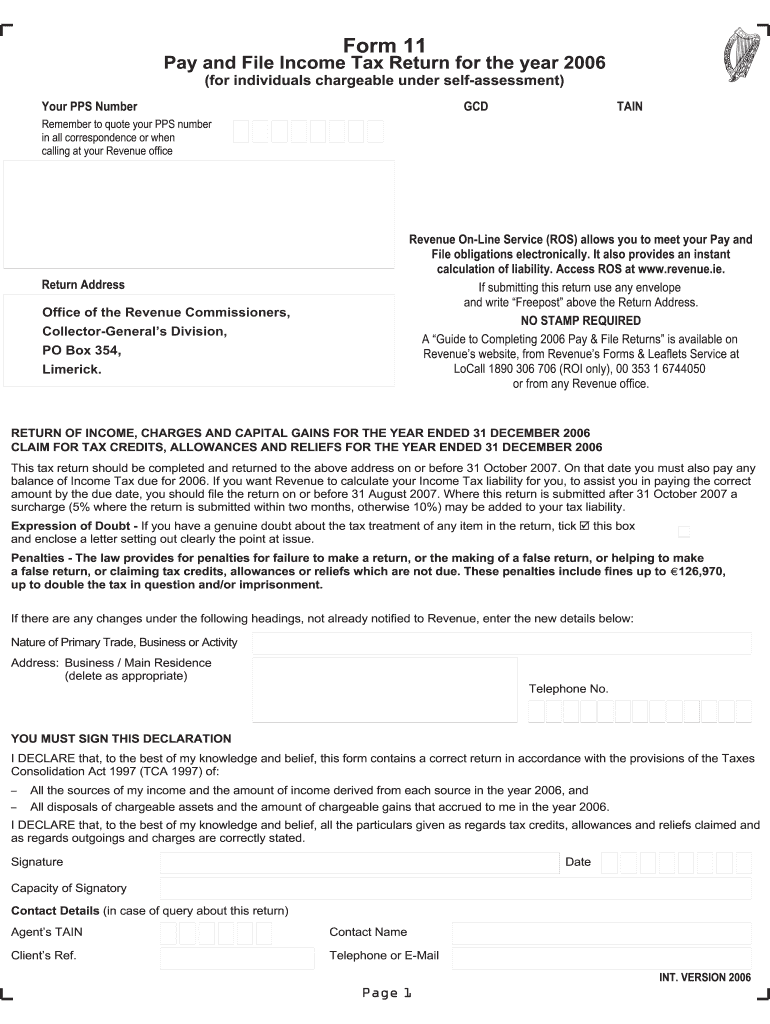

Form 11 Pay and File Income Tax Return Revenue Revenue 2006

What is the Form 11 Pay And File Income Tax Return Revenue Revenue

The Form 11 Pay And File Income Tax Return is a crucial document used by taxpayers in the United States to report their income and calculate their tax liability. This form is typically required for individuals and entities that meet specific income thresholds. It serves as a formal declaration to the Internal Revenue Service (IRS), detailing various income sources, deductions, and credits that may apply. Understanding the purpose and requirements of this form is essential for compliance with federal tax laws.

Steps to complete the Form 11 Pay And File Income Tax Return Revenue Revenue

Completing the Form 11 Pay And File Income Tax Return involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which could be single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Fill out the personal information section, including your name, address, and Social Security number.

- Report all sources of income accurately in the designated sections of the form.

- Calculate your total deductions and credits to determine your taxable income.

- Compute your total tax liability based on the IRS tax tables or tax rate schedules.

- Review the completed form for accuracy before submission.

Legal use of the Form 11 Pay And File Income Tax Return Revenue Revenue

The legal use of the Form 11 Pay And File Income Tax Return is governed by IRS regulations. This form must be completed accurately and submitted by the designated deadline to avoid penalties. It is essential to ensure that all information provided is truthful and complete, as inaccuracies can lead to audits or legal repercussions. Electronic filing is permitted, and using a reliable eSignature solution can enhance the legitimacy of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 11 Pay And File Income Tax Return are critical to ensure compliance. Typically, the deadline for individual taxpayers is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and the associated deadlines for those extensions.

Form Submission Methods (Online / Mail / In-Person)

The Form 11 Pay And File Income Tax Return can be submitted through various methods:

- Online: Taxpayers can file electronically using IRS-approved software or through a tax professional.

- Mail: The form can be printed and mailed to the appropriate IRS address based on the taxpayer's location.

- In-Person: Certain IRS offices may accept in-person submissions, though this method is less common.

Required Documents

To complete the Form 11 Pay And File Income Tax Return, several documents are typically required:

- W-2 forms from employers for reported wages.

- 1099 forms for any additional income, such as freelance work or interest earned.

- Records of deductible expenses, including receipts for medical expenses, mortgage interest, and charitable contributions.

- Any prior year tax returns that may provide relevant information for the current filing.

Quick guide on how to complete form 11 2006 pay and file income tax return 2006 revenue revenue

Complete Form 11 Pay And File Income Tax Return Revenue Revenue effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Form 11 Pay And File Income Tax Return Revenue Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 11 Pay And File Income Tax Return Revenue Revenue without any hassle

- Find Form 11 Pay And File Income Tax Return Revenue Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 11 Pay And File Income Tax Return Revenue Revenue and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 11 2006 pay and file income tax return 2006 revenue revenue

Create this form in 5 minutes!

How to create an eSignature for the form 11 2006 pay and file income tax return 2006 revenue revenue

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the purpose of Form 11 Pay And File Income Tax Return Revenue?

Form 11 Pay And File Income Tax Return Revenue is designed for individuals to report their income and calculate tax liabilities efficiently. It ensures compliance with Irish tax regulations, making it essential for accurate filing. Using this form is a crucial step towards maintaining your financial health.

-

How can airSlate SignNow help with submitting Form 11 Pay And File Income Tax Return Revenue?

airSlate SignNow streamlines the process of completing and submitting Form 11 Pay And File Income Tax Return Revenue by providing an easy-to-use digital platform. Users can eSign documents securely, which saves time and minimizes errors. This solution simplifies tax compliance for both individuals and businesses.

-

What are the pricing options for using airSlate SignNow for Form 11 Pay And File Income Tax Return Revenue?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs when facilitating Form 11 Pay And File Income Tax Return Revenue. Our plans are designed to be cost-effective while providing all necessary features. Explore our pricing page for detailed options that suit individuals and businesses alike.

-

What features does airSlate SignNow offer for handling Form 11 Pay And File Income Tax Return Revenue?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure eSigning, which are invaluable for managing Form 11 Pay And File Income Tax Return Revenue. Additionally, our platform allows for easy document sharing and tracking, ensuring that your tax filings are efficiently handled. These features help enhance productivity and accuracy.

-

Can I integrate airSlate SignNow with other software for Form 11 Pay And File Income Tax Return Revenue?

Yes, airSlate SignNow offers seamless integrations with popular software that facilitates Form 11 Pay And File Income Tax Return Revenue. By connecting to accounting systems or document management platforms, users can enhance their efficiency. This integration supports a smooth workflow, making tax documentation much easier to manage.

-

What benefits does using airSlate SignNow provide for filing Form 11 Pay And File Income Tax Return Revenue?

Using airSlate SignNow to file Form 11 Pay And File Income Tax Return Revenue brings several benefits, including improved efficiency, enhanced security, and reduced turnaround time. Our platform allows you to manage your tax filings from anywhere, ensuring that you never miss a deadline. Furthermore, the user-friendly interface helps simplify the complex filing process.

-

Is airSlate SignNow suitable for both individuals and businesses when filing Form 11 Pay And File Income Tax Return Revenue?

Absolutely! airSlate SignNow is tailored for use by both individuals and businesses needing to complete Form 11 Pay And File Income Tax Return Revenue. Our flexible features accommodate various needs, whether you're a freelancer or a large corporation. This versatility ensures everyone can handle their tax obligations with ease.

Get more for Form 11 Pay And File Income Tax Return Revenue Revenue

- Buyers home inspection checklist massachusetts form

- Sellers information for appraiser provided to buyer massachusetts

- Subcontractors agreement massachusetts form

- Option to purchase addendum to residential lease lease or rent to own massachusetts form

- Massachusetts prenuptial premarital agreement with financial statements massachusetts form

- Prenuptial agreement massachusetts form

- Amendment to prenuptial or premarital agreement massachusetts form

- Fill out and submit a personal history statement pdf capcog form

Find out other Form 11 Pay And File Income Tax Return Revenue Revenue

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free