two individuals to husband and wife kansas form

Find out other 1040 Esv

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document