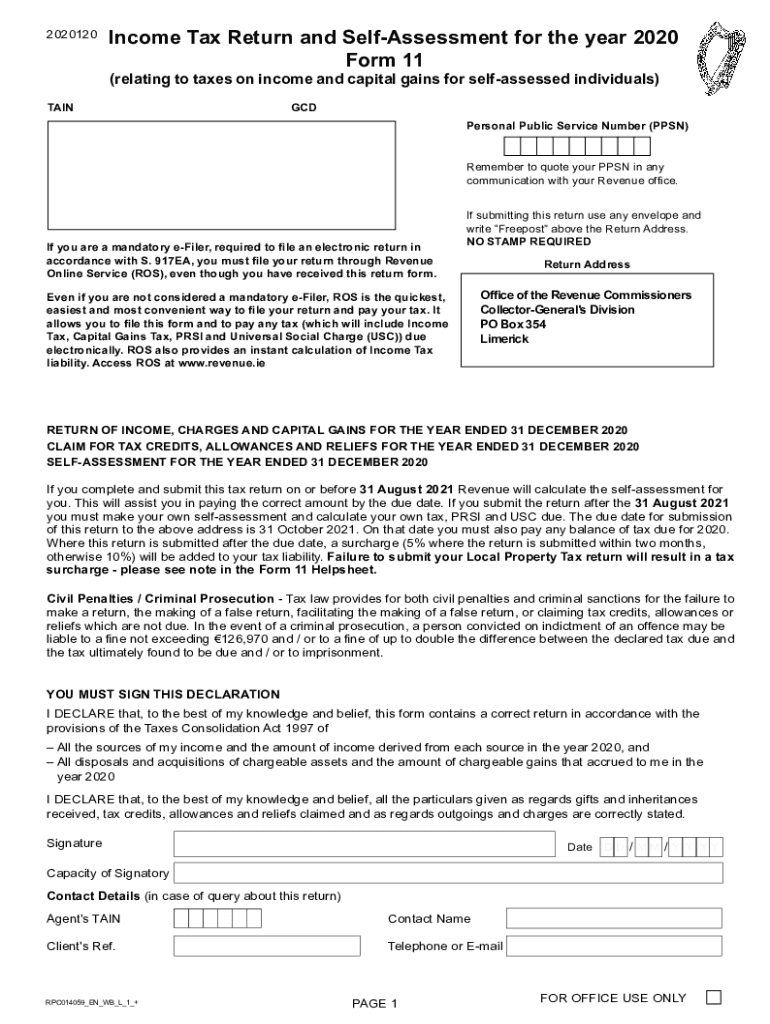

Form 11 Tax Return and Self Assessment for the Year 2020-2026

What is the Form 11 Tax Return and Self Assessment for the Year

The Form 11 tax return is a crucial document used by individuals in the United States to report their income and calculate their tax obligations for a specific year. This form is primarily utilized by self-employed individuals, those with additional income sources, or anyone who does not fall under the standard withholding tax system. The Form 11 serves as a self-assessment tool, allowing taxpayers to declare their earnings, claim deductions, and ultimately determine the amount of tax owed or any refund due.

Steps to Complete the Form 11 Tax Return and Self Assessment for the Year

Completing the Form 11 involves several key steps to ensure accuracy and compliance with tax regulations. Here’s a structured approach:

- Gather Financial Documents: Collect all necessary documents, including W-2s, 1099s, and records of any additional income or expenses.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: List all sources of income, including wages, self-employment income, and any other earnings.

- Claim Deductions: Identify and enter eligible deductions, such as business expenses, retirement contributions, and educational expenses.

- Calculate Tax Liability: Use the provided tax tables or software to determine your total tax liability based on your reported income and deductions.

- Review and Sign: Carefully review the completed form for accuracy, then sign and date it to certify the information provided.

Filing Deadlines / Important Dates

Being aware of filing deadlines is essential for compliance and to avoid penalties. Typically, the deadline for submitting the Form 11 is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It is advisable to check the IRS website or consult a tax professional for any updates or changes to these important dates.

Required Documents

To successfully complete the Form 11, several documents are essential. These include:

- W-2 forms from employers for reported wages.

- 1099 forms for freelance or contract work.

- Records of any additional income, such as rental income or investment earnings.

- Documentation for deductions, including receipts for business expenses and contributions to retirement accounts.

Penalties for Non-Compliance

Failing to file the Form 11 or submitting inaccurate information can lead to significant penalties. The IRS may impose fines for late filings, which can accumulate over time. Additionally, underreporting income can result in further penalties and interest on owed taxes. It is crucial to ensure that the form is completed accurately and submitted on time to avoid these consequences.

Digital vs. Paper Version

Taxpayers have the option to file their Form 11 either digitally or via paper. Filing electronically is often faster and more efficient, allowing for quicker processing and refunds. Digital submissions also reduce the risk of errors associated with manual entry. However, some individuals may prefer the traditional paper method for record-keeping purposes. Regardless of the method chosen, ensuring that the form is completed accurately is essential.

Quick guide on how to complete form 11 2020 tax return and self assessment for the year

Complete Form 11 Tax Return And Self Assessment For The Year effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal green alternative to conventional printed and signed documents, allowing you to locate the right template and securely archive it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Form 11 Tax Return And Self Assessment For The Year across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Form 11 Tax Return And Self Assessment For The Year with ease

- Locate Form 11 Tax Return And Self Assessment For The Year and click on Get Form to begin.

- Use the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow provides for that specific purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you prefer to send your document, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 11 Tax Return And Self Assessment For The Year to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 11 2020 tax return and self assessment for the year

Create this form in 5 minutes!

How to create an eSignature for the form 11 2020 tax return and self assessment for the year

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the role of airSlate SignNow in the tax income return process?

airSlate SignNow streamlines the tax income return process by allowing users to electronically sign and send essential documents securely. This reduces paperwork and speeds up the filing process, ensuring you can submit your tax income return efficiently. By using SignNow, you ensure that your documents are legally binding and compliant with regulations.

-

How does airSlate SignNow enhance collaboration for tax income return submissions?

With airSlate SignNow, multiple stakeholders can easily collaborate on tax income return documents in real-time. The platform allows for commenting, tracking changes, and obtaining necessary signatures quickly. This collaborative approach helps ensure all parties remain informed and engaged, minimizing errors in your tax income return.

-

Can I access my tax income return documents on mobile with airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile access, allowing you to manage your tax income return documents on-the-go. The mobile app provides you with the same features as the desktop version, ensuring you can review and sign documents anytime, anywhere. This flexibility helps you stay organized and responsive during tax season.

-

What are the pricing options for using airSlate SignNow with tax income return services?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting from a free trial to affordable monthly subscriptions. Each plan includes features tailored to enhance your efficiency in preparing and submitting your tax income return. A transparent pricing structure means you can choose the best plan without any hidden fees.

-

What features of airSlate SignNow help with managing tax income return documents?

Key features of airSlate SignNow that assist with tax income return management include customizable templates, automated reminders, and the ability to create workflows. These tools help streamline the documentation process, ensuring that all necessary steps are completed promptly. As a result, you can focus more on your business while ensuring a smooth tax income return submission.

-

Does airSlate SignNow integrate with accounting software for tax income returns?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, which can greatly simplify tax income return processes. These integrations allow for quick transfer and synchronization of data, reducing the likelihood of errors. By integrating your tools, you can create a more cohesive workflow that enhances your overall productivity.

-

How secure are my tax income return documents with airSlate SignNow?

Security is a top priority at airSlate SignNow, and your tax income return documents are protected with advanced encryption and secure cloud storage. The platform complies with industry standards and regulations to ensure that your sensitive information remains private. You can have peace of mind knowing that your documents are safe while using SignNow.

Get more for Form 11 Tax Return And Self Assessment For The Year

- Dyc nursing form

- Solicitud de registro de nacimiento form

- Inpatient surgeryprocedure request form

- Pdf checklistforescalatorswalksjune2016pdf city of chicago cityofchicago form

- Navperscom 126301 civilian request for extended leave public navy form

- Request for hecs or domestic fee related letters or documents sydney edu form

- Puppy deposit contract form

- Office of the registrar 27 33 west 23rd street form

Find out other Form 11 Tax Return And Self Assessment For The Year

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document